Amundi Technology has grown each year since the business was set up in 2021 by the largest European asset manager, Amundi Group, which is majority owned by French bank Crédit Agricole. The group’s technology arm is looking at acquisitions as it aims to gain strength in Asia and in wealth.

Guillaume Lesage, chief operating officer at Amundi, whose responsibilities include the technology business, told Markets Media that segment has grown year after year. The business was launched on Amundi’s ability to develop and implement software and transform operational models for its own needs, such as after the acquisition of Pioneer Investments, and this capability was then offered to external clients.

Lesage said that in 2021 Amundi Technology had $23m of revenues, which have increased to $80m, with organic growth of around 22%. In the first quarter results of 2025, the group reported that Amundi Technology revenues had grown 46% from the same period last year. Valérie Baudson, chief executive of Amundi Group, described Amundi Technology as one of its “main growth pillars.”

Lesage said the financial industry needs technology because it wants ‘asset management as a service’. Through its cloud-based ALTO suite, Amundi Technology offers a range of solutions, including portfolio management systems, discretionary portfolio management and advisory platforms, savings software, and specialized solutions.

“Regulation is complex so it is becoming very difficult to build and maintain technology if you are an asset manager with less than $300bn under management,” he added.

Wealth

Amundi’s first quarter results were boosted by a contribution from last year’s acquisition of aixigo, which has developed a platform for wealth technology that is entirely based on APIs and enables new services to be deployed quickly and easily into existing IT infrastructures of banks and financial intermediaries.

Lesage explained that banks have solid technology in payments, loans and investment banking but have not invested enough in tools for advisors, tools that advisors and wealth clients use directly, and the management of mandates. For example, one major bank which has a $4bn budget spent just $50m on advisory.

German-based aixigo is 20 years old and Lesage said the business already has 20 clients, including major banks.

“aixigo has developed an awesome set of 30 APIs that can be integrated into a bank’s system,” Lesage added. “Integration is done and we have started to gain clients.”

In May this year AJ Bell, the UK wealth platform which caters to retail investors, high-net-worth individuals and institutional clients, chose Amundi Technology’s ALTO Investment platform to streamline portfolio management processes, increase automation and support its growth plans. AJ Bell’s assets under management reached £7.5bn at its last trading update.

Lesage said: “AJ Bell is an important firm in wealth and very technology oriented, so we are gratified that they have confidence in us. We will not only provide technology to AJ Bell but also our execution activities.”

Amundi already has 30 clients who use its trading services and this is the first client in the UK, according to Lesage.

In a year, Amundi Technology wants to be much stronger in Asia and in wealth. Lesage said the business has gained a few clients in Asia and is one of the two only non-Chinese companies to have a fintech status in China, reserved for very large banks.

“We have started to look at acquisitions that accelerate our development, our competencies, gain fantastic people or new geographies, which was the case with aixigo,” Lesage added.

AI

Weath is one of the three themes at the top of Lesage’s mind, alongside artificial intelligence and open source. He said Amundi invested very early in AI and has developed its own environment, ALTO Studio. Users can access all ALTO data and generative AI engines like ChatGPT and Mistral in a secure environment.

There is a lot of demand from asset managers who want to get into AI, but don’t want to take the risk of going on the public cloud and Lesage believes that will be a major growth area.

“Half of our employees use ALTO Studio every week, we have developed 20 applications and the next step would be to provide that to our clients,” said Lesage. “We first do our own cooking, we test it for a long time and then we propose it to our clients.”

Fund Channel Liquidity

Amundi also jointly owns Fund Channel, a B2B fund distribution platform, with Caceis, the asset servicing banking group of Crédit Agricole and Santander. The platform is supported by Amundi Technology.

“In the last five years Fund Channel has transformed into a real marketplace between distributors and asset managers,” said Lesage. “Today they have got 600 asset managers, 100 distributors and €521bn for which they do fund execution, data, management, business intelligence, know your customer (KYC).”

Fund Channel Liquidity was created in September last year and the first client will join this month, according to Lesage. The online platform aims to simplify and optimize liquidity management for treasurers across Europe

Lesage said: “A new type of client, corporates, and more precisely the treasurers of those companies, buy money market funds directly from fund managers and are looking for a marketplace in Europe.”

Competition

Lesage believes that one differentiator for Amundi Technology is its scale and backing from the group. He argued that choice of a system is now so strategic that the decision is made by the chief executive, and they want to partner with companies who will be there for a long time.

“Companies in Europe and Asia are more and more looking at European solutions, and today the main offers are only American,” said Lesage. “They want modern solutions and ALTO is less than 15 years old, open source, digital, API-based and provides stability.”

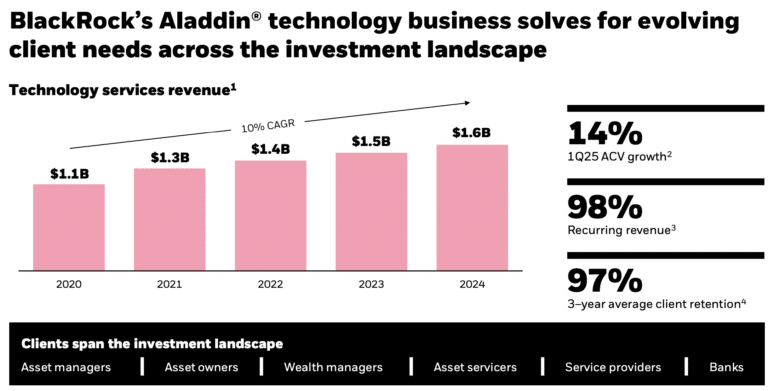

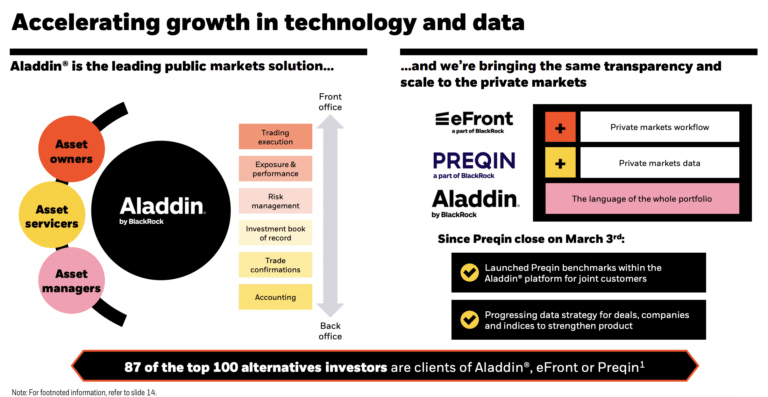

BlackRock, the US asset manager, also offers its technology platform Aladdin to external clients.

Sudhir Nair, global head of Aladdin, said at BlackRock’s investor day on 12 June 2025 that the fact that Blackrock i the lasrgest user of Aladdin allows the firm to stay uniquely attuned to the changes in the marketplace and adapting client needs.

“This user provider model, in many ways, continues to be our special sauce,” he said.

Nair added that Aladdin began as a risk management system supporting fixed income at Blackrock but has grown to cover the end-to-end investment life cycle. The goal is for Aladdin to become the common language across all portfolios.

BlackRock said it aims to accelerate growth in technology and data by expanding its private markets capabilities. building new tools to support wealth management’s transition from advisory to discretionary, completing the build out of Aladdin’s native accounting capabilities, pioneering innovations across digital assets and tokenization and enabling new ways of managing data in an AI-first world, Nair said BlackRock is looking to embed AI into every aspect of Aladdin.

“By opening Aladdin, having a world class suite of APIs and connection points for third parties, we continue to build out Aladdin as a platform,” he added.