Profit margins in the fund management industry are due to fall this year despite assets under management increasing since 2018.

Consultancy McKinsey & Company said a report that it expects assets under management this year to be approximately 10% higher than last year but average assets under management to be up by only 3%. “Most importantly, however, we expect profit margins to be down by approximately 2%,” said the report.

While asset managers’ ongoing cost-reduction efforts have received recent press attention, sustained operating leverage has remained elusive for the industry overall. Here's why. https://t.co/1p9ZGsZjPf

— McKinsey & Company (@McKinsey) November 29, 2019

McKinsey said fund management is having to contend with persistent structural shifts – smaller returns due to low interest rates; the shift to passive and alternative asset classes; slowing organic growth, continued fee pressure, elusive operative leverage and aggressive competition.

“Pressure has been persistent on revenue yields, with fee compression responsible for about 80% of the decline in revenue yields year over year (asset class and style-mix shifts are responsible for the remaining 20%),” added the report.

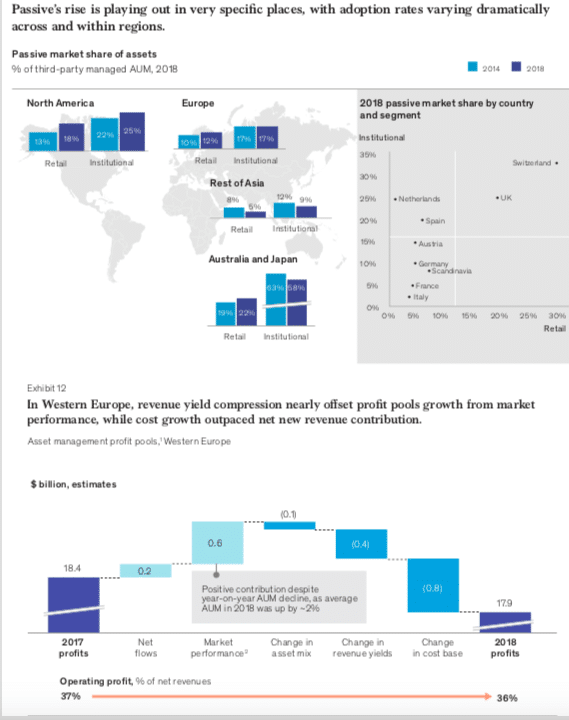

The consultancy said passives are growing faster than other investment styles but the pace of the shift has been more muted in Europe than in North America.

Assets invested in the European exchange-traded fund were a record $959.9bn (€871bn) at the end of October according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem. Net inflows to the end of October this year were $88.9bn, nearly double the $47.71bn last year.

@ETFGI reports that assets invested in #ETFs and #ETPs listed Globally reached a new record high of US$5.96 trillion at the end of October 2019#assetallocation #investing #etfs #trading https://t.co/7LQJ9dej1z

— ETFGI (@etfgi) November 12, 2019

McKinsey continued that sustained operating leverage has remained elusive for the industry although functional spending in investment management, distribution, and operations was flat to slightly below 2017 levels. “As a silver lining, European managers did demonstrate more discipline than their North American peers on average, where cost growth was twice as fast and increased across virtually all functional areas,” added the report.

In Europe the industry is also feeling the impact of MiFID II, the regulation which went live in the European Union at the start of 2018. McKinsey said some of the affects of MiFID II include distributors narrowing manager buy lists and raising the bar on performance; fragmentation of research with large managers driving a 20% to 30% reduction in broker research spending and redeploying spending to niche/ specialist research providers; and transparency increasing fee sensitivity.

“Growth continued favoring managers with scale and scope, and consolidation gathered steam as managers sought to build their presence in high-growth areas and invest in technology to create more efficient operating platforms,” said the consultancy.

McKinsey said asset managers have three strategic options – compete within the core: “tighten up the ship” to meet clients’ urgent needs in the “lower for longer” economic environment; move the boundaries: “innovate selectively” and realign business models to capture growth in retail hot spots; and finally, redefine the game: “become a disruptive player” and expand beyond asset management.

The first option includes transforming the operating platform and cost structure with technology and automation and simplifying operating models through using data, and analytics to streamline costs.

“Asset managers are just beginning to mine these data sources at scale, as middle- and back office platforms are modernized or outsourced to innovative market infrastructure providers,” said McKinsey. “These innovations include providing more integrated investment, research, trading, and analytical platforms; the continuing electronification of flow products, including corporate and sovereign fixed-income trading; and promising initial blockchain uses in investment and trade operations.”

Sustainable investing

McKinsey’s first strategic option also includes doubling down on sustainability and impact investing.

Detlef Glow, head of Lipper Emea research, said in a report today that the lack of a standard definition of environmental, social and governance investing is holding back growth.

The lack of a common language is a hindrance for the transparency, understanding and implementation of ESG strategies. Different institutions in the EU have started to tackle this issue. Read more about this topic in my latest Mo…https://t.co/TBVwFSMdPV https://t.co/hXZV84E9H7

— Detlef Glow (@DetlefGlow) December 2, 2019

He continued that as well as the lack of a single definition, there are also several different names and acronyms, such as ESG, SRI, impact investing, sustainability etc., with different methodologies underneath their product strategies.

“The lack of a common language between the different stakeholders from investors via the portfolio managers to the corporate reporting is a significant barrier to the growth of responsible investments and enables the so-called “greenwashing” (the use of unclear language to pretend that a company or a fund follows is sustainable) which can mislead investors,” Glow added.

As a result regulators are developing taxonomies and frameworks for sustainable investing .

“From my point of view, the initiatives started by the European Commission and other local regulators, such as the Financial Conduct Authority (FCA) in the United Kingdom, will help to align the communication around sustainable practices and investing,” said Glow. “Nevertheless, even as these new standards are a step into the right direction, it is already clear that they won’t be sufficient to eliminate all hindrances and greenwashing, so that it is foreseeable that these standards will be extended in the future.”