The volatility caused by the Covid-19 pandemic highlighted that markets were moving faster than many investment managers’ proprietary valuation models were able to refresh.

Deloitte’s 2021 investment management outlook found that many firms were not operating at the speed of the markets, especially in March this year during the peak of the volatility caused by COVID-19.

The report said: “Even the central banks were updating their economic models to incorporate data sources that reflected near real-time data to achieve what has been called ‘nowcasting.’”

Just released: Our 2021 #financialservices industry outlooks. This year, 800+ industry leaders weighed in on their companies’ #COVID19 recovery. Stay resilient with actionable insights. https://t.co/bTprD04KeB pic.twitter.com/WhIJ05eNDO

— Deloitte Financial Services UK (@DeloitteUK_FS) December 7, 2020

The majority of hedge funds, 53%, have embraced the technology and Deloitte said long-only managers and private capital managers are following suit.

“Now that the alternative data technology is more mature, the application to long-term investing has blossomed,” added the report. “Furthermore, the risks associated with implementation are now offset by the risk of being left behind.”

In addition to digitally transforming the investment process, asset managers are also looking to use technology to change the customer experience and to cut costs.

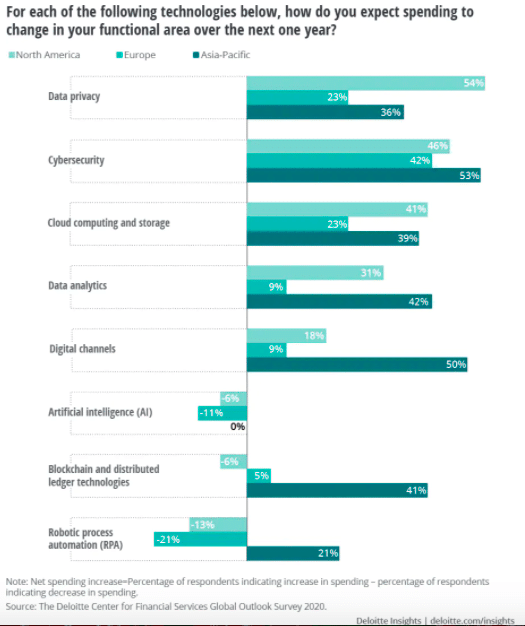

“Overall, investment management firms are changing approaches to digital transformation to support cost savings, added Deloitte. “The spending allocations by technology are also changing in ways that appear to support the security and efficiency of digital interaction.”

Source: Deloitte.

In addition nearly all, 92% of survey respondents, are implementing or are planning to implement technologies that allow staff to work from anywhere through outsourcing and offshoring, rather than building or buying new technologies.

“In addition to the broad modernization benefits that cloud computing offers, it enables firms to perform their tasks in a remote, low-contact work model while meeting the heightened data security requirements,” said Deloitte.

Cost cuts

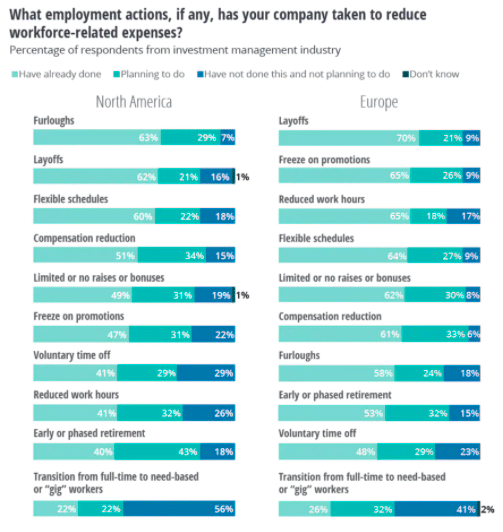

Half of the survey respondents said their firms plan to reduce total costs by between 11% and 20%.

Source: Deloitte.

Deloitte continued that these targets look ambitious as the workplace-related cost per employee is estimated to increase by as much as 50%. However, firms have many more flexible options to manage the cost of the workforce as traditional patterns were broken during the pandemic.

ESG

Despite the cost-cutting, the majority of respondents in all three regions – North America, Europe, and Asia-Pacific – said their firm is reprioritizing environmental, social and governance policies, programs, and products as a result of COVID-19.

“Similar to the early development of the automobile, which was initially offered in any desired color as long as it was black, ESG is in the process of unpacking into dozens of targeted environmental, social, or governance goals, which can more closely match the specific ESG goals of investors,” said Deloitte.