Sarah Bratton Hughes, head of sustainability at North America at Schroders, said interest in sustainable investing accelerated in the US last year and this is likely to continue under the new administration.

Schroders Global Investor Study 2020 found that the majority, 55%, of American investors are more likely to invest in sustainable funds because of their more attractive return profile. The study found that higher returns, rather than just positive societal and environmental impacts are driving Americans’ adoption of sustainable funds.

Sarah Bratton Hughes, Schroders

Bratton Hughes told Markets Media: “Interest in environmental, social and governance strategies in the US has only accelerated since the survey.”

She highlighted a turning point in October last year when the market capitalisation of NextEra, a solar and wind power generator, became larger than oil company Exxon Mobil.

“That was an ‘aha’ moment which was not anticipated even five or three years ago,” added Bratton Hughes.

She continued that President Biden has already moved the needle for sustainability by making the US rejoin the Paris climate agreement and naming John Kerry as the US Special Presidential Envoy for Climate, which will also be a new position on the National Security Council. In addition Brian Deese, who will lead the National Economic Council, was previously head of sustainable investing at BlackRock.

In addition the new administration has put a freeze on the implementation of new regulation. This affects rules from the US Department of Labor covering environmental, social and governance strategies which came into force last month.

Last summer the department proposed regulatory changes that would limit the use of ESG in ERISA plans – pension schemes governed by the Employee Retirement Income Security Act of 1974 – which were opposed by the asset management industry. It is possible this rule could be reversed.

Bratton Hughes also expects a focus on ESG in the second half of this year from regulatory bodies such as the US Securities and Exchange Commission and FINRA.

“There are growing pools of capital for sustainable investment and we will be off to the races,” she said.

She added that the administration has also said it will review a carbon pricing scheme and make recommendations by the end of this year.

Last year Schroders’ Sustainability investment team, developed a new “Carbon Value at Risk” (Carbon VaR) framework which quantifies how company profits and investor returns could be affected by tougher climate policies and higher carbon prices.

ICYMI: The infographics from last quarter’s sustainable investment report focused on identifying true “low carbon leaders”, our Global Cities Index, and our active ownership. Read our report here: https://t.co/une9557c9V#sustainability #ESG #snapshot pic.twitter.com/DsFeycmXSs

— Schroders (@Schroders) June 27, 2020

The research showed that almost half of listed global companies would face a rise or fall of more than 20% in earnings if carbon prices rose to $100 a tonne.

“We use $100 a tonne as this is needed to meet the Paris target which aims to limit global warming,” added Bratton Hughes.

She noted that in December last year the Canadian government proposed increasing the cost of carbon to $170 per tonne by 2030.

ESG integration

Last year Schroders completed the integration of ESG across all of its investments.

Schroders’ Sustainability Accreditation spans ‘Screened’, ‘Integrated’, ‘Sustainable’ and ‘Impact’ categories – and helps Schroders’ clients distinguish how ESG factors are considered across its products.

Bratton Hughes explained that each investment desk goes through an annual accreditation process and has to demonstrate the impact of ESG on their portfolios.

Schroders commits to full #ESG investment integration by 2020 – https://t.co/BWbVGwBnuS #sustainableinvesting #esginvesting

— Schroders US (@SchrodersUS) November 26, 2019

“They have to explain how they integrate ESG, both philosophically and from the bottom up on a systematic basis, and their allocation of tools and resources,” said Bratton Hughes.

The available tools and resources include data and SustainEx, a proprietary investment tool launched in 2019 to quantify social and environmental impacts across individual companies, industries and geographies.

The framework analyzes more than. 47 measures of social and environmental impact, examines over 400 academic and industry studies and reviews over 70 available company-specific data points, and uses alternative data from relevant public sources. It measures the costs companies would face if all of their negative externalities were priced, or the boost if benefits were recognised financially.

Data

Peter Harrison, Schroders

Peter Harrison, group chief executive at Schroders, said last week at the Schroders Data Insights 2021 Forum that the amount of information had grown exponentially. Therefore the asset management formed a team of data scientists and engineers who sit on the floor next to the portfolio managers and analysts in order to create more alpha for clients.

Francesca Guinane, relationship manager for the Data Insights Unit, said at the forum that the team was set up in 2014 and now has more than 30 data people recruited from outside finance.

“We complement financial analysis and do not replicate the sellside,” she said. “We try to be as close to the portfolio managers as possible.”

In February last year the unit compiled a Covid-19 epidemiology model using public data from around the world so that for example, all the US national and regional information was in one place.

Read how data science helps sustainable investors: https://t.co/pcBHUh5D4w #sustainability #infocus pic.twitter.com/LqQLlcza5b

— Schroders (@Schroders) February 4, 2021

The Data Insights Unit helps the portfolio managers make sense of datasets. For example, Schroders has a weather database going back ten years which has billions of rows of data.

Tom Wilson, head of emerging market equities, said at the forum that the Data Insights Unit is integral to testing the team’s investment thesis and analysing trends.

For example, the unit performed bespoke research on permafrost melting in the Arctic Circle after one incident in Russia which allowed physical risk to assets to be identified. James Blake, lead data scientist geospatial, explained in the seminar that they had to identify and map the locations of key facilities to the weather database and individual companies.

“This changed the dynamic of our interaction with clients as it became more powerful,” aded Wilson. “We could evaluate their response and give them relative sustainability scores.”

Source: Schroders.

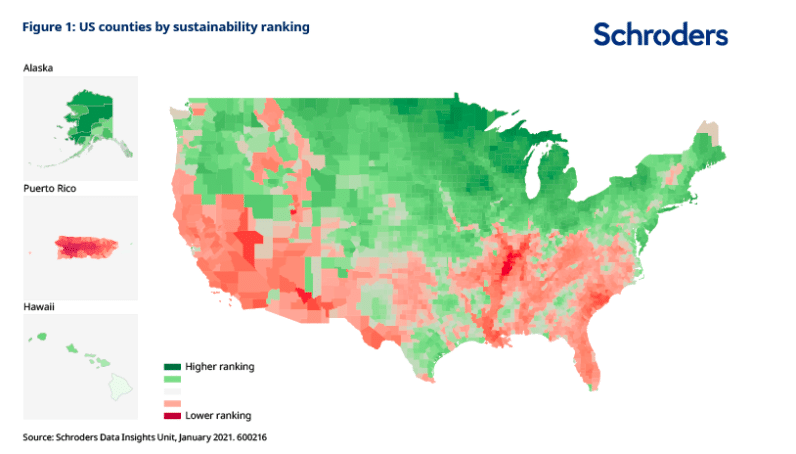

The unit has developed Schroders Municipal US Sustainability Explorer, MUSE, for the asset manager’s US municipal bonds team and sustainability experts in North America. The tool allows analysts to access ESG factors and assign an overall sustainability score to more than 3,000 counties in the US. The data can be combined with the weather database to identify risks such as tornadoes.

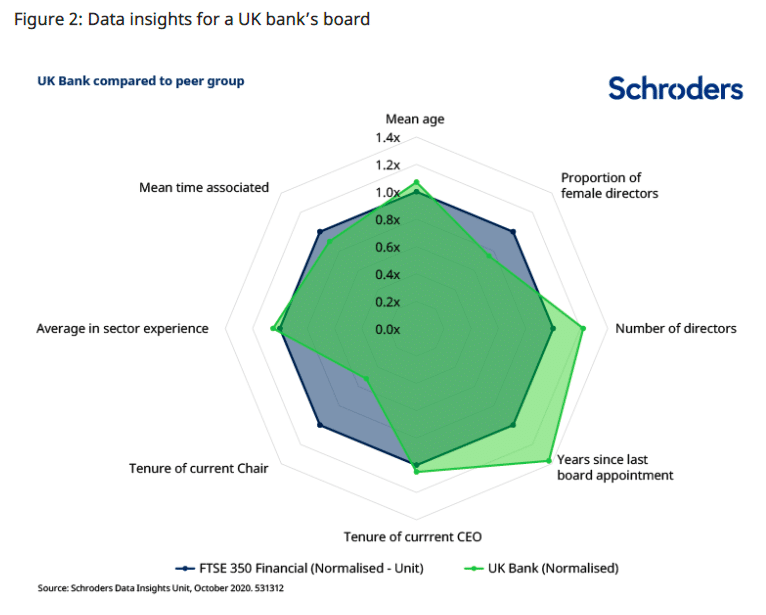

Data is also used to analyse company boards for governance and identify factors such as overboarding, where someone sits on too many company boards. It is also possible to compare diversity, such as the proportion of the board that is female to prompt engagement.

Source: Schroders.