BlackRock is focussing on growth in higher multiple, less market sensitive products which include private markets, technology, exchange-traded funds and whole portfolio solutions.

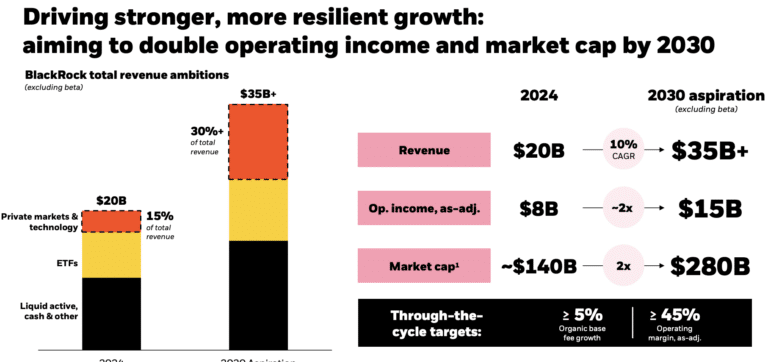

Larry Fink, chairman and chief executive of BlackRock, spoke at the investor day in New York on 12 June 2025. He said the 2030 ambition for the firm is to drive more than $35bn in revenues, $15bn in operating income and to double market cap to $280bn. He added: “It is achievable and realistic.”

“We raise the bar at aiming for above 5% organic base fee growth,” said Fink. “We plan to raise a cumulative of $400 bn in private markets by 2030.”

Martin Small, chief financial officer at BlackRock, described the asset manager’s growth strategy during the investor day

Small highlighted that BlackRock has reached $11.6 trillion in assets under management and achieved its 5% organic growth target, on average, over the last five years, even in less supportive markets such as the first quarter of this year. Going forward, the firm will follow its clients and invest to build its platform around “higher multiple, less market sensitive” products and services such as private markets, technology, ETFs and whole portfolio solutions.

The 2030 ambition assumes a flat market environment and Small said that even with modestly positive markets of between 3% to 5%, revenues and operating income are expected to be meaningfully higher. He argued that BlackRock works with over 90% of the top 100 asset owners and they are looking to deepen their relationships with fewer managers.

“They require a breadth of capabilities across asset classes and styles, global access. expertise, and excellence in public and private markets,” Small said. “Leading asset owners want to work with platforms, not monoline product providers.”

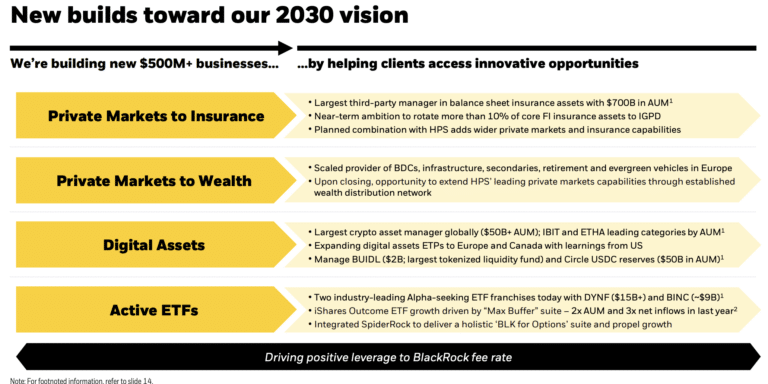

As a result, BlackRock is building four new businesses, each with the potential of at least $500m in revenue. Small said: “We are building them from the ground up and all of these businesses barely existed at our 2023 investor day.”

Private markets

Private markets and technology comprised a fifth of BlackRock’s total revenue of $20.4bn in 2024, according to Small. When the acquisition of HPS Investment Partners closes, more than 30% of the group’s revenue is expected to come from private markets and technology.

In December 2024 BlackRock agreed to a $12bn acquisition of HPS Investment Partners to create an integrated private credit franchise. Small said the deal is expected to close on 1 July this year.

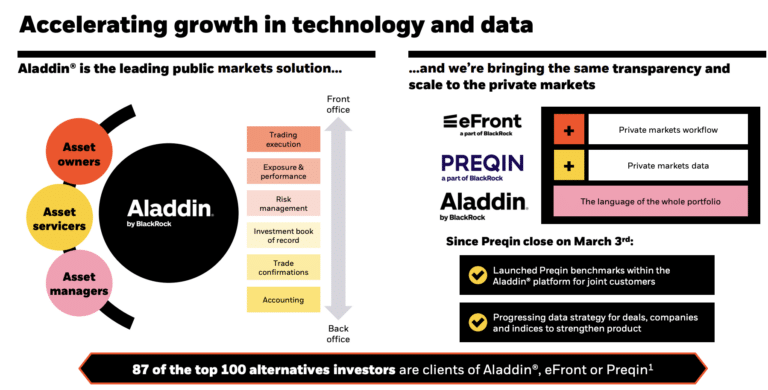

The HPS transaction followed other deals that BlackRock has made to expand in private markets. In November last year BlackRock completed the purchase of infrastructure fund manager Global Infrastructure Partners (GIP) and added approximately $170bn in assets under management. In March this year BlackRock completed its acquisition of Preqin, the private markets data provider. BlackRock is integrating Preqin’s proprietary data and research tools with Aladdin, its technology platform, and eFront, its end-to-end alternative investment management software and solutions provider.

Data, benchmarks, risk models and analytics have transformed public markets and Small said BlackRock aims to do the same for the less mature data, analytics and index business in private markets.

BlackRock believes its private markets capabilities are now positioned to deliver best-in-class outcomes for clients and that it has leading capabilities in infrastructure, private credit and private equity solutions.

Small argued that even if existing insurance, wealth and OCIO (outsourced chief investment officer) clients allocate just 5% of their BlackRock relationships to private markets thsi represents a growth opportunity of over $150bn in new private markets assets under management, and over $1bn of estimated new base fees “just within our walls.”

“We are aiming to raise $400bn in private markets through 2030 powered by exceptional origination reach, strong investment performance and depth of our client relationships,” he added.

Nearly all, 91%, of investors plan to increase their holdings of alternatives within the next two years according to financial services group Brown Brothers Harriman’s first Private Markets Investor Survey. The survey covered 500 institutional investors and wealth advisors from the U.S., U.K., Germany, Switzerland, and Japan.

Chris Adams, global head of alternative funds business development at BBH, said in a statement: “Although private asset strategies have seen exponential growth over the past decade, it’s clear that many LPs still believe they’re under-invested.”

Fink said that following its acquisitions, Blackrock will be a top five alternatives provider, which can be tied with its “leading” retirement services and technology.

“As private markets make their way into retirement solutions and portfolios and 30+ years of relationships with large and small plan managers,” Fink added. “Our proven Aladdin technology is powering whole portfolios across public and private markets.”

Digital assets

Different members of the management team also laid out BlackRock’s strategy for digital assets. Rob Goldstein, chief operating officer, said at the investor day that its four-part strategy is about connecting traditional capital markets with the developing digital assets ecosystem.

The first part is to connect networks. Aladdin, a leading network in traditional capital markets, is connected to crypto group Coinbase, a leading network in the digital assets ecosystem. Goldstein said: “This positions Aladdin at the center of this continually evolving whole portfolio, public, private and crypto universe.”

The second part of the strategy was to recognise the important role that stablecoins would play in digital assets, and ultimately in capital markets, which led to a relationship with Circle. Stablecoins are a cryptocurrency whose value is pegged to another asset, such as a fiat currency or gold, to maintain a stable price. BlackRock is the preferred asset manager for the underlying reserves of Circle’s USDC stablecoin.

“Today we manage over $50bn for Circle and we see tremendous opportunity for growth,” added Goldstein.

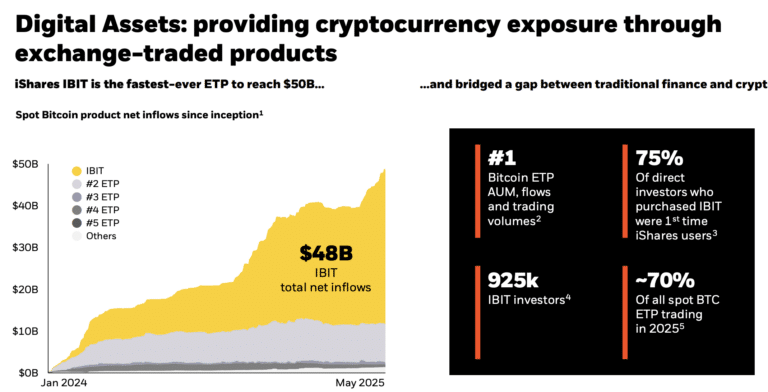

Access is the third part of the strategy as BlackRock aims to provide institutional quality access to bitcoin, ethereum and other digital assets with the convenience and efficiency of the exchange-traded product (ETP) wrapper. Goldstein described IBIT, BlackRock’s bitcoin ETP, as the bridge enabling bitcoin exposure through the “traditional old, boring” capital markets.

“IBIT has been anything but boring,” he added. “It’s the fastest growing ETP in history to get to $30bn, $40bn, $50bn, $60bn and this week, $70bn.”

The bitcoin ETP was only launched at the start of 2024.

Finally, BlackRock is focused on tokenized funds which the firm thinks can be transformational in the long term. BlackRock launched a tokenized treasury fund, BUIDL, which Goldstein said is the largest tokenized fund in the industry at over $3bn.

“Imagine a world where iShares ETFs are tokenized and can sit and live within digital wallets,” he added.

BlackRock’s digital asset revenues have grown to $0.25bn in a reasonably short time, according to Goldstein. He argued that it was even more important that the tokenized fund, the bitcoin ETP and the USDC stablecoin are all effectively utilities that have become cornerstones of the digital asset ecosystem.

“Each of them has brought and will continue to bring new clients to BlackRock from outside traditional finance,” said Goldstein. “We also see great opportunity for them to ultimately become utilities within the traditional capital markets ecosystem.”

Jessica Tan, head of Americas for global product solutions, said at the investor day that IBIT has nearly four times the flows of its nearest competitor.

“The bigger story is that out of nearly one million investors, 75% were new to iShares,” she added. “Of those new investors, 27% now hold other iShares ETFs. That’s not just category growth, that is platform expansion.”