Larry Fink, chairman and chief executive of BlackRock, said he believes the asset manager can lead the indexing of private markets, in the same way that indexing has become the language of public markets, following its £2.55bn acquisition of Preqin, an independent provider of private markets data.

BlackRock said in a statement on 30 June 2024 that it had agreed to acquire Preqin for £2.55bn or approximately $3.2bn in cash.

Fink said on a conference call on 1 July that the acquisition is about driving evolution and growth in private markets by measuring them, understanding their drivers of performance and making them more investable. He highlighted the importance of data, benchmarks and risk analytics in transforming public markets by making them more accessible, increasing the transparency of investment performance and creating risk models.

“We envision we can bring the principles of indexing, and even iShares [BlackRock’s exchange-traded funds business], to the private markets,” he added. “We anticipate indexes and data will be important future drivers of the democratisation of all alternatives, and this acquisition is the unlock.”

In addition, Fink said private markets are the fastest growing segment of asset management and there is significant demand from BlackRock clients.

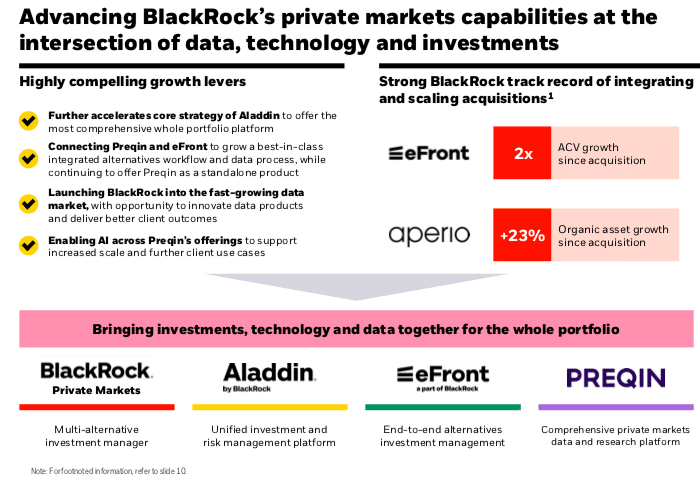

BlackRock has made previous acquisitions to expand in alternatives. In 2019 the asset manager purchased eFront, an end-to-end alternative investment management software and solutions provider to allow investors to seamlessly manage portfolios across public and private asset classes on a single platform by integrating with Aladdin, BlackRock’s technology platform. In January this year BlackRock agreed to acquire Global Infrastructure Partners, an independent infrastructure manager with more than $100bn in assets.

Fink said: “We are taking the next step with Preqin, to build industry leading capabilities in investing, technology and data. We believe this will deepen our relationships with clients and provide a whole new engine for premium diversified organic growth.”

Rob Goldstein, chief operating officer of BlackRock, said on the conference call that the acquisition of Preqin and its combination with Aladdin, eFront and the overall BlackRock platform unlocks an opportunity that the firm has been thinking about for a very long time as it has delivered growth by investing ahead of emerging trends.

“eFront was the starting point and we are extending the growth of existing products, innovating new capabilities, and serving as the leading portfolio provider, offering best in class tools across public and private markets technology,” Goldstein added. “Preqin represents the key next step in our transformation of private markets which we think is the ultimate unlock to increase accessibility, efficiency and growth.”

Goldstein said BlackRock was built to help catalyse growth in the capital markets, particularly in fixed income and structured products, through an integrated ecosystem of technology, data and analytics.

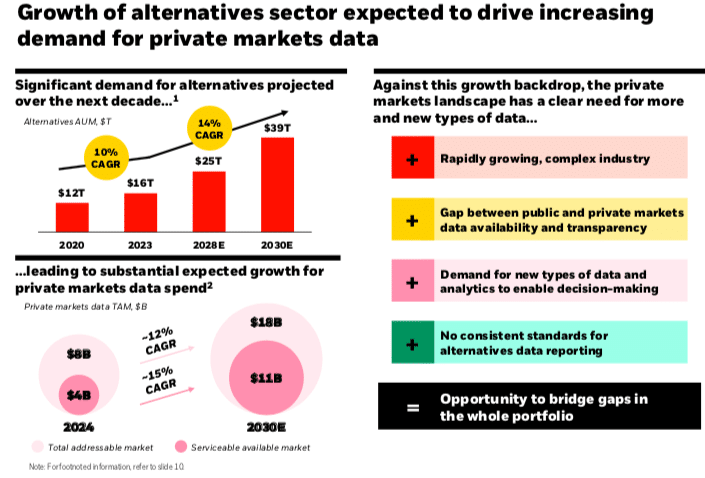

“While private market assets and demand are growing significantly, the current state of private markets investing is well ahead of the underlying technology infrastructure, Goldstein added. “There is a large gap in private asset transparency relative to the public markets which we believe will be narrowed with technology and data for the benefit of our clients and the industry.”

He believes that narrowing this gap will increase private markets allocations, and benefit investors and alternative asset managers by making private markets more investable through the introduction of high quality benchmarks for asset allocation, performance measurement and investing.

“Aladdin models over 100,000 public market benchmarks that help investors make informed decisions and power world class portfolios,” said Goldstein. “We envision a world where we bring that level of precision, discipline and transparency to private market portfolios.”

Martin Small, chief financial of Blackrock, said on the conference call that the Preqin acquisition can unlock an additional $8bn total addressable market in private markets data, which is expected to more than double by 2030. He expects the transaction to close before the end of this year, subject to regulatory approvals, and other customary closing conditions. The transaction is also expected to generate significant synergies, resulting in an 18% internal rate to return.

With a 20-year history, Preqin covers 190,000 funds globally, 60,000 fund managers and 30,000 private markets investors, reaching more than 200,000 users, including asset managers, insurers, pensions, wealth managers, banks, and other service providers. In 2024, Preqin is expected to generate $240m of highly recurring revenue and has grown approximately 20% per year in the last three years. Preqin founder Mark O’Hare will join BlackRock as a vice chair after the transaction closes.

“The longer term opportunity is leveraging our engines, Aladdin, indexing and our capital markets expertise to build the machine for the indexing of private markets,” Small added. “We think we can bring new products to market based on this data and we have a strong track record of accelerating revenue growth by bringing firms into BlackRock.”

For example, since the acquisition of eFront five years ago the annual contract value growth has doubled.