BlackRock said the risk-return profile of private credit may well be more attractive than it has ever been due to higher rates, wider spreads and larger call protections.

In its report, 2023 Private Markets Outlook: A New Era for Investors, BlackRock said private credit has expanded as banks have withdrawn from lending, largely as a result of regulatory changes, but companies still need financing so they are increasingly turning to private lenders.

“While there’s the risk of higher default rates, that can be mitigated through disciplined investment selection and deal structuring, which is easier in private arrangements and can provide opportunities for rescue financing,” added the report.

BlackRock sees non-cyclical businesses such as segments of healthcare, software, technology, consumer staples and business services as better insulated from inflationary pressures as they can usually pass on more cost increases to customers and maintain profitability, and they often come with lower loan-to-value ratios.

“In opportunistic credit, investors are increasingly able to extract more equity participation from companies who prefer credit to raising dilutive down rounds of equity capital,” said BlackRock.

Edwin Conway, global head of BlackRock Alternatives, added in the report that the value of underwriting standards and structures have never been higher in managing the risk of investments through language stipulating the asset revenue/spread adjustments, seniority of investment risk, and covenants allowing earlier intervention and restructuring.

BlackRock’s private markets deal-flow pipeline has been consistent, with the third quarter of 2022 at a similar level to the same period last year, partly a result of wider usage of private credit as well as accelerated investment in infrastructure.

Although 2023 is expected to bring some turbulence, BlackRock Alternatives has a cautiously optimistic outlook for the new year according to Conway.

“More and more companies are turning to the private markets for their capital and financing needs, enlarging the field of potential investments,” he added “And history tells us that even through periods of turmoil private assets can perform well on an absolute and relative basis.”

Conway said in a media briefing in London on 6 December that opportunities can present themselves in times of crisis because there is a repricing of assets and recalibration.

“Repricing bodes well for many alternative assets such as infrastructure, private credit and real estate that have tremendous yield-enhancing characteristics as the rate environment has changed,” he said.

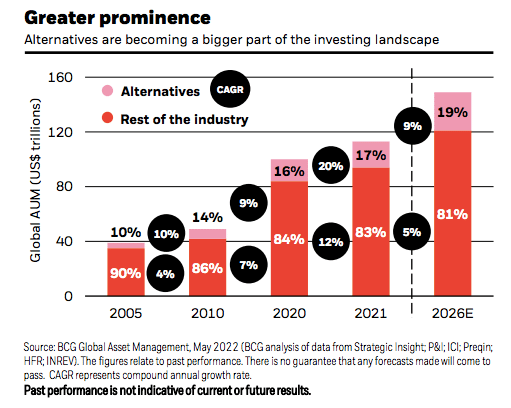

He continued that alternative assets are now a core holding for most institutional clients because they are additive to a fixed income and equity portfolio. Most have between 20% and 30% of their portfolio in alternatives, and more than 50% in some cases.

BlackRock Alternatives has a total of $313bn in assets under management with about $86bn in Europe and approximately 1,500 employees globally, with around 450 in 14 offices across Europe. Conway explained that clients are looking for differentiated alpha, so it is important to have networks across Europe.

“Those networks are rich, deep and local and gives us access to proprietary sourcing,” Conway added. “In many respects, the new form of alpha is sourcing, originating and structuring these investments so our clients get the best outcome.”

BlackRock sources deals based on the three ‘D’s – decarbonisation digitization, and decentralization. The firm manages approximately $21bn in infrastructure debt, making it one of the largest funds in the world, although it is still small compared to large fixed income portfolios.

‘The asset class is in its infancy and is still not well understood,” said Conway. “There is close to zero adoption in the pension community and I think that is the next wave of activity.”

Infrastructure should benefit from continued investment in sustainable energy and energy security and can also play a role as a non-correlated inflation hedge, according to BlackRock’s report.

In private equity, the asset manager expects lower valuations, increased buyout, carveout and M&A activity, and more quality portfolios for sale in the secondary markets. In real estate values are resetting in response to changing tenant demand and higher financing costs, leading to disparate returns among regions, sectors and property types.

“We expect further asset repricing in 2023, but we believe that investors who can identify the regional and thematic sweet spots will find a compelling opportunity set,” said the report.