Laurence Fink, chairman and chief executive of BlackRock, said tokenization is one of the most exciting areas of growth in financial markets. The fund manager envisages a future where investors can use a digital wallet to allocate across crypto, stablecoins, as well as traditional assets such as stocks and bonds.

On BlackRock’s third quarter results call on 14 October 2025, Fink said there are commercial opportunities in using tokenization to further bridge the gap between traditional capital markets and the growing digital asset space. He continued there are over $4.5 trillion dollars in digital wallets across crypto assets, stablecoins and tokenized assets, and BlackRock expects this to grow significantly over the next few years.

“Today, there’s no access to high-quality traditional investment products in digital wallets and BlackRock plans to change that,” he said. “We are exploring tokenizing long-term investment products like iShares.”

Fink said the firm is spending a great deal of time trying to develop its own technology related to tokenization and digitization of all assets.

BlackRock envisions a future where investors never need to leave a digital wallet to allocate across crypto, stablecoins, stocks and bonds. Fink argued that BlackRock brings technological and operational scale, client trust and a footprint across 100 countries, which puts the firm in a prime position to be a part of a global conversation around tokenization and digital assets.

“We are having conversations with all the major platforms today about how we can move forward on the digitization and tokenization of traditional assets, so they can play a role in digital wallets,” Fink said.

He believes the industry needs to move rapidly to tokenize all assets, especially assets that have multiple levels of intermediaries in order to eliminate fees. For example, the cost of buying a home could be made much cheaper.

“If we can legitimately move towards a digital offering of ETFs through tokenization, we can bring down the execution cost and deliver ETFs seamlessly in a digital wallet environment,” added Fink. “We believe this will begin a sooner, and a broader, pathway for more investments in our capital markets across bonds and stocks.”

Martin Small, chief financial officer, added on the call that BlackRock sees a world where the firm can build model portfolios natively in a digital wallet that brings together crypto assets, tokenized long-term investment products and other exposures.

iShares ETFs

BlackRock’s exchange-traded fund franchise, iShares, surpassed $5 trillion of assets under management in the third quarter, contributing to the group reaching a record $13.5 trillion in assets under management.

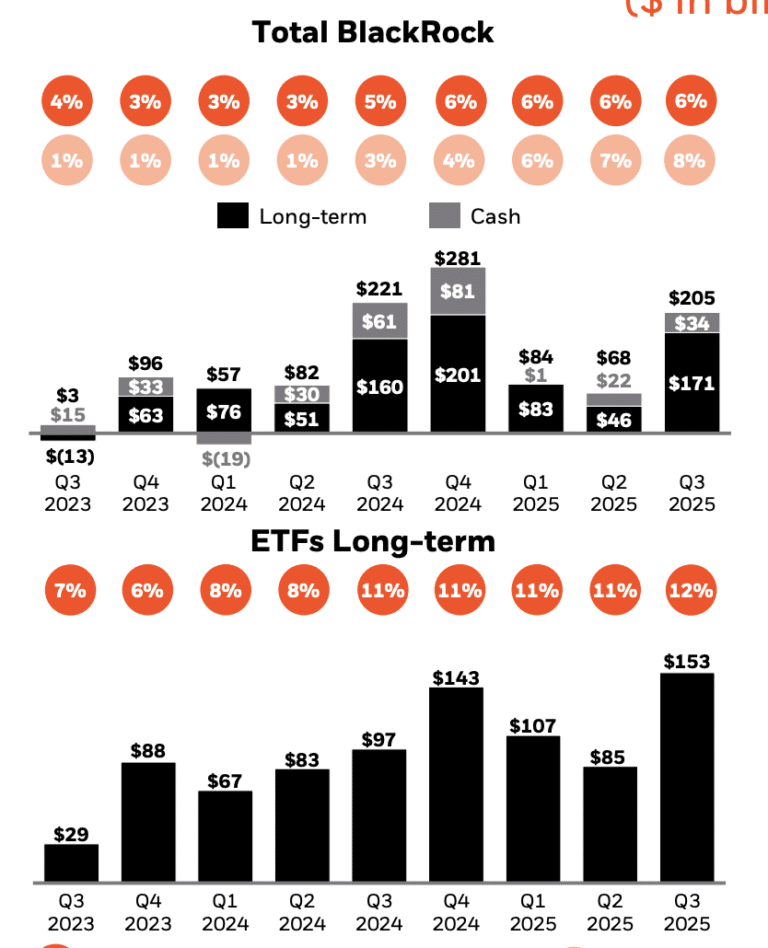

Third quarter net inflows of $205bn for the firm were boosted by record quarterly net inflows of $153bn into iShares ETFs, led by digital asset ETPs, bond ETFs and active ETFs. BlackRock’s digital asset ETPs raised $17bn in the third quarter. Small said on the call: “Our flagship offerings in bitcoin and ether were among the top five products in the ETP industry for inflows.”

He added that BlackRock is also seeing demand for its high value, higher fee active ETFs which gathered $21bn of net inflows in the third quarter.

BlackRock’s digital asset ETPs have grown from practically zero in 2023 to over $100bn and active ETFs from zero over $80bn in the same period, according to Fink. The firm’s active ETFs have had $40bn of new flows in the year to date, approximately double the active ETF flows for the whole of last year.

Fink said: “The rapid growth of these premium categories is another proof point of our success in scaling distribution and quickly adapting to new offerings and new markets”

He described the ETF market in Europe as at an “inflection point.” Net inflows into BlackRock’s European ETFs of $103bn so far in 2025 have already surpassed the full-year flows for last year.

Cash management

BlackRock’s cash management platform recently crossed $1 trillion in assets under management, with $34bn of net inflows in the third quarter, according to Small. He added: “The platform has grown 45% in the last three years. We are seeing demand across scaled money market funds, customized and tokenized liquidity products and money market ETFs.”

The firm is also the primary manager of cash reserves for Circle, the stablecoin issuer which went public this year. Small said the Circle partnership is driving meaningful growth and the mandate has surpassed $64bn.

BlackRock’s tokenized money market fund, BUIDL, has reached more than $3bn in assets under management.

Private markets

Fink said iShares gave investors the new ability to seamlessly blend active and index strategies, and the firm is positioned for the increasing convergence of public and private markets. He added: “Clients are focused on strategies and solutions that work across the whole portfolio.”

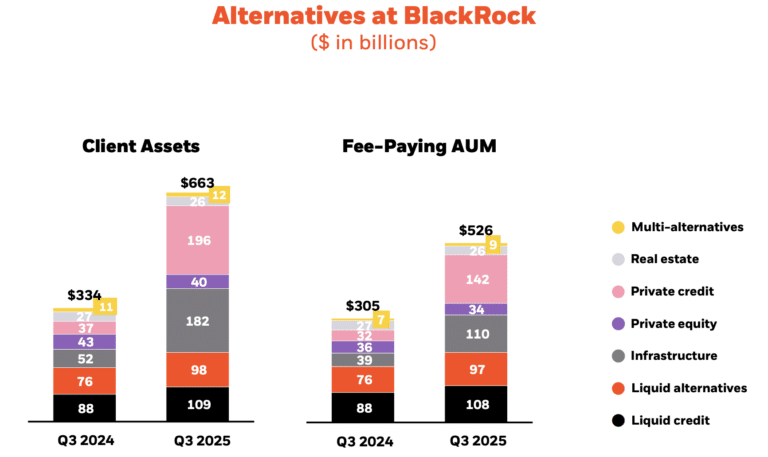

On 1 July 2025 BlackRock completed its acquisition of HPS Investment Partners, a private credit manager. BlackRock said in a statement that financing activity is shifting towards capital markets, positioning asset managers to match long-dated capital with long-term investors, including insurance companies, pensions, sovereign wealth funds, wealth managers, and individuals saving for retirement.

“Client engagement with HPS is even stronger than we expected, especially in the insurance and wealth channels,” said Fink. “We are positioned to be a preferred capital partner with insurers, while maintaining our balance sheet-light approach in wealth.”

He continued that HPS has strong connectivity to private banks and high net worth wealth practices that is augmented by Blackrock’s extensive network across warehouses, independents and RIAs. BlackRock has created Private Financing Solutions (PFS), which combine the firm’s private credit, GP and LP solutions, and private and liquid CLO businesses into one platform.

On 2 September, BlackRock also completed its acquisition of ElmTree Funds, a leader in the commercial net-lease sector.

Scott Kapnick, chairman of PFS executive office and founding partner and chief executive of HPS Investment Partners, said in a statement: “Combining ElmTree’s expertise in the commercial net-lease sector with our leading capabilities and scale further augments our ability to provide diverse investment solutions for our clients as we continue to capture the immense opportunities created by structural shifts in the capital markets.”

Small said that despite the headlines, the private credit teams are generally seeing strong credit quality from borrowers.

“We read the same headlines that you do around private credit bankruptcies, but those exposures are actually in syndicated bank loan and CLO markets,” added Small. “They are not with large private credit managers and direct lending books, and in those very public cases, potential frauds have also been reported.”

In addition, private credit lenders have more control over credit agreements and terms, more access to management teams and more information about company performance relative to the public markets.

“I know the teams are being very vigilant with our clients and monitoring credit conditions, but they are not seeing widespread credit stresses at this point,” said Small.

The HPS and ElmTree acquisitions followed two deals which were announced last year to expand BlackRock’s private market capabilities. In October last year BlackRock completed the purchase of Global Infrastructure Partners (GIP), as Fink described infrastructure as a “generational investment opportunity.”

BlackRock has made “significant progress” in both fundraising and deployment since closing the GIP acquisition, according to Fink. He said the GIP V fund closed above its $25 bn target in July, and represents the largest client capital raise in a private infrastructure fund.

In March this year BlackRock completed its purchase of Preqin, a private markets data provider. BlackRock said this provided the ability to serve clients’ whole portfolios across public and private markets by combining investment, technology, and data solutions in one platform. Over time, BlackRock is integrating Preqin’s proprietary data and research tools within Aladdin, its common technology platform, and eFront, an end-to-end alternative investment management software and solutions provider.

Fink said on the call: “We’ have brought together the strengths of GIP, HPS and Preqin and we are already driving landmark fundraising and deal flow, accelerating client engagement, and have double-digit organic revenue growth over the last year.”

He continues that the firm is working to enable access to growth-oriented private market strategies in 410Ks, U.S. defined benefit pension funds.The fiduciary standard rule will require fiduciaries to carefully perform due diligence on all investments, which Fink said could create an acceleration in demand for Aladdin products.

“Fiduciaries will need better data and analytics on private markets to substantiate and justify their inclusion in 401k offerings, representing a large potential unlock for Aladdin and Preqin,” Fink added.

Fink said BlackRock recently signed its first full portfolio technology mandate encompassing Aladdin, eFront and Preqin as a seamless public-private workflow and data solution.

Financials

BlackRock had net inflows of $205bn in the third quarter, which were positive across all asset classes and client types, according to Fink. This powered 10% organic base fee growth in the third quarter and 8% over the last twelve months. Small added 8% organic base fee growth is the firm’s highest in over four years, and higher than the target of 5% or more.

Fink highlighted the diversification of the growth as a differentiator for BlackRock. The top organic base fee growth contributors included the systematic franchise, private markets, digital assets, outsourcing, cash and iShares, which saw record demand.

“Technology and data analytics, ETFs, private markets, and digital assets are just a few examples where we invested and built leading positions,” Fink added.

Small also highlighted the diversification. Since 1 July this year, BlackRock closed its acquisitions of HPS and Elm Tree, announced an $80bn separately managed account (SMA) solution with Citi Wealth and onboarded a $30bn pension mandate.

“These represent just the start of what our newly integrated platform can unlock,” said Small. “We’ve expanded our capabilities across private markets, digital assets, data and technology.”

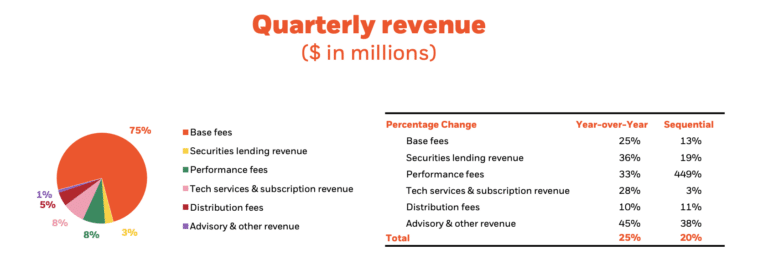

Third quarter revenue of $6.5bn was 25% higher year-on-year, which Small said was driven by the acquisitions of GIP, Preqin and HPS. Operating income of $2.6bn in the same period was up 23% year-on-year.

Fink continued that BlackRock is entering its seasonally strongest fourth quarter with building momentum and a fully unified platform. He added: “One that’s anchored by a public-private investment model, backed by Aladdin technology, and united by a shared culture of performance and client service.”