Larry Fink, chairman and chief executive at BlackRock, said the US asset manager is open to making large transformational acquisitions, especially to extend capabilities in technology and private markets.

Fink spoke on BlackRock’s third quarter results call on 13 October.

“Times of uncertainty are often when transformational opportunities emerge and moments like this in our history led to new ideas, new partnerships and acquisitions,” Fink said. ”BlackRock has a strong track record of successful transformational M&A.”

During the financial crisis in 2009 BlackRock made a $13.5bn acquisition of Barclays Global Investors (BGI), the asset management arm of troubled UK bank Barclays. The purchase has been dubbed the ‘deal of the decade’ for making BlackRock the largest global fund manager with $2.8 trillion in assets at the time, which have since risen to more than $9 trillion. This deal followed BlackRock’s $9.5bn purchase of Merrill Lynch Investment Managers in 2006.

Fink said BlackRock has spent about $4bn on M&A over the last five years. He highlighted the acquisitions of eFront, an end-to-end alternative investment management software and solutions provider, in 2019 and Aperio, which provides customized tax-optimized index equity separately managed accounts, in 2021. He described them as smaller in size but also transformational in their own way as they anticipated client needs.

“We scaled strong existing technologies and built new revenue streams for our shareholders,” added Fink. “Organic growth at Aperio has been over 20% since our acquisition and eFront’s revenues have grown nearly 50% while strengthening our value proposition in private markets.”

During the third quarter, BlackRock closed its acquisition of private debt manager Kreos Capital, which provides growth and venture debt financing to companies in the technology and healthcare industries.

Advances in technology and artificial intelligence, the scaling of private markets and more attractive valuations mean BlackRock is becoming increasingly engaged in M&A discussions according to Fink.

Martin Small, chief financial officer, said on the results call that the hallmark of BlackRock’s M&A strategy has always been about accelerating organic growth, developing new capabilities or derisking.

“We are not capital constrained, we have ample debt capacity,” said Small. “Our goal is to be able to drive earnings acceleration and deliver more for our clients through M&A.”

Partnerships

In addition to acquisitions, BlackRock will also continue to form new partnerships.

In July BlackRock and Jio Financial Services agreed to form Jio BlackRock, a 50:50 joint venture to deliver tech-enabled access to affordable, innovative investment solutions in India. Fink said India has been an integral part of the firm’s global platform, with 15% of its employees in the country, and that BlackRock is one of the largest international investors in India today.

In September BlackRock announced a partnership with Monzo to launch a new investment offering to the UK bank’s 8 million customers and more than 250,000 have joined the waiting list for the product.

On 11 October Upvest, a Berlin-based fintech providing the trading, settlement and custody infrastructure for digital wealth management in one API, said it was partnering with BlackRock to make investing more accessible for investors across Europe.

Fink said: “What we have seen in market after market is that we can make investing easier and more affordable, and we can quickly attract new clients.”

Flows

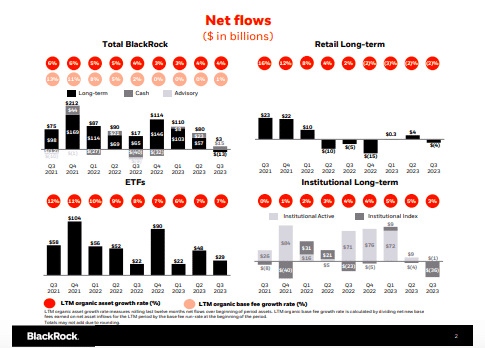

In the third quarter BlackRock had $3bn of total net inflows which it said reflected $49bn of outflows from lower-fee institutional index equity strategies, including $19bn from a single international client

Fink said that for the first time in nearly two decades, clients are earning a real return in cash and can wait for more policy and market certainty before re-risking, which affected third quarter flows across the industry. He compared the environment to 2016 and 2018 and argued that when investors were ready to put money back to work, they came to BlackRock, leading to record flows and share gains.

“The long-term trend of clients consolidating more of their portfolios with BlackRock is only accelerating, and underlying business momentum remains strong,” added Fink.

Small added that the long-term trend of clients consolidating business with fewer managers will be accelerated as a result of this period. Third quarter gross funds sales were 95% of average levels over the last 12 months and Small said flows would have been meaningfully positive, except for a $19bn single client index redemption and $13bn of market-related precision ETF net outflows.

In addition, Small said the client who made the $19bn index redemption is working with BlackRock on more active strategies.

He continued that outflows were partially offset by continued demand for target date funds, illiquid alternatives and outsourcing capabilities. BlackRock has been building private markets capabilities and generated nearly $3bn of net inflows in the third quarter, driven by infrastructure and private credit.

“We are only seeing bigger and better private markets opportunities for BlackRock and for our clients,” said Small. “These investments can unlock future revenue and earnings potential for our shareholders.”

BlackRock said assets under management in the first nine months of this year increased $1.1 trillion year-over-year to $9.1 trillion, which included $307bn of net inflows – $98bn for ETFs, active had $65bn and $46bn in cash management.

Over the same period revenue rose 5% which the fund manager said was primarily driven by organic growth and the impact of market movements over the past twelve months on average AUM and higher technology services revenue.

Small said: “We believe in our 5% organic base fee growth target over the long term.”

ETFs

The exchange-traded fund business, iShares, had $29bn of net inflows in the third quarter, led by core equity inflows of $34bn and fixed income net inflows of $12bn. Historically, the fourth quarter has been the strongest for ETF flows, comprising more than a third, 35%, of annual net inflows on average.

“In line with these historical results, we would expect to see an acceleration in iShares ETF flows as we get closer to the end of 2023,” added Small.

ETFs had nearly $100bn of net inflows in the first nine months of this year according to Fink, and he said the firm is committed to expanding iShares globally.

“I think that’s going to be an integral part of what we are doing in India,” Fink said. “If you look at the ETF trends in the year-to-date, ETF flows are up 70% in Europe and we become a very large beneficiary.”

Fixed income

Fink continued that as the market approaches peak interest rates, BlackRock expects a resurgence in fixed income flows with clients capitalizing on higher yield and the firm is well positioned to benefit with a comprehensive $2.6 trillion fixed income platform.

“Going back to the periods immediately following the taper tantrum in 2013, or the Fed pause in early 2019, the industry saw a quick rebound in fixed income flows following rate stability,” added Fink. “ Both our ETFs and active fixed income funds were large beneficiaries at that time.”

Rob Kapito, president of BlackRock, said on the results call that the yield curve is the most inverted it has been since the 1980s.

“Investors are really getting paid to wait and money market funds have nearly $7 trillion in assets under management,” Kapito added. “As we approach peak interest rates, we expect there are going to be some large allocations to fixed income which some will call the great reallocation.”

As well as active and indexed fixed income, clients are also turning to private markets with greater frequency for their capital and financing needs.

In the third quarter, BlackRock announced it is partnering with the New Zealand government to launch a climate infrastructure strategy with more than $1bn. BlackRock’s partnership with Temasek in Decarbonization Partners has also reached $1bn in committed capital for its first round, and is invested in five portfolio companies.

Fink said BlackRock’s flagship private equity fund currently stands at more than 35% net IRR, and that flagship private credit strategies had double-digit net returns this year.