Robert Kapito, president of BlackRock, said there are generational opportunities in the bond market as rates rise, and the US has introduced infrastructure and sustainability stimulus.

Kapito said on the asset manager’s third quarter results call on 13 October that markets in 2022 have disrupted traditional portfolio allocations and liquidity profiles.

“For the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk,” he added.

“For the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk,” he added.

For example, 12 months ago US two-year Treasury notes were yielding 25 basis points and that has risen to 4%. In addition, corporate bonds are yielding over 5% and high yield above 9%.

He gave the context that back in 1995 when institutions were looking for a 7.5% yield, they could achieve their objective with a 100% bond portfolio. Ten years ago that required 15% bonds, 60% equities and 25% in alternatives. Today, the same return requires 85% bonds and 15% in equities and alternatives, and BlackRock clients have been underweight in fixed income.

“Infrastructure and sustainability stimulus in the US is going to create significant opportunities for long-term investors and over the last several years, BlackRock has built some great teams that have great performance in these particular areas,” said Kapito. “So clients are coming to BlackRock to help them pursue generational opportunities in the bond market, and we’re helping them navigate recalibrations of their fixed income portfolios.”

There were net inflows of $1.5bn into private credit and active fixed income in the third quarter.

Kapito said: “I think we are gonna see dramatic and large inflows into fixed income over the next year as interest rates rise and clients look to lock in yields, rebalance back to target allocations, or execute on opportunities for additional yield, inflation protection and infrastructure.”

BlackRock also had $37bn of net inflows into iShares’ bond ETFs in the third quarter, which the firm said was its second best quarter in history, and $76bn in the first nine months of this year.

ETFs

Larry Fink, chairman and chief executive of BlackRock, said on the call: “Bond ETFs are revolutionising fixing income investing, with iShares leading industry growth and industry innovation. Flows in 2022 highlighted the unique diversity of BlackRock’s bond ETF platform and were led by US Treasuries, investment grade, municipal bonds and international government bonds.”

BlackRock has $700bn in assets under management in 300 bond EFTs.

Gary Shedlin, chief financial officer of BlackRock, said on the call: “It took the bond ETF industry 17 years to reach $1 trillion in assets in 2019 and it is now closing in on $2 trillion. We believe that the industry will be at $5 trillion before the end of this decade, with BlackRock leading that significant growth.”

Fink highlighted the opening of the bond ETF ecosystem, including CME Group’s announcement that the derivatives exchange would accept certain bond ETFs for collateral management and continued adoption from US insurers following changes in their capital treatment.

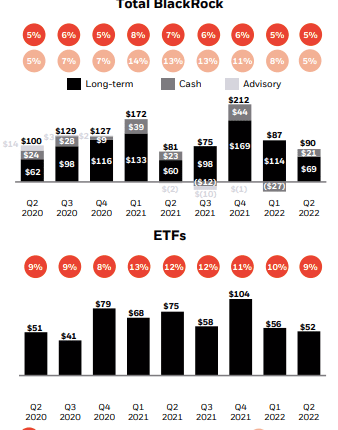

Across iShares, BlackRock generated ETF inflows of $22bn in the third quarter and $131bn in the year-to date.

Shedlin said the demand for bond ETFs was partially offset by sentiment driven outflows from commodities, broad emerging market and small-cap equity precision ETFs.

ESG

Management were asked if they would adjust or reposition their message on environmental, social and governance strategies as the firm has been accused of both doing too much and not found enough in the sector.

Fink replied that ESG inflows in the US were $85bn in the third quarter, $133bn for the year-to-date and $258 bn over the last 12 months.

“Importantly, I think what is resonating is that we are providing clients with choice,” he added. “There are many clients who believe that investing in a sustainable strategy is the right long-term strategy and other clients may have different views. Our best edge has always been about providing whatever the client is looking to do and moving forward.”

He highlighted that BlackRock had provided institutional clients with voting choice. The firm would like to expand that choice to individual investors.

“We announced it over a year ago and it’s a major part of the dialogue today,” he said., “We’re telling our story with facts and I’m here to tell our shareholders that choice is resonating.”

LDI strategies

Management were also asked about liability-driven investing (LDI) strategies in the UK pensions industry, and the role played by asset managers, including BlackRock.

Fink said LDI has been a 20-year market , is transparent and approved by regulators and investment consultants. He estimated that the LDI market in the UK is approximately $1.7 trillion and BlackRock has around one fifth of the market.

Pensions can minimize possible shortfalls by using some assets to borrow capital, so the scheme can invest to grow the value of their current investments for the benefit of future retirees. As bond yields rise, asset managers can ask pension funds to increase the assets in their LDI strategies, if they wish to keep the same exposures.

“These products were built with the idea that you had risk corridors of 100 to 125 basis points,” Fink said. “That corridor worked for over 20 years until gilt markets fell over 100 basis points in one day after the fiscal policy announcement by the UK Government and many corridors were penetrated.”

The market movement required some pension schemes to post margin on their total return swaps and many did not have the ability to rapidly post enough collateral in a single day, requiring intervention from the Bank of England. Fink said the announcement by the Governor of the Bank of England yesterday indicates that much of the reconstruction of these products has been done.

“We want to work with the regulators so that if volatility is going to continue, there has to be a redesigning of some of these products,” he added.

Financials

BlackRock reported $65 billion of quarterly long-term net inflows driven by continued momentum in strategic ETFs and significant outsourcing mandates, which represented approximately 3% annualised organic asset growth.

Fink said BlackRock generated industry-leading long-term net inflows of $248bn in the first nine months of 2022.

“Active strategies reflected momentum from significant outsourcing mandates and continued demand for alternatives, where we raised $6bn across commitments and net inflows,” he added. “We had record Aladdin client mandates in the first nine months of 2022, with over half coming from multi-product solutions.”

Larry Fink shares his insights on BlackRock’s Q3 earnings results https://t.co/k7QXvPqffv pic.twitter.com/V2I3CEkOv6

— BlackRock_News (@BlackRock_News) October 13, 2022

“Market conditions remain very challenged in the third quarter with global equity and debt markets ending down 25% and 14% respectively for the first nine months of 2022.,” said Shedlin. “In total, these market declines along with significant dollar appreciation against major currencies reduced the value of BlackRock assets under management by over $2 trillion since December 31.”

Total assets under management were $7.9 trillion at the end of the third quarter, compared to $9.4 trillion a year ago.

“Even with these historically difficult market conditions, AUM is still up $2 trillion since the beginning of 2019,” added Fink. “During that period, we also added over $1.6 trillion in assets under management from organic growth alone.”

Third quarter revenue of $4.3bn was 15% lower year-over-year, primarily driven by the impact of significant lower markets, appreciation on average assets under management and lower performance fees. Operating income of $1.6bn was down 22% and reflected the impact of approximately $96m of closed end fund launch costs in the third quarter of 2021 according to BlackRock.

“While we continue to have deep conviction in our strategy and the long term growth of the global capital markets, we have begun to more aggressively manage the pace of certain discretionary spend,” said Shedlin. “We are continuing to pursue critical hires that support our near term growth, but are pausing the balance of our hiring plans for the remainder of 2022.”

Shedlin will be succeeded by Martin Small in 2023. He will transition his CFO responsibilities after the firm completes its 2022 financial reporting processes, which is anticipated to be on or about March 1 2023, and will take on a new role as vice chairman working directly with key strategic clients of the firm. Small, head of BlackRock’s U.S. wealth advisory business, will work with Shedlin in the interim to assure a smooth transition.

Small has been head of the U.S. Wealth Advisory business for the past four years and BlackRock said he has vastly expanded capabilities for wealth clients. He was previously head of iShares in the U.S. and Canada and in leadership roles for BlackRock’s financial markets advisory unit. Small joined BlackRock in 2006 in its legal & compliance team from law firm Davis Polk.