Broker Robinhood is launching its own blockchain to allow users in the European Union to trade tokenized U.S. stocks, with some observers commenting that this will put “immense pressure on traditional exchanges” but another stating that they are “not good products.”

Galaxy Research said in a note that Robinhood, led by co-founder and chief executive Vlad Tenev, has been one of the most outspoken proponents of blockchains and tokenization.

Introducing The Robinhood Chain.

The first Ethereum Layer 2 optimized for real-world assets via @arbitrum—from public to private to global.

You shouldn’t have to rely on a broker to trade assets. Instead, you should be able to seamlessly trade real-world assets in seconds.… pic.twitter.com/nDqEyduOED

— Vlad Tenev (@vladtenev) July 2, 2025

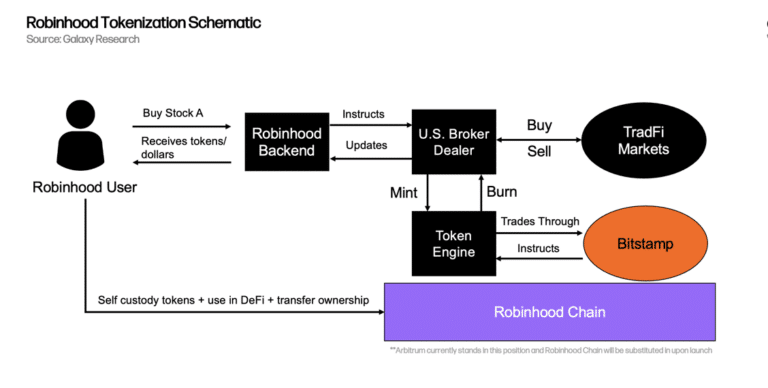

Robinhood said in a presentation on 2 July 2025 that it is launching its own blockchain to allow users in the European Union to trade tokenized U.S. stocks. Users trade as normal through the Robinhood app but are actually trading tokenized derivatives on the Robinhood blockchain. Galaxy explained that users can trade the underlying asset at its real market rate while tapping into the asset’s offchain liquidity because the actual stocks are held in custody by a U.S. broker-dealer according to Tenev’s presentation.

Unlike standard stocks the tokens can be transferred onchain to another wallet, can interact with other onchain applications in decentralised finance. Smart contracts can be used to program tokenized assets so they can automatically be used in collateral movements, integrated into automated financial strategies and make corporate actions such as dividend payments more efficient.

Zack Pokorny, a researcher at Galaxy said in the note: “Robinhood’s presentation offers a glimpse of what it will mean for traditional finance (TradFi) firms to integrate blockchains. Increasingly, it is clear these firms want sovereign block space they control.”

This model allows Robinhood to earn revenue from its block space by encouraging developers to build applications that use tokenized assets, so the firm can monetize the full “tokenization stack” from offchain trading to onchain utility.

In addition, the main value-add and disruption from the technology comes in the form of 24/7 trading. Pokorny said Robinhood’s recent acquisition of crypto exchange Bitstamp is expected to play a critical role in realizing this vision as it will be the venue facilitating tokenized asset trades offchain and outside market hours on weekdays.

He argued that Robinhood is effectively pulling assets out of the traditional market trading flow onto blockchain rails, which directly challenges the deep concentration of liquidity and activity that gives major TradFi exchanges (e.g. NYSE) their competitive advantage.

“This moving of trading volume could erode the exchanges’ activity and core revenue streams, which rely on trading fees and the sale of market data,” added Pokorny. “While Robinhood is just a single fish in a massive ocean, more brokerages adopting a blockchain-based strategy for trading could put immense pressure on traditional exchanges.”

Rob Hadick, general partner at crypto venture fund Dragonfly_xyz, said tokenized stocks with the structure that Robinhood appears to be using are “just not good products.”

For example, the vehicle holding the actual shares as collateral for the tokens can only buy them during traditional market hours, so all after hours/weekend trading will require a market maker to hold the price risk.

“Market makers, because they will have to take massive amounts of weekend and after hours price risk, will have to blow out spreads that will make trading these things outside of market hours untenable for most professional traders and firms,” said Hadick. “Those firms will also, likely, pull liquidity in times of market stress on weekends and after hours.”

I know everyone is really bulled up on the Robinhood announcement and tokenized equities, and not to be a bear, but the conversation seems to lack a lot of nuance. I'm a long term bull but I expect near term expectations are WAY too high. So lets take a critical look.

So, how…

— Rob Hadick >|< (@HadickM) July 1, 2025

Hadick acknowledged that tokens do provide access to otherwise underserved markets and provide ease of transfer, fractionalized shares and better reconciliation. However, he said this is only for a small subset of retail and tokens cannot serve a sophisticated, real, and global equities market.

“Long-term, as primary markets come onchain, collateral mobility moves to tokenized products, and traditional takers can fix their (pretty outdated) tech stacks, you’ll see equities move in real size onchain and liquidity increase dramatically,” added Hadick. “There will be lots of headlines, but these existing products are likely going to be a disappointing speed bump in the trajectory we are on.”

In addition, an employees at early stage venture firm Electric Capital, said it is unlikely that the Robinhood tokens can interact with defi:

Just decompiled Robinhood's tokenized stock contracts. It's a walled garden, every transfer checks a registry of approved wallets (kyc/aml)

It's unlikely these tokens can interact with defi

It's very possible cefi with distribution just outcompetes existing defi protocols pic.twitter.com/JC24VUEBmA

— ren (wassie arc) (@0xren_cf) July 1, 2025

Ondo Finance stressed the importance for tokenized stocks. The blockchain technology company said in a blog: “Tokenized stocks recently launched onchain. While the direction is promising, early models reveal deep structural issues: limited liquidity, wide spreads, and persistent price dislocations.”

3/ These pricing dislocations aren't temporary launch issues. They reflect fundamental limitations.

High-friction minting & redemption mechanisms prevent efficient arbitrage. Without seamless arbitrage, secondary market prices inevitably diverge from underlying reference prices.

— Ondo Finance (@OndoFinance) July 2, 2025

7/ Ondo GM takes a fundamentally different approach.

Tokens are fully backed and secured by underlying stocks and ETFs, while also giving investors access to the liquidity of traditional markets.

When users buy TSLA via Ondo GM: stablecoins fund the purchase → TSLA acquired on…

— Ondo Finance (@OndoFinance) July 2, 2025

Superstate, a financial technology firm, also said that its Opening Bell is different:

2/ For already public companies, it's simple:

✔️No new registration

✔️Direct collaboration

✔️No fragmented liquidityJust a simple update to name Superstate as the on-chain transfer agent.

— Superstate (@superstatefunds) July 2, 2025

4/ Issuers configure how their shares function on-chain.

They choose the blockchain(s) and protocol integrations.

They maintain a direct relationship with their investors.

They gain a foundation to innovate over time: https://t.co/VDufjo9Dfz— Superstate (@superstatefunds) July 2, 2025

Regulation

In addition Galaxy warned that U.S regulators may not allow Robinhood’s approach and public or private issuers may also object.

The Securities Industry and Financial Markets Association, the U.S. trade association for securities firms, told the Securities and Exchange Commission that it was concerned about reports that certain digital asset firms have submitted requests for immediate no-action or exemptive relief from requirements under the federal securities laws to allow such firms to offer investors the ability to purchase and trade tokenized equities or other digital forms of traditional securities.

SIFMA said in a letter: “The SEC should reject such requests to make significant changes to the regulatory structure for the securities markets under the federal securities laws through immediate no-action or exemptive relief in lieu of a more substantive notice and comment process.”

Pokorny said: “While we view SIFMA’s letter as representing its members’ interests as intermediaries, it does show the extent to which Robinhood’s tokenization model (which itself goes well beyond what most are proposing onshore) and tokenization in general is seen as challenging the traditional system.”

He claimed that if incumbent exchanges cannot support the utility introduced by tokenized assets, they risk becoming custodians of a less functional version of the same assets, which will incentivize users to move to blockchain-based alternatives.

“This sets the stage for a race between nimble fintechs and incumbent exchanges to become the centers of trading in the digital world,” he added. “ In this sense, the fintechs are already “off to the races,” while the larger exchanges face a more complex and slower path to modernization.”

This is really good from @matt_levine on tokenization.

If we're totally cool with people trading equity in "private" companies, because it's on-chain, then eventually it seems possible that in the future we don't have IPOs or even standardized disclosure for any company at all. pic.twitter.com/PdlK48fES4

— Joe Weisenthal (@TheStalwart) July 2, 2025

Private shares

Robinhood is also allowing EU users to trade tokens that represent equity in privately held companies including OpenAI, who objected to the tokenization:

This highlights another risk on the private company side I didn't address yesterday, but we often see in these secondary markets. There is no requirement for these companies to honor the sale of the equity you think you own – in fact I said recently at a private conference that I… https://t.co/nyzhjfgXwV

— Rob Hadick >|< (@HadickM) July 2, 2025

Alex Johnson, a former fintech operator and industry analyst at Fintech Takes highlighted in a note that the difference between tokens and equity is ‘really important’, especially as retail investors will not understand what they are investing in private companies who make fewer disclosures. He argued that private companies don’t want this market to exist, and they will likely take actions to make it more difficult for tokens that are loosely affiliated with them to be sold.

It seems to me that tokenized private stock "investing" is going to create a significant adverse selection problem.

The private companies that investors should want to invest in (OpenAI, SpaceX, Stripe, etc.) don't need or want it (see OpenAI's tweet below) and will likely take… pic.twitter.com/FO1Of9K6La

— Alex Johnson (@AlexH_Johnson) July 4, 2025

“Private companies that know their business isn’t good enough to attract significant investment from venture capital firms work with Robinhood to sell tokens that give retail investors exposure to their last valuation, without disclosing any information about their business to those investors,” Johnson added. “This isn’t going to end well, but we shouldn’t be surprised Robinhood is pushing in this direction. That entire company is essentially just an engine that generates a steady stream of adverse selection for its customers. This is just the latest flavor.”

Pokorny said it is understandable that OpenAI disavowed Robinhood’s tokenization of its private company shares and clarified that the tokens do not confer equity ownership as they are derivatives that provide indirect exposure to the underlying asset.

“In the bigger picture, we’re unlikely to see tokenization of shares in private companies at scale without the express consent of issuers themselves,” he added.

Security Token Group said in a newsletter that Robinhood ‘changed the game ’by announcing their own chain and their own version of tokenized stocks for public and private equities.

The newsletter argued: “This can’t be stopped or controlled by OpenAI even, despite best efforts by the company to tweet the trend out of legitimacy. That probably backfired given it only brought more attention to the whole debacle.”

Christopher Perkins, president of cryptonative investment firm CoinFund, highlighted that 81% of U.S. companies with over $100m in revenue are private and most Americans are locked out of investing in these innovative companies. He said: “As Robinhood offering shows, tokenization of equity in private companies could change this.”

Last week, @RobinhoodApp announced that it is now offering tokenized shares of @OpenAI and @SpaceX to users in Europe.

While imperfect, tokenization of equity in private companies could have far reaching implications for the democratization of global markets.

Yes, OpenAI was… pic.twitter.com/dn8vI1fsOF

— Christopher Perkins 🦅🌎⚓️NYC (@perkinscr97) July 7, 2025

“Fast forward a bit, and the line between private and public markets could start to blur,” added Perkins. “With the appropriate disclaimers and guardrails, this might not be a terrible thing.”