Craig Donohue, chief executive of Cboe Global Markets, took on his role in May this year and has completed a review of the derivatives and securities markets operator. The new strategy includes initiating a sales process for Cboe Australia and Cboe Canada, discontinuing U.S. and European corporate listings efforts and reducing costs related to U.S. and European ETP listings businesses, Cboe Europe Derivatives and several of Cboe’s smaller risk and market analytics businesses.

On the third quarter results call on 31 October 2025, Donohue said that although the Australian and Canadian equities businesses are performing well, they fall outside Cboe’s core focus and strategy.

“We see tremendous opportunities across index and multi-list options, futures, US and European equities, foreign exchange and Data Vantage,” he added. “In leveraging these core areas of strength for Cboe and the strong secular growth trends supporting them, we believe we are well positioned to fully capture their growth and earnings potential as we strengthen our competitive position.”

Donohue said the review process began under his predecessor, Fredric Tomczyk, but he aimed to accelerate that process and reach a conclusion. He explained that Cboe wants to pivot towards the largest growth opportunities amongst all the available choices.

These opportunities are the current large core businesses that are hugely successful with a critical mass of markets, products, liquidity and customers, and optimization for greater profitability in each of those businesses, according to Donohue. In addition, many emerging growth trends in the industry align with these core capabilities such as event prediction markets, as well as digital asset and crypto markets, which are currently retail oriented.

Possibilities for continued investment include adding scale in derivatives, prediction markets, retail-oriented digital asset and crypto products, clearing capabilities in Europe and the U.S. and developing onchain capabilities as the industry migrates toward atomized settlement capabilities and extension of traditional trading hours.

Cboe has made a regulatory filing to extend trading hours for U.S. equity options from the current 9.30 ET to 4 ET with an additional morning session from 7.30 ET to 9.25 ET and a post-close session from 4 ET to 4.15 ET.

Donohue continued that the realignment and focus on growth allows Cboe to continue to build senior leadership talent across the organization. In the past six months, Dononue said Cboe has made key hires in strategy and corporate development, global derivatives clearing and Data Vantage. On 30 October Cboe said in a statement that it had hired JJ Kinahan as head of retail expansion and alternative investment products, who is a veteran in the retail broker space with deep expertise in equity derivatives markets.

“I look forward to working closely with him and Rob [Hocking] as we pursue new growth opportunities in the retail oriented digital, crypto and event contract space,” added Donohue.

In September this year Cboe announced the appointment of Hocking as global head of derivatives and Brian McElligott as global head of Cboe Data Vantage.

Jill Griebenow, chief financial officer at Cboe, said on the call that she does not anticipate that the strategic changes will have a material impact on Cboe’s 2025 total organic net revenue growth or 2025 adjusted operating expenses.

Options

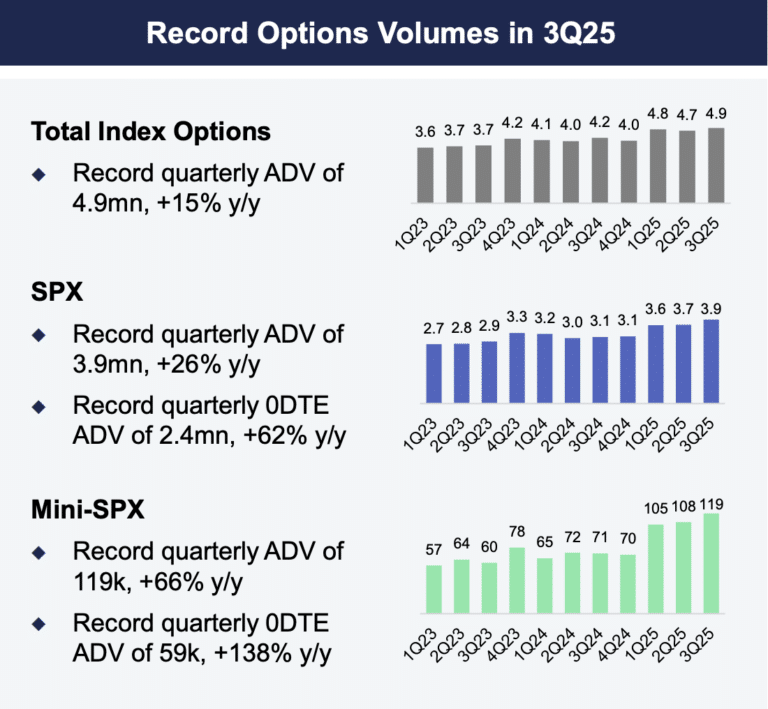

Derivatives net revenue increased 15% versus the third quarter of 2024. Griebenow said the options segment delivered its fifth consecutive quarter of record net revenue with 19% year-over-year growth.

Donohue added: “Cboe is well positioned to benefit from strong secular trends, having taken meaningful steps to deepen our talent pool in the options space while actively pursuing thoughtful regulatory reforms that support both the industry and investors.”

The group’s proprietary SPX options complex on the S&P 500 index set new records, according to Donohue, with average daily volume for zero days to expiry (0DTE) options increasing 62% year-over-year. In addition, 0DTE SPX options made up over 61% of total SPX volumes, up from less than half, 48%, a year ago.

“It’s noteworthy that nine of the 10 highest average daily volume months occurred in 2025 with September ranking as the third highest month on record, only behind March and October,” said Donohue. “Our largest SPX day on record occurred on October 10, with 6.4 million contracts traded and a record 33.2 million total options contracts traded across our index and multi-list products.”

He continued that Cboe remains positive on the outlook for its core derivatives business due to the growth in index options, despite lower volatility.

Event prediction markets

Donohue argued that Cboe has been an innovator in shorter-dated contracts through 0DTE options and event prediction markets are just another variation of this.

“That’s something that we have demonstrable expertise and success in,” he added, “We were also an early participant in digital asset markets.”

Cboe management argued that options have always been centered around forecasting future market movements and that its proprietary VIX index is a real-time measure of volatility and the market’s expectation of a trading range over a period of time. Therefore, VIX’s predictive nature has driven it to become one of the most watched equity market benchmarks in the world.

Prashant Bhatia, head of enterprise strategy & corporate development at Cboe, said on the call that Cboe sees broad based interest in prediction markets which aligns with the secular trends of increased retail participation, appetite for short-dated options, and smaller contract sizes, with dollar-sized contracts being the “ultimate mini contract.”

In August this year CME Group, the derivatives market operator, announced a partnership with FanDuel to launch new products and expand access to financial markets for millions of customers of the U.S. online gaming company. The companies will develop new fully funded, event-based contracts with defined risk which are expected to launch this year on benchmarks such as the S&P 500 and Nasdaq 100, prices of oil and gas, gold, cryptocurrencies, and key economic indicators such as GDP and CPI. Customers will be able to express their views multiple times a day on a wide range of markets with simple “yes” or “no” positions for as little as $1.

In October this year ICE, which provides financial technology and data services across asset classes, announced a strategic investment of up to $2bn in Polymarket, a prediction market platform. Alongside its investment, ICE has also formed a strategic data agreement with Polymarket to become a global distributor of the firm’s event-driven data as the leader in non-sports prediction markets. Polymarket provides real time probabilities on events such as elections, economic indicators and cultural trends.

Bhatia said Cboe wants to leverage its strengths and provide industry participants them with a neutral infrastructure platform on both the exchange and clearing side. Cboe trades an average of $18bn premium each day in SPX options, while for event and prediction markets that is less than $50m.

“You can expect our focus to be on financial and economic related contracts and we’re crafting a go to market plan,” added Bhatia. “Event prediction markets are clearly an area of interest for us.”

Donohue said the primary focus is a launch plan that’s focused on organic efforts. He added: “Obviously, we’ll always look at inorganic opportunities if they make sense. ”

Financials

Griebenow said: “Cboe produced a third consecutive quarter of record net revenue to drive record diluted earnings per share (EPS) and adjusted diluted EPS.”

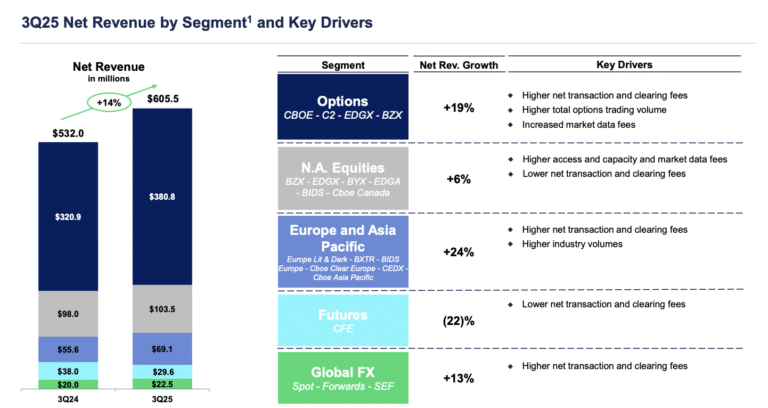

Cboe reported record net revenue for the third quarter of $605.5m, up 14% from a year ago. Donohue highlighted that all three of Cboe’s revenue categories – derivatives, cash and spot markets and Data Vantage – posted double-digit net revenue growth.

Data Vantage net revenue grew 12% year-over-year. Griebenow said: “Moving forward, we are increasing our 2025 organic total net revenue growth guidance range to ‘low double-digit to mid-teens’ from ‘high single-digit.’”