Just over six months ago, in February this year, Meaghan Dugan joined Cboe Global Markets as head of U.S. options, with responsibility for overseeing the strategy, competitive positioning, market structure and market development for the business. She had previously been head of options at the New York Stock Exchange and had also spent 11 years at Bank of America, including as head of product for U.S. electronic options and global future algorithms.

She told Markets Media that after speaking to Cathy Clay, Cboe’s global head of derivatives, she realised she had a “great” opportunity to join a derivatives-first organization. In addition, the business is supported by strong internal partners such as The Options Institute, which has been providing education for 40 years, and the Market Intelligence team, led by Mandy Xu, which produces research.

Dugan describes her new role as jumping in the deep end as market volatility spiked in April. She said: “There was a collaborative effort and a lot of daily conversations across technology, operations, the business and market structure on making sure that we were resilient and stable and latency remained as low as possible.”

In the first half of this year, overall options volume for the industry increased 24% over the same period in 2024, according to Dugan.

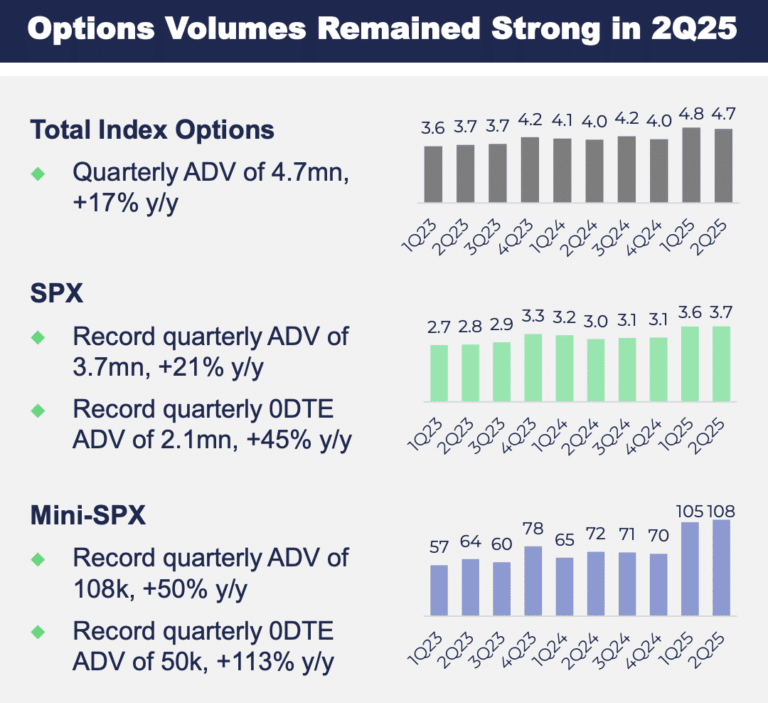

Cboe reported in its second quarter results that the derivatives franchise had a record quarter with organic net revenue increasing 17% year-over-year. Multi-list options’ net transaction and clearing fees revenue was up 32%. Volumes of SPX options on the S&P 500 index rose 21% to a new record average daily volume of 3.7 million contracts and set a single day record of 6 million contracts on 4 April.

In April Cboe launched S&P 500 Equal Weight Index (EWI) options in which each constituent of the S&P 500 EWI is allocated a fixed weight of 0.2% of the index total at each quarterly rebalance.

FLEX options

On June 23 Cboe launched FLEX vs. listed complex orders functionality which it said was a first-of-its-kind.

“We continue to deliver new products regardless of the craziness in the markets,” said Dugan. “We feel strongly about keeping that pipeline strong, and it is very strong going into the end of the year.”

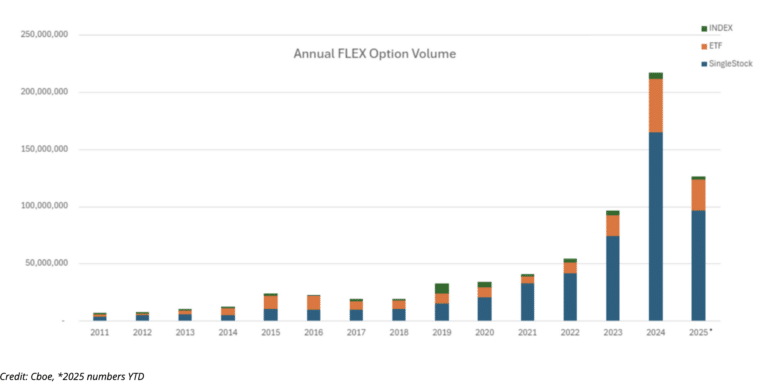

FLEX options were first introduced by Cboe in 1993 and offer customizable contract terms, such as strike price, expiration date, and exercise style while keeping the benefits of exchange-traded products, such as central clearing and competitive price discovery. Cboe said FLEX options are one of the fastest-growing segments in the U.S. listed options market as more than 200 million contracts were traded across the U.S. listed options market in 2024, compared to 12 million in 2012.

The new functionality allows traders to combine FLEX options and standard listed options of the same security into a single order. Previously they would have needed to place two separate orders, with a possible time lag in execution between them. Dugan described the new functionality as a wrapper around a single transaction and a single spread ticket which increases efficiency from an order entry, negotiation, trading and liquidity provision perspective and also in the settlement process.

“A lot of innovations come from conversations with our clients,” she added . “This one in particular is a great one, because it is really helping clients be as efficient as possible in order placement on the exchange.”

Dugan said clients are using the new functionality across a number of single stock options and volumes are increasing every day. Cboe is working with order management system (OMS) vendors as they can provide access to the new functionality to their clients.

In October this year, Cboe hopes to launch complex orders on its BZX options markets and is planning to expand the toolkit for retail traders footprint toolkit such as supporting complex orders and limit orders.

Zero day to expiry (0DTE) options

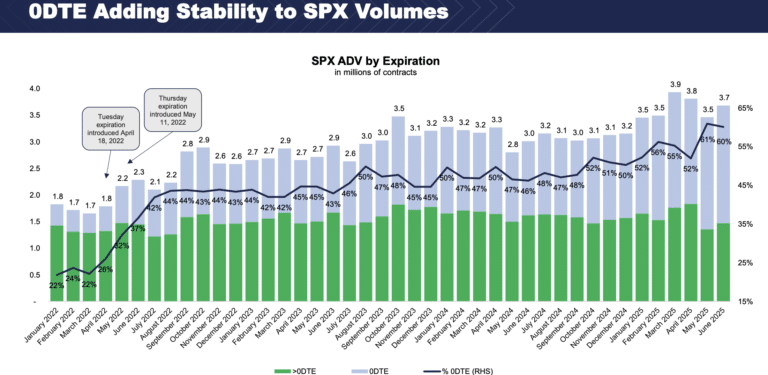

In addition to FLEX options, 0DTE options have also grown in volume. Retail investors stepped back from trading when volatility spiked in April but came back in May and June. SPX 0DTE volumes ended June with a new record monthly average daily volume of 2.2m contracts.

Craig Donohue, chief executive of Cboe, said on the second quarter results call: “In the past year alone, we’ve seen the VIX index hit a high of 60 twice and SPX intraday volatility jump to a post-global financial crisis high. Through it all, SPX 0DTE options have continued to grow, propelled by wider adoption and new use cases.”

In the second quarter, SPX 0DTE options were a record 57% of overall SPX options volume.

Dugan continued that another exchange has filed with the SEC to allow 0DTE options on a select group of stocks which would open the contracts to some single stock options. However, this would also need discussion with the industry as there is potentially more exposure to risk, especially related to events such as earnings reports or corporate actions.

Global trading hours

Cboe operates global trading hours for some index contracts providing access to nearly 24 hours a day, five days a week to investors around the world. Dugan said that as more overseas retail brokers use Cboe’s global trading hours, the exchange is continuing to monitor the use of 0DTE contracts.

“We are seeing more retail clients and brokers accessing our global trading hours,” said Dugan. “As interest expands globally and our reach continues to expand, Cboe has a strategic goal to continue to spread education of U.S. options across the world.”

Cboe’s strategy includes importing demand from overseas into US markets. The strategy includes using The Options Institute to offer education in different languages and putting boots on the ground with native language speakers. For example, Cboe has appointed Steven Jorgensen as head of derivatives sales for Europe and the Middle East and made a number of hires in Asia Pacific for derivatives sales.

Dugan said Cboe is in discussions with market participants and financial infrastructures about expanding trading hours for US options markets in the morning, for example, between 6:30am and 9:15am.

“As the theme of trading equities 24×5 continues, it’s a natural evolution to think about it in the derivatives space,” she added.

She argues that because Cboe already operated global trading hours, the firm is well positioned to support extended trading hours from an infrastructure, operational and technical standpoint.

Competition

Cboe faces increased competition in the U.S. options space. IEX, which operates an equities exchange, plans to launch an options venue at the end of the first quarter of 2026, pending regulatory approval. MEMX, a technology-driven exchange operator, has received regulatory approval for its second options exchange, which is targeted to launch in the first half of 2026.

Last week Miami International Holdings, (MIH), which has built and operates regulated markets in equites, futures and options, went public. Its fourth electronic U.S. equity options exchange, MIAX Sapphire, was launched in August 2024 and accesses approximately 94% of total multi-listed volume. The remaining 6% is traded on exchange floors and MIAX is due to open a trading floor in Miami, Florida in September this year.

Dugan said: “We are always fighting as it relates to product innovation and a competitive pricing landscape. Our close partnerships with clients and right relationships are very important to us as we want to help them grow.”

Cboe also operates a trading floor in Chicago which Dugan said was highly valued as there are still large complicated transactions that cannot be executed electronically. The firm is investing in updating its floor itself to provide a higher level of client experience, such as on investor days or for tours. She said: “The SPX pit is still very active.”