Central counterparties remained resilient during the increase in volatility related to the Covid-19 pandemic according to the Bank for International Settlements but central banks may have to change their thinking on margining.

BIS said in a report that, as expected, CCPs issued larger margin calls as volatility increased which contributed to their resilience. However this weighed on the liquidity of clearing member banks.

In the midst of the Covid-19 induced financial turbulence, central counterparties remained resilient, vindicating post-crisis reforms that incentivise central clearing #BISBulletin #Covid19 #CentralClearing https://t.co/Fa8qcdVQtw pic.twitter.com/qsskSSm1d3

— Bank for International Settlements (@BIS_org) May 11, 2020

Wenqian Huang and Előd Takáts, authors of the report, said: “Therefore, when thinking about margining, central banks need to assess banks and CCPs jointly rather than in isolation.”

The report continued that the margin models of some CCPs seem to have underestimated market volatility because relied on a short period of historical price movements from tranquil times. As a result, they had to increase margins at the wrong time, squeezing liquidity when it was most needed.

“Importantly, actions that might seem prudent from an individual institution’s perspective, such as increasing margins in a turmoil, might destabilise the nexus overall,” said the study.

When there are large price movements traders with losing positions need to transfer cash to meet variation margin calls and so suffer capital losses, which could increase the leverage ratio and pressure them to reduce their positions.

This happened after both the Lehman Bank default during the financial crisis in 2008 and the current pandemic market turmoil. BIS highlighted that central clearing mitigated counterparty credit risk and provided transparency, which is a clear improvement in comparison with the bilateral clearing that was common before the Lehman collapse.

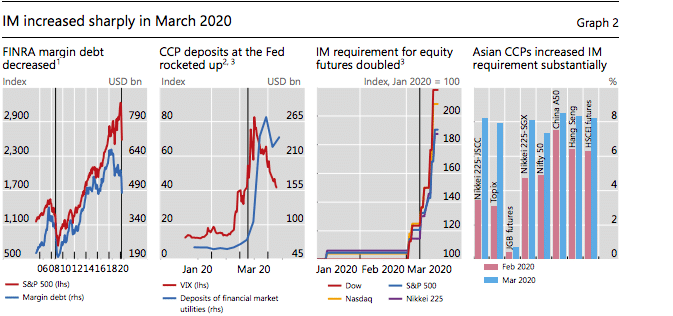

In March this year CCP deposits at the Federal Reserve more than tripled within a month around $70bn (€65bn) to more than $270bn.

“This most likely reflects the increasing amount of initial margin pledged by clearing members,” added BIS. “For instance, the initial margin requirements for major US equity futures have doubled since March.”

In addition as markets became more volatile and counterparty credit risk increased, more trades shifted to central clearing. So margin calls affected a wider ranges of trades, increasing the cost of collateral, especially high-quality liquid assets.

In addition, the liquidity squeeze can also further intensify if banks hoard liquidity in anticipation of margin calls.

“And indeed, large US commercial banks hoarded liquidity: in less than two months, between end-February and early April, they doubled their cash assets from $789bn to $1.5 trillion,” added BIS. “The increase was also sharp, though slightly less pronounced, for foreign commercial banks and small banks.”

However, the the five largest members together account for more than one half of the total outstanding positions at CCPs. Therefore, increasing margin during market stress can put undue pressure on clearing member banks exactly at the wrong time.

“The resulting bank liquidity squeeze might be particularly harmful now, as corporates and households rely on banks for funding,” added BIS. “Therefore, central banks and regulators need to think about CCPs and banks jointly rather than in isolation. One area for such thinking is a trade-off in margin setting guidance.”