Citi is launching digital asset custody in 2026 and believes it has an advantage in being able to bridge traditional and digital assets on one platform.

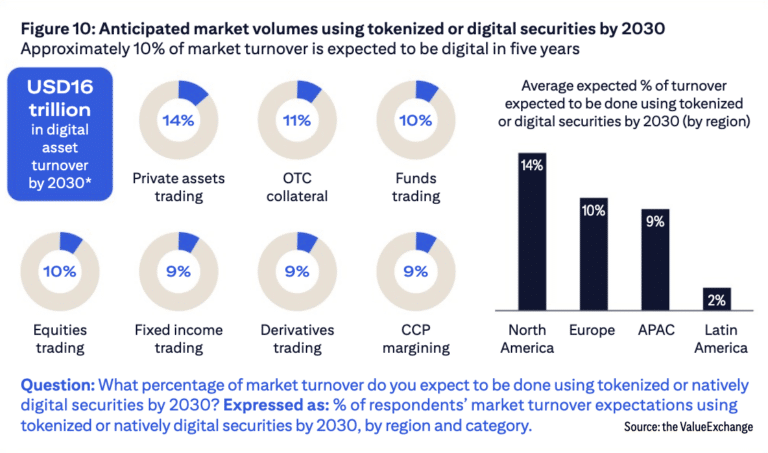

Market participants expect about 10% of market turnover to be digital in five years according to the Citi Securities Services Evolution 2025 survey of over 500 market participants. Adoption of digital assets scored the highest positive change year-on-year and respondents said custodians are their preferred route to accessing these digital assets and markets.

Ryan Marsh, head of innovation & strategic partnerships at Citi Issuer Services and Investor Services, told Markets Media that regulatory clarity, maturing technology and the scaling of ecosystems are driving an increase in institutional adoption. He said: “We are launching crypto custody next year so we need to make sure we have the right key management infrastructure and have CIDAP integrated back into our traditional custody platform. All of that work has been going on for some time and is very well developed.”

CIDAP is an enterprise platform that contains all of Citi’s digital asset and blockchain specific technologies so that the entire firm can benefit as the bank launches a wide range of use cases. For example, the platform includes an internal blockchain, connectivity to external blockchains, tokenization capabilities, custody services and a set of microservices dedicated to blockchain and digital asset capabilities. Digital asset custody needs some new capabilities that sit within CDAP such as managing and storing keys for digital asset wallets and hosting nodes on blockchains that help to maintain a network by validating and relaying transactions.

The platform has been built at an enterprise level so that the firm only has to build once, and it becomes a bridge between traditional applications and blockchain, according to Marsh. He continued that digital assets are not a standalone area of focus but are fully integrated into Citi’s innovation strategy.

“We are talking about both the assets themselves and the blockchain infrastructure, which we view as potentially the next evolution of financial infrastructure,” Marsh added.

For example, blockchains are designed to be borderless and operate 24/7 allowing an increase in the speed of transactions, transparency and an opportunity to reengineer financial processes to make them more efficient.

Marsh said that in the near term the world is becoming more fragmented because traditional markets and infrastructures are not going away, but a range of new blockchain structures and asset classes are emerging.

“We have connected our capabilities and our technologies into all of those networks to effectively stitch them together,” he added. “CIDAP is the bridge that enables us to operate across those different blockchain infrastructures.”

Competition

Crypto-native firms such as Coinbase have launched custody, and other firms in traditional finance have also launched digital asset custody. Marsh argued that Citi is using tokenization as a technology to move money more seamlessly in real time across clients, but a differentiator is that it is fully integrated into clients’ current experience. Clients do not need to be able to hold tokens or digital wallets, but just send Citi an instruction.

“One of our key value propositions is that Citi clients can add digital assets to their existing platform, rather than fragmenting their operating model,” he said. “Our design abstracts the complexity of having to maintain multiple relationships and service levels for two different asset classes.”

In addition, Citi is already modernizing its traditional financial structure as settlement cycles are being compressed globally and there is a desire to move assets, including money, faster and eventually 24×7. Marsh said Citi’s custody platform can already process asset servicing events in real time and can already move securities 24 hours a day.

“When you stitch those two things together they become complementary and transformative in how we can serve our clients in the future,” Marsh added. “I think we have gone the extra mile in designing a model that we think is absolutely seamless.”

He argued that another differentiator is that Citi has developed most of these technologies because the bank wanted to build something that was integrated into its existing security and compliance frameworks.

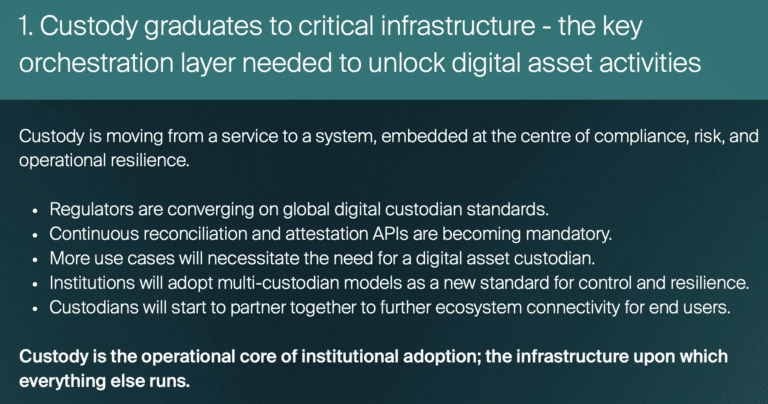

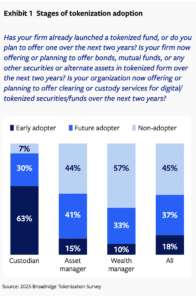

The recent Broadridge Tokenization Survey said custodians are clearly “out front,” using their infrastructure to provide secure custody, smart contract integration, and real-time asset servicing.

“These services are not speculative; they are foundational to how tokenized assets will be created, distributed, and managed,” said Broadridge.

However, Broadridge added that even firms confident in tokenization’s long-term value often struggle to operationalize it as most capital markets environments run on fragmented systems, with tokenized and traditional assets operating in parallel but not in sync.

The survey said: “Firms with more modern and modular technology stacks are far more likely to have launched tokenized offerings. This reinforces the idea that operational readiness, not just enthusiasm, enables firms to move ahead.”

Increasing efficiency

Marsh said: “We see our role as being a critical enabler because we are the leading subcustodian with licenses in 63 countries, and we have dealt with complexity in the traditional infrastructure through our integration.”

For example, Citi and SDX, the digital asset arm of Switzerland’s SIX Group, said in a statement in May this year that the bank will be tokenizing, settling and safekeeping assets on SDX’s digital central securities depositary and will bring late-stage pre-IPO equities to institutional and eligible investors on the SDX platform.

Marni McManus, Citi country officer & head of banking for Switzerland, Monaco & Liechtenstein, said in a statement that private markets is a major and growing opportunity and the partnership will simplify and digitize what is essentially a manual and paper-driven industry.

In June this year Citi was dealer and issuing and paying agent when Türkiye İş Bankası A.Ş. (İşbank) issued the first digitally native note in the market using the Euroclear D-FMI platform. Citi Services connected issuers, investors and the Euroclear platform, resulting in quicker issuance and settlement processes, as well as faster communication and data sharing.

In October this year Citi and Coinbase said in a statement that they intend to collaborate on digital asset payment capabilities for the bank’s institutional clients. The initial phase of their collaboration focuses on fiat pay-ins/pay-outs, supporting Coinbase’s on/off-ramps as the bridge between traditional fiat and digital asset ecosystems, along with payments orchestration

Marsh also highlighted that in traditional finance you can only move collateral when markets are open, it takes longer to move securities than it does money and you cannot move an asset versus an asset. Citi’s ultimate vision is to be a custodian holding traditional assets, tokenized securities, tokenized forms of money, crypto, and eventually using that portfolio more efficiently for collateral management purposes.

“Redesigning these flows on our infrastructure to operate in real time, 24×7, with the ability to program assets, resolves these issues and that is what we are working on,” he added.