Clear Street has expanded into futures clearing and execution services, after launching clearing for registered market makers in listed U.S. equities and options this month. The US financial services firm said marked the first successful entry into the professional clearing market in close to a decade.

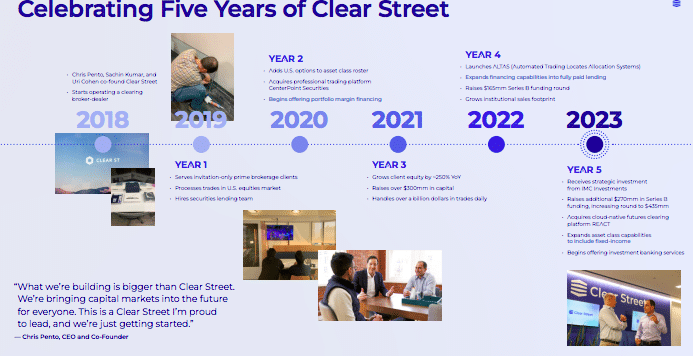

Andy Volz, chief operating officer of Clear Street, told Markets Media that when the company began building proprietary technology about five years ago, the long-term goal was to clear every product in every market globally. Clear Street decided to first tackle US equities, and then added US options.

“We had a good amount of successful growth in clearing, executing and financing those asset classes,” he added. “In the summer of 2023 we added support for US fixed income and around that time, we started a significant build out to support futures.”

In July last year Clear Street acquired React Consulting Services and its cloud-native futures clearing platform, BASIS, which has been integrated into Clear Street’s existing cloud-native clearing, settlement, execution, and custody platform.

Volz believes it is a good time to launch futures clearing due to the limited number of prime brokers as the industry has been retrenching and consolidating, and that is almost more acute in the futures space. Exchanges have also been launching many new futures contracts and volumes have been rising. For example, CME Group reported in its first quarter 2024 results on that Treasury futures and options average daily volume increased 12% to a record 7.8 million contracts. There were also quarterly annual daily volume records across ultra 10-Year futures, ultra treasury bond futures, and 2-year treasury note options. BGC Group, the brokerage and financial technology firm, also aims to launch its FMX Futures Exchange for U.S. Treasury and SOFR contracts in September this year.

In addition, the implementation of Basel III, as currently proposed, would have a big impact on the bank’s lending and markets businesses. The Basel Committee on Banking Supervision (BCBS) finalized revisions to its risk-based capital standards, known as the Basel Endgame package, in 2019 in order to achieve greater global standardization of risk-based capital requirements. National regulators have been making proposals to implement the package with US regulators jointly publishing their proposals in July this year. Bank executives have said the increased capital requirements are onerous and will push more activity into the non-bank financial sector.

“A new FCM has not launched in recent memory, and certainly not one with self-clearing and the scale that we expect to have,” said Volz. “We are seeing very fast customer uptake and excitement for the offering.”

Clear Street is a member of three futures exchanges – CME, ICE US, and NODAL – and is actively pursuing memberships with other global futures venues.

Volz admitted that clearing involves sticky relationships, which can make it difficult for firms to move their business but Clear Street has hired experienced people with long customer relationships who are experts. For example, for broker-dealer clearing Clear Street hired Kevin McCarthy, who spent more than spent more than 30 years running that business at Bank of America Merill Lynch, and Chris Smith for futures clearing.

Chris Smith, chief executive of Clear Street Futures, said in a statement: “Intensified competition, increased capital requirements, technological advancements, and evolving global trading dynamics have driven substantial FCM consolidation, leaving many institutional participants like hedge funds, corporates, and professional trading groups with limited clearing options. The current landscape underscores the critical need for a new player with technology that enables firms to navigate the market in real-time amid escalating volatility, regulatory shifts, and rapid changes.”

Volz continued that Clear Street currently clears about 3% of equities volume on a daily basis, equivalent to roughly $10bn, and he expects that to increase, with a similar trajectory for futures clearing.

International growth

Volz said Clear Street has done a good job of rounding out its offering across products in public markets, and will be adding geographies. The firm has submitted a registration for a broker dealer in the UK with the Financial Conduct Authority.

“This is our first global foray and we aim to build a full-service institutional business, similar to the US,” he added. “The UK headcount is growing and we are filling key management, operational and risk positions in a significant commitment to the business.”

`