On the surface, there may not be appear to be a connection between the collapse of a German bank about 50 years ago and today’s crypto market.

The link starts on the afternoon of 26 June 1974, when German regulators were forced to close Bankhaus Herstatt. The bank was the 35th largest bank in Germany at the time but had been very active in foreign exchange. When Herstatt failed, some counterparties had paid Deutschemarks to the bank for their trades but were still waiting for dollars in return, due to the time difference with U.S. markets. This resulted in the freezing of inter-bank lending and widespread panic in the market.

As a result, central banks called on the industry groups to develop services to reduce this “Herstatt risk.” CLS (Continuous Linked Settlement) was established in 2002 to provide provide payment-versus-payment (PvP) for the two currency legs of an FX trade i.e the payment of both currency legs of an FX transaction take place at the same time.

ClearToken, the UK digital financial market infrastructure group, has launched CT Settle, an FCA regulated platform which aims to reduce “Herstatt risk” in the crypto ecosystem.

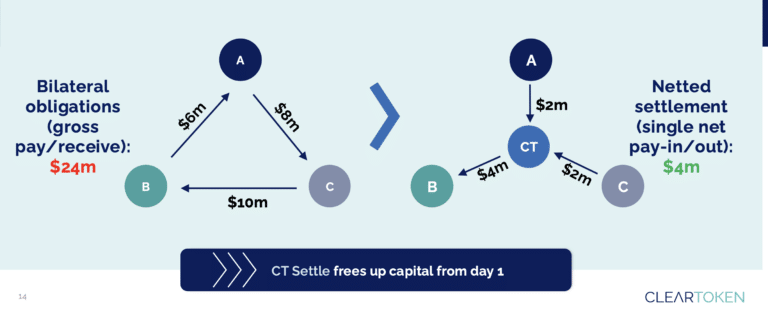

Benjamin Santos-Stephens, founder and chief executive of ClearToken, told Markets Media that CT Settle works very similarly to CLS, although the firm is not a bank. He said: “We take in transactions from brokers and custodians all day, then net down what everybody owes each other at a cut off time.”

The platform ensures that transactions settle delivery versus payment (DvP) stablecoins, fiat currency and crypto assets. Participants have the opportunity to significantly increase capital efficiently as they do not need to fund positions across a number of venues, but can centralise trade completion on a single, regulated platform.

“If people do not pay, there is no delivery,” Santos-Stephens added. “If both sides of the trade connect to CT Settle, we can reduce the amount settled by up to 90% and lower risk.”

In December this year, CT Settle completed its first complete settlement cycle, settling netted cryptoasset and fiat currency transactions between regulated institutional exchange, LMAX Digital and market maker Flow Traders. The transactions used Zodia Custody and Bank Frick as sole digital custody and banking partner. CT Settle never owns the assets and cash which are held by custodians and banks.

“One of the important things in going live with LMAX is that they have a good number of customers,” said Santos-Stephens. “The FCA also wanted to know our initial trading venues because we needed to demonstrate the strength of our anti-money laundering controls.”

Net settlement currently occurs daily, as the initial clients want, according to Santos-Stephens. CT Settle intends to move net settlement to every hour in three months.

Santos-Stephens continued that for firms wanting to offer brokerage services, this can be very capital-intensive and hard to do without a delivery versus payment service that provides netting. He argued that CT Settle should facilitate a lot of the brokerage desks that don’t yet exist in crypto.

Michael Lie, global head of digital assets at Flow Traders, said in a statement that net settlement across clear timing windows improves capital efficiency and reduces operational overheads.

“For a liquidity provider, that structure is essential to deploying capital at scale,” Lie added. “CT Settle provides the infrastructure that allows institutional liquidity to grow, and that is why this partnership fits so naturally with how we run our business across markets.”

Growth

CT Settle initially supports the cryptoassets and stablecoins that LMAX supports. Santos-Stephens said the roadmap is to add regulated stablecoins in currencies that make sense for institutions. He continued that there is a healthy queue of people lined up to join CT Settle.

ClearToken sees the launch of CT Settle as the first step in offering post-trade services for 24/7 digital markets with the legal certainty offered by a regulated financial market infrastructure.

“We are not currently authorised as a clearing house, so we do not act as a principal in the trade and do not make participants whole if there is a failure,” said Santos-Stephens. “This service is a precursor to operating a clearing house.”

The firm has applied to Bank of England for approval to provide clearing and settlement services across digital asset markets for securities, derivatives and financing transactions. This will allow ClearToken to creating unified market structure that reduces credit and settlement risk through multilateral netting and trade compression.

Santos-Stephens added: “We are well on our way to delivering the world’s first clearing house and settlement depository for both tokenised traditional and digitally native assets, unifying the traditional finance (TradFi) and decentralized finance (DeFi) worlds to unlock the vast potential of the digital assets revolution.”

The clearing house will address the challenge that much of the digital asset market consists of bilateral trading conducted on a gross basis without netting, requiring participants and market makers to fully prefund their trades, which is an inefficient use of capital.

The long-term objective is for Clear Token to extend its services to all asset classes, including tokenised securities, for which it is participating in the Bank of England’s Digital Securities Sandbox. ClearToken has adopted Nasdaq Eqlipse Clearing to support the development of its innovative new clearing and settlement service for digital assets which Santos-Stephens said is because Nasdaq technology provides the software for 20 other clearing houses. He added: “The software is very good from a risk management point of view in supporting all types of derivatives.”

Citi’s Securities Services Evolution 2025 report found that liquidity and post-trade cost efficiencies are the most significant areas of impact for DLT initiatives, with 43% and 51% of respondents citing these areas as being significantly impacted in the next three years. The report said more than half of the survey’s respondents said the ability of DLT to increase the velocity of securities around the world’s capital markets can have major impacts on their funding costs, financial resource requirements and operating costs before 2028.

Santos-Stephens fully believes there will a convergence between digital and traditional assets, and they will all trade and settle in the same systems, and have the same investor protections.

“It is an understatement to say the crypto market has undergone a tectonic shift in the last three to six months,” he added. “Nasdaq has said they will trade 24/7 and tokenize equities; the CFTC has authorized the first venue for spot crypto trading and onshore clearing and the SEC has authorized the DTCC to tokenize certain securities.”