Operational resilience, ESG, data privacy and technology issues have emerged as key themes for supervisors according to the 2020 Global bank regulatory outlook from Ernst & Young.

John Liver, partner, financial services, Ernst & Young (UK) said on a webcast last week that the financial industry has reached a tipping point as it is now more than a decade since the financial crisis. He continued that regulators are led by new people, need to review whether regulations are proportionate and deal with a change in the economic environment.

“Regulatory fragmentation, operational resilience, ESG and climate risk are new challenges,” added Liver.

ESG

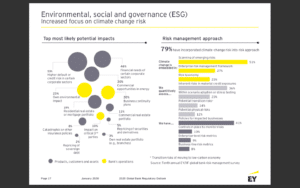

A poll on the webcast found that more than two-thirds of attendees have not started to build climate change into their risk management and governance structures.

Liver said that climate risk and environmental, social and governance (ESG) strategies will be a priority this year.

“We see in our dialogue with boards that climate risk and ESG have moved up the ladder to the top table,” he added.

The latest EY/Institute of International Finance (IIF) risk survey found that geopolitical and climate change risks were amongst the 10 major risks to manage over the next decade.

The 2020 Global bank regulatory outlook said: “The survey covered banks, not policymakers, which suggests that key decision-makers in governance and control functions across the industry are fully aware of the new agenda and the challenges that will come with it.”

Liver continued that regulators need to set standards for green finance, with a taxonomy and benchmarks.

“Regulatory convergence is required to ensure efficient capital allocation,” he said. “There are also prudential issues and firms need asset level data for their scenarios. We are at an early age of evolution and a lot of work is needed to meet investor demand for ESG.”

The outlook said initial steps have already been taken by supervisors in recent years with changes to rules on compensation that shift the emphasis from meeting short-term objectives to recognizing the importance of longer-term, more holistic goals and rewarding ethical behavior.

“These changes will have a significant impact on risk management frameworks. How will they need to evolve to encompass these emerging risks?,” added the report. “How much more will they need to change if regulators are asked to promote broader social goals in the financial market space? For example, another area of focus may be issues in the workplace environment, such as pressure, stress and mental health that are perceived as contributing factors to poor culture and misconduct.”

Technology

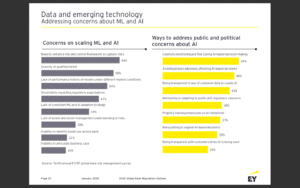

Another poll on the webcast found that less than 15% of attendees were comfortable with the current regulations on artificial intelligence and machine learning.

The 2020 Global bank regulatory outlook said: “As evidenced by the recent EY/IIF survey, regulators and financial institutions are focusing on how existing risk management and governance practices need to be enhanced to capture the dynamic and inter-related risks (e.g., model, legal, compliance and cyber) associated with AI and ML.”

As these technologies have more impact on the end customer, they have attracted more regulatory scrutiny, particularly in the areas of bias and discrimination.

EY said that apart from specific cases such as the issues around data and the growth of AI and ML, regulators will be looking at the impact of technological change across the risk and control infrastructure in banks.

Many banks have systems that have been pieced together over the years and will need to spend more money on maintaining their legacy technology, rather than moving to new platforms.

“The impact of digital transformation on risk management, therefore, has not yet been fully realized,” said the report. “Fintech, regtech, suptech and any other techs have disrupted but not yet revolutionized the industry.”