Average daily volume for Treasury futures and options at CME Group reached a record in the first quarter of this year and the derivatives exchange expects further growth due to the different market opinions on whether the Federal Reserve will cut interest rates, an increase in issuance and its ability to offer capital efficiencies.

CME Group reported in its first quarter 2024 results on 24 April that Treasury futures and options average daily volume increased 12% to a record 7.8 million contracts. There were also quarterly annual daily volume records across ultra 10-Year futures, ultra treasury bond futures, and 2-year treasury note options.

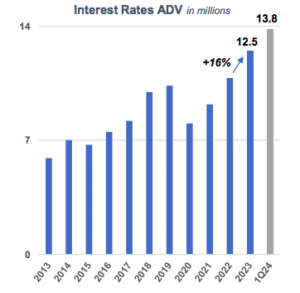

Overall average daily volume for interest rate contracts was 13.8 million, lower than the record 14.5 million in the first quarter of 2023, but still the second highest quarter on record.

Terry Duffy, chairman and chief executive of CME Group, said on the results call that it would be really difficult to draw the conclusion that the Treasury complex has reached peak activity.

Duffy said: “In fact, if the Fed does cut rates that would generate more activity. We are not near a peak as it relates to activity in the Treasury market.”

He highlighted that CME had the highest January average daily volume for Treasury contracts, despite the lack of a specific macro event or change in Federal Reserve rates in the first quarter, and that April has continued to build on many of these trends.

“There’s a big difference of opinions out there, which also generates a tremendous amount of activity,” he added.

Tim McCourt, global head of financial & OTC products at CME, said on the results call that volume and open interest has continued to grow with the stock of outstanding Treasury issues, which has doubled during the last 10 years. This is likely to continue as the Congressional Budget Office has forecast that the stock will also double over the next 10 years.

McCourt said: “As Treasury ramps up issuance to finance growing budget deficits, that plays very well with the complex of the products that we offer. We expect the general issuance backdrop to continue to be a tailwind.”

Management said that another boost to growth has been the launch of CME’s enhanced cross-margining arrangement with DTCC, the US post-trade market infrastructure, which went live in January this year. The partnership enables capital efficiencies for clearing members that trade and clear both U.S. Treasury securities and CME interest rate futures.

Suzanne Sprague, global head of clearing and post-trade services at CME, said on the results call that there is increased participation in the cross-margin programme with DTCC.

“Some of those clearing members are seeing upwards of 75% to 80% in margin savings,” Sprague added. “That is in addition to the portfolio margining programme that we offer within CME between our interest rates, futures, options and swaps, which delivered average daily savings of about $7bn in the first quarter.”

Growth of the Treasury complex

CME said that its new credit futures are scheduled to begin trading on 17 June 2024, pending regulatory review. The contracts will be the first futures to help market participants manage duration risk through an intercommodity spread with U.S. Treasury futures according to the exchange. In addition, investors can gain exposure to, and manage, credit component risk through futures on Bloomberg’s duration-hedged index for the first time.

The contracts will be based on the Bloomberg U.S. corporate index, which measures the performance of investment grade corporate bonds, and the Bloomberg U.S. high yield very liquid Index, which is designed to measure a liquid, diversified component of the high yield corporate bond market.

Credit futures will have automatic margin offsets against CME’s interest rate and equity index futures, adding more capital efficiencies.

McCourt said: “We think there will be a 70% margin offset between US Treasury futures and the investment grade credit future, and a 50% offset against E-mini equity contracts for high yield.”

CME faces competition from BGC Group, the brokerage and financial technology firm, that aims to launch its FMX Futures Exchange for U.S. Treasury and SOFR contracts in the summer of this year.

Duffy said: “I have sat here for 22 years as chairman and CEO of this company and I’ve seen nothing but competition my entire career so this is no different.”

However, he argued that the capital efficiencies that CME can offer are a powerful differentiator.

“We believe that capital efficiencies are the name of the game and it is hard to walk away from $7bn to $8 bn a day in efficiencies,” said Duffy. “It’s also hard to walk away from an additional 80% that they are receiving from our new offering with DTCC.”

The US Securities and Exchange Commission has adopted rule changes to facilitate additional clearing of U.S. Treasury securities transactions. CME has said it will apply to clear US Treasuries, which will probably be filed in the fourth quarter of this year.

Duffy said CME spoke to DTCC before publicly announcing its application as he believes the market infrastructure currently provides the most efficient clearing.

“We didn’t create the mandate that is coming at us in 2026,” added Duffy. “We don’t know what the market structure is going to look like in 2026 but we cannot wait until then to file an application.”

He argued that CME is just being prepared, and if DTCC provides a better offering with more efficiencies for clients, then CME will continue that relationship.

Volumes

CME Group reported revenue of $1.5bn and operating income of $960m for the first quarter of 2024.

Total average daily volume in the first quarter was 26.4 million contracts, including non-U.S ADV which reached a record 7.4 million contracts. CME said this was the highest quarterly ADV outside the first quarter of 2020 during the onset of global pandemic, and the first quarter of 2023 during the US regional banking crisis.

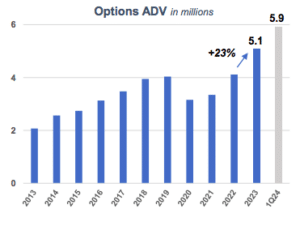

Options ADV increased 2% in the first quarter to a record 5.9 million contracts including records in equity index options and energy options.

Growth outside the US was driven largely by 38% growth in energy and 29% growth in agricultural products. Physical commodities asset classes contributed 18% of total volume and 32% of clearing and transaction revenues in the first quarter.

McCourt described the rise in volume in the metals complex as “spectacular’, boosted by a change in expectations around the role of gold and more activity from both commercial participants and the buy side. In addition, questions around global growth, China and electrification are good for base metal markets such as copper and aluminium.

Duffy added that through to 22 April, average daily volume is up 4%, including year-over-year growth in all six asset classes.

“CME Group’s multi asset class offering is in higher demand today than ever,” he said.

Google Cloud migration

In November 2021 CME and Google Cloud announced a 10-year strategic partnership which the exchange said would transform derivatives markets through technology, expand access and create efficiencies. The intention was to migrate CME’s technology infrastructure to Google Cloud with data and clearing services, and eventually move all of its markets to the cloud. As part of the partnership, Google also made a $1bn equity investment in CME Group.

Sunil Cutinho, chief information officer at CME, said on the results call that the group is making very good progress on migrating non-market workloads.

“We intend to migrate our clearing, regulatory services and business intelligence services this year, subject to regulatory approval,” Cutinho added.

Cutinho continued that CME’s data platform has been stood up with Google Cloud and has over 26 petabytes of information including rich historical data, market data and instantaneous order books, which could be monetized in the future. CME is adding risk information as clearing workloads migrate.

Over the over the last two years CME has made margin calculation services available via the cloud. The current margin calculation was released first, followed by giving the clients the ability to make historical calculations.

“Now, we are allowing our clients to actually compute margin intraday,” Cutinho added. “We are progressing to give clients increased visibility into risk in a highly scalable way in and in real time.”

The next functionality being released towards the end of this year is margin optimization, which provides tools to move positions between risk pools to get the best margin treatment.

Duffy added: “I’ve said from the very beginning of this transaction that I will not put CME’s markets into the cloud, or any other platform, unless it’s more efficient than CME offers today to clients.”