CME Group has begun the second phase of testing for its payments and tokenization partnerships with Google Cloud.

In March this year CME Group said in a statement that it is expanding its partnership with Google Cloud to pilot solutions for seamless and secure wholesale payments and tokenization of assets.

At the time CME said it had completed the first phase of integration and testing of Google Cloud Universal Ledger (GCUL), a distributed ledger from Google Cloud, which can potentially deliver significant efficiencies for collateral, margin, settlement and fee payments.

Suzanne Sprague, chief operating officer and global head of clearing at CME Group, said on the second quarter results call on 23 July 2025 that the partnership is thinking about tokenizing cash and other non-cash assets for CME’s current ecosystem, starting in the clearing space.

She said: “We’ve now entered the second phase of testing, focusing on settlement. We are very optimistic about our ability to bring solutions to market in 2026.”

Sprague added it was too early to define a use case for the launch.

Terry Duffy, group chairman and chief executive of CME, said on the call that creating additional efficiency is critical to CME’s efforts on stablecoins and tokenization.

“We’ve created capital efficiencies, but we also need to create other efficiencies,” he added. “We believe that our multi-asset class exchange could increase our value to clients on a stablecoin, especially as it relates to risk management and tokenizing cash.”

Volumes

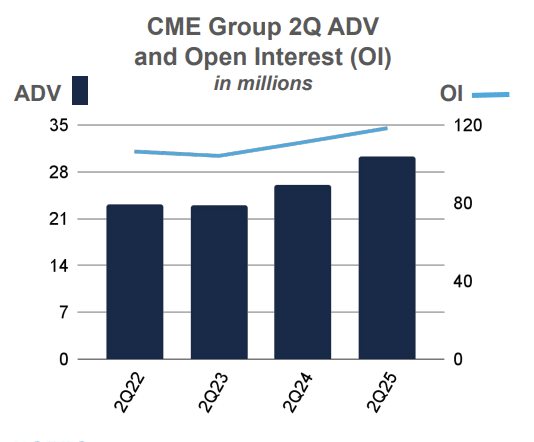

Duffy said average daily volume exceeded 30 million contracts in a quarter for the first time in the group’s history. Record volumes drove record revenue of $1.7bn for the second quarter, up 10% from the same period of 2024. Average daily volume of 30.2 million contracts in the second quarter was 16% higher than the same period of 2024 and and included records in each month of the quarter, according to Duffy.

He said: “In an environment of heightened headline risk and macro uncertainties, clients are increasingly choosing the transparency and capital efficiency of our centrally cleared benchmark products as they look to manage and mitigate risks.”

Volume grew in all six asset classes, including records in interest rates, agricultural commodities and metals contracts.In aggregate financial products volume grew by 17% year-on-year and commodities grew by 15%.

Derek Sammann, global head of commodities markets at CME, said on the call that global uncertainties, including tariffs, freeloading to a realignment of a number of the global supply chains.

Sammann said: “With the benchmark markets we run, and the fact that U.S. is now exporting record amounts of energy, we’re seeing that is leading to record results, across the commodities complex.”

He continued that tariffs are increasing global participation and also creating both short and long-term dislocations in the market in the cost of basis trades, the price differential between cash and derivatives markets.

“Not only did we see record activity in April when a number of tariffs were announced, but we saw that follow through into records in metals and energy in June,” Sammann added. “Some come to CME to manage that basis risk and for others it’s an opportunity, so we also see activity on the speculative side.”

Duffy described the environment as “risk on” as evidenced by the continued growth in open interest which has risen 7% from the end of the second quarter of last year, and 10% from year end.

CME’s international business also achieved record average daily volume 9.2 million contracts, up 18% from the prior year, which Duffy said was across all asset classes and customer segments.

Duffy said that although it is hard to predict future volumes, there are many events globally that still need to be managed and mitigated through risk management. such as unprecedented levels of debt around the globe, the war between Russia and Ukraine and unrest between Israel and Palestine.

FX Spot+

CME Group reported that FX Spot+ reached a single-day volume of over $1.4bn traded in spot and FX futures via implied matching technology on 12 May 2025.

In the first month of trading, more than 40 clients have actively traded on the new all-to-all spot FX marketplace which connects cash market participants to the company’s FX futures market. Over-the-counter traders can interact with the futures market through an anonymous, transparent, central limit order book environment that operates totally in OTC spot terms.

Tim McCourt, global head, equities, FX and alternative products at CME, said on the call that banks that had previously not interacted with CME’s FX futures market were using FX Spot+.

McCourt said: “FX Spot+ is something that we introduced back in April and had gone exceedingly well in the rollout. Single day volume of $2.7bn is great for an offer that’s only about three months old and nearly 50 entities have actively traded on this new marketplace, including a few dozen banks that have not previously interacted with our FX futures market.”

In addition, he said FX Spot+ has allowed CME to improve the competitiveness and the market quality of some spot-based currency pairs.

“We’re very pleased that we’re seeing new participants, better market quality and significantly added volume to our complex all as a function of rolling out FX Spot+,” he added.

Retail traders

The number of new retail traders at CME increased 57% year-over-year and over 90,000 new retail traders participated in CME’s markets for the first time in a quarter. Retail contributed to record micros average daily volume of 4.1 million contracts in the second quarter.

“It’s unprecedented to see that type of growth and I don’t believe it is going away,” added Duffy. “People have access to markets they never had before, and I think it only accelerates for many more years to come as people start to participate in different asset classes.”

Retail investors have also been attracted to CME’s suite of crypto contracts which Duffy said was due to its regulated platform.

“One of the reasons we’ve seen massive growth is because people are using CME’s reference prices based off our future contracts,” he added.

Julie Winkler, chief commercial officer, said on the call that this was CME’s fifth consecutive quarter of double-digit retail client acquisition growth. She attributed the growth to the three pillar strategy of partnering with new futures brokers, which has been instrumental, expanding market access with a diverse product set and enhancing trader education.

“We held over 100 client events just in the second quarter just to help educate traders, so we feel pretty good about the outlook going forward,” she added

Winkler continued that retail traders in the last five years are more sophisticated and educated on products in general, which is partly due to the growth of simulation environments.

“We just launched a new simulator on July 12 and these tools are equipping retail traders with more data and more analytics, so that when they do start and fund their accounts they are more ready to trade,” she added.