CME Group is increasing the spot position limit on the amount of bitcoin futures contracts that exchange-traded funds can own as ETFs on the contracts have started trading on US exchanges.

Valkyrie Funds launched its Bitcoin Strategy ETF on Nasdaq on October 22, following the ProShares Bitcoin Strategy ETF which listed on the NYSE on 19 October. Both funds were approved by the US Securities and Exchange Commission as they invest primarily in bitcoin futures contracts listed on CME Group and do not directly invest in bitcoin. Another issuer, VanEck, has also made an SEC filing to launch its Bitcoin Strategy ETF “as soon as practicable.”

The strict limit of 2,000 spot futures contracts that ETFs can own could lead to the suspension of new share issuance.

Terrence Duffy,

CME Group

Terry Duffy, chairman and chief executive of CME Group, said in the third quarter results call on 27 October that the existing spot position limit is 2,000 contracts and will increase to 4,000 in November.

Duffy said: “We feel very confident from a risk perspective that we are not being reckless in any which way, shape or form and this has been vetted by our entire team and with the regulators. We’ve filed for those changes as we are confident that the product is mature enough to increase the size of the limit.”

Duffy continued that the exchange will remain cautious about bitcoin futures which were only launched in 2017 in a new asset class.

“We are excited by the uptake and the credibility associated with ProShares and the other ETFs that decided to benchmark against our futures contract,” he added.

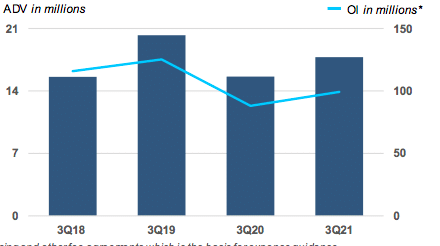

Average daily volume for bitcoin futures in the third quarter increased 170% from a year ago and Duffy added that ether futures are also off to a good start since their launch in the first quarter of this year.

Sean Tully, global head of financial and OTC Products at CME Group, said on the call that the average daily volume of bitcoin futures in October rose to more than 12,000 contracts. This was the equivalent of more than 60,000 bitcoin or $3.5bn per day, an increase of of 57% over September.

Average open interest in bitcoin futures also grew to a record 17,433 contracts, 70% more than in September. CME’s micro bitcoin futures volume also increased by 33% month-over-month and average open interest rose 97% over the same period.

In addition Tully highlighted that CME’s BRR, a daily reference rate of the US dollar price of one bitcoin, was launched in 2017 and has become an essential benchmark for the industry.

Sean Tully, CME Group

“Our unique value proposition is that in addition to bitcoin, we offer asset classes across the entire spectrum,” he added. “We are also highly regulated, highly transparent, have an enormous distribution and a 170 -year history of being a reliable exchange.”

Sunil Cutinho, president of CME Clearing, said on the call that the exchange has a very strong record of risk management, especially for both bitcoin and ether.

“We manage through extreme periods of volatility seen even early this year,” he added. “This is true for every product that we bring to the market.”

SOFR

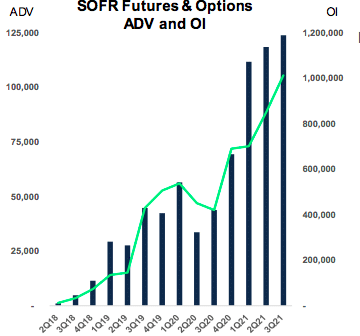

The third quarter included a quarterly ADV record in SOFR (Secured Overnight Financing Rate) futures of 123,705 contracts, an increase of 183%.

After the financial crisis there were a series of scandals regarding banks manipulating their submissions for setting benchmarks across asset classes, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and want to move to risk-free reference rates based on transactions, so they are harder to manipulate and more representative of the market.

The US Alternative Reference Rates Committee (ARRC) selected SOFR to replace US dollar Libor, although other new reference rates have also been launched.

Source: CME Group.

In the third quarter ARRC formally recommended the use of CME Term SOFR Reference Rates based on their previously outlined best practices. CME began publishing a 12-month SOFR term rate on September 19 after launching 1-Month, 3-Month, and 6-Month Term SOFR rates in April.

Tully said: “We have already signed more than 100 Term SOFR licenses and are working with an additional 300 firms on licensing.”

In the fourth quarter a record 396,421 SOFR futures contracts traded on October 18. SOFR futures open interest also reached a record 1.2 million contracts on October 19.

In interest rates Tully said the market is now pricing in a 60% chance of tightening by June 2022, up from just 17% just one month ago, according to CMEs FedWatch Tool.

“Nonetheless rate volatility, while higher in the third quarter of 2021 than it was in recent quarters, remained historically quite low,” added Tully.

Interest Rates ADV was up 53% to 8.1 million in the third quarter.

Volumes

Duffy said in a statement: “Average daily volume grew 14% year over year during the quarter, led by double-digit growth in interest rates, energy and options products, as well as strong non-U.S. volumes, which increased 13% to 5 million contracts per day.”

Third-quarter average daily volume was 17.8 million contracts, including non-U.S. ADV of 5 million contracts.

He continued that in October ADV has averaged more than 20 million contracts, a 35% increase from a year ago. Interest rates and energy volumes have grown by double digits.

Since the beginning of this year CME has delivered 70 new products and solutions, including the introduction of Micro Treasury futures and new environment, social and governance-focused products in the third quarter according to Duffy.

For example, CME launched the derivatives industry’s first sustainable clearing service to help market participants track and report on how their hedging activities are advancing their ESG goals.

In August CME also launched Nature-Based Global Emissions Offset (N-GEO) futures.

N-GEO futures are based on eligible voluntary offsets from Agriculture, Forestry, and Other Land Use (AFOLU) projects with additional Climate, Community, and Biodiversity (CCB) accreditation, while GEO futures are based on the CORSIA framework.

Watch Russell Karas, Sr. Director of Energy Products at CME Group, discuss the voluntary emissions markets and the GEO and N-GEO futures contracts used to support meeting emissions reduction targets. https://t.co/NmZrTPizYq

— CME Group (@CMEGroup) August 9, 2021

Global Emissions Offset (GEO)/Nature-based GEO (N-GEO) reached record open interest of 9,009 contracts on September 30.

Tully said CME is seeing record amounts of physical deliveries of offset certificates through facilitating the physical delivery of 146,000 offset credits across four separate delivery cycles.

“That is the equivalent of 146 million metric tonnes of CO2 equivalent,” said Tully. “That’s pretty significant traction early on.”

CME’s S&P 500 ESG index futures also have open interest of about $4bn in notional value.

The exchange is also integrating OSTTRA, its joint venture with IHS Markit for post-trade services for the global over-the-counter market across interest rates, equities, foreign exchange and credit.

For the third quarter of 2021 CME Group reported revenue of $1.1bn and operating income of $614m. Net income was $927m.