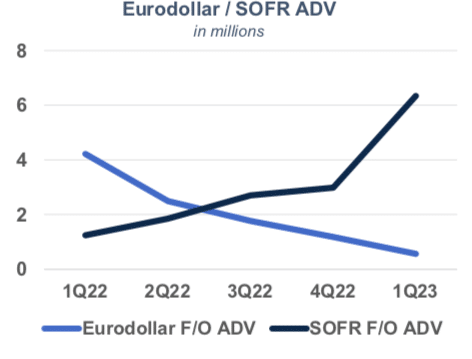

CME Group said average daily volume in SOFR futures and options exceeded the best ever quarterly ADV for Eurodollar contracts, which helped deliver record revenue for the derivatives exchange group’s rates business in the first quarter of this year.

Sean Tully, global head of rates & OTC products, said on the first quarter results call on 26 April that CME delivered all-time record revenue for its rates business.

The average daily volume of SOFR futures and options in 2023 has reached nearly 6 million contracts, which is 34% higher than the highest annual ADV that Eurodollar futures and options reached in their four-decade history.

After the financial crisis in 2008 there were a series of scandals regarding banks manipulating their submissions for setting Libor benchmarks, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and moved to risk-free reference rates based on transactions, so they are harder to manipulate and more representative of the market, and US regulators chose SOFR. The USD LIBOR panel will cease on 30 June 2023.

Tully described the move away from LIBOR as arguably the single largest transition in the industry’s history. For example, on 15 April CME had to convert open interest in eurodollar futures and options into equivalent SOFR contracts.

“It’s very clear from the first quarter that SOFR contracts are being used just as intensively and extensively as Eurodollar futures and options ever were,”Tully added. “In terms of the long-term strategic positioning of the business, it is in a better position today than it ever has been.”

He argued that part of the reason was the global banking system turning to CME Term SOFR for lending. There are now more than $3.7 trillion in loans using the reference rate by more than 2,400 institutions that have been licensed in nearly 90 countries.

“This gives us huge cross-selling opportunities, and will increase our penetration of regional banks who have licence CME Term SOFR,” added Tully.

He continued that CME Term SOFR will be used by ICE Benchmark Administration from 1 July this year in synthetic LIBOR to manage tough legacy contracts.

“So we have replaced US dollar LIBOR,” said Tully. “That’s a huge opportunity for us and we are strategically better positioned for future growth.”

The Eurodollar is no more… https://t.co/j8vWL5PA83

— Clarus (@clarusft) April 18, 2023

Clarus Financial Technology, the derivatives analytics provider, said in a blog that the March 2023 ISDA-Clarus RFR Adoption Indicator hit a record of 56.6%, before the CME Eurodollar contracts were converted into SOFR.

“Whilst the Eurodollar conversion is a momentous (and nostalgic!) occasion for market participants, the impact on overall RFR and SOFR adoption will be quite small,” added Clarus.

When CME launched SOFR futures and options, the exchange also redesigned how packs and bundles are quoted and traded, which Tully said will make it much easier for CME to launch options on SOFR packs and bundles later this year. CME launched SOFR futures in May 2018, followed by SOFR options in January 2020.

“We love to have listed, cleared standardised contracts that are lower total cost than the over-the-counter equivalents,” added Tully. “Options on packs and bundles are going to be listed, cleared, standardised, lower total cost alternatives to the swaptions market, which is not cleared.”

Tully described himself as “massively excited” about that opportunity for the SOFR business which had not existed for eurodollar contracts, as they were designed differently. He said: “The pipeline that we have in front of us for further development is very strong, and I would say it’s the strongest it’s ever been.”

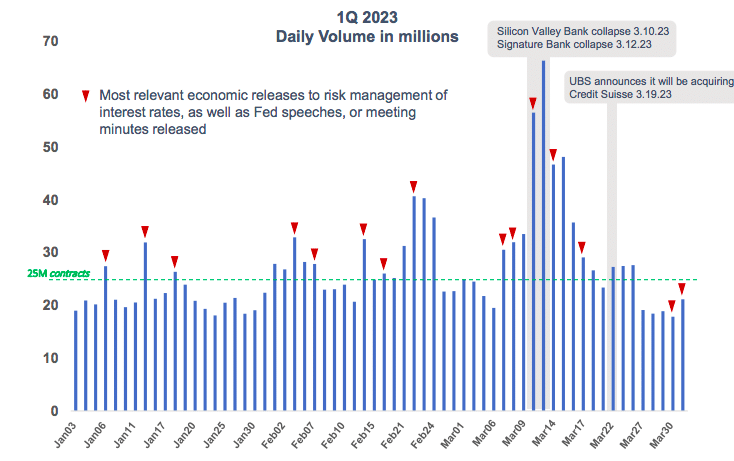

Terrence Duffy, chairman and chief executive, continued on the results call that there were shifting perceptions about the Fed’s near-term rate path throughout the quarter, as well as significant banking concerns in March.

“The continued development of the SOFR market led to the increasing need for the management of interest rate risk,” Duffy added. “This drove 16% growth in our interest rates ADV to a record 14.5 million contracts.”

Cleared SOFR swaps averaged a record $22bn notional per day at CME in March, representing over 80% of the cleared USD trade count. The secondary conversion of US dollar swaps is scheduled for 3 July 2023 when zero coupon swaps and remaining US dollar LIBOR swaps will be converted.

Banking sector

The turmoil in the banking sector in March, with the collapse of Silicon Valley Bank and the rescue of Signature Bank, has led to CME Initiating a sales campaign across the group specifically for regional banks . CME is focused on providing them with interest rate swaps and other products they need in order to better manage their risk.

Tully said that in addition to potentially increasing CME’s OTC swap business, those swaps will be handled by larger banks who hedge these transactions using futures or CME’s BrokerTec US treasury platform.

“People understand they need to manage risk in order to stay in business and some of these second and third tier banks did not hedge some of their portfolios,” added Duffy. “This is a big push by our sales teams to cross-sell.”

Financials

Duffy said the first quarter was continued evidence of this new era of uncertainty.

“Risk management has been elevated from a supporting player to the star attraction, as investors are managing portfolios with near constant market challenges,” he added.

First-quarter average daily volume increased 4% to 26.9 million contracts and was just short of CME’s quarterly record ADV of 27 million contracts in the first three months of 2020.

“This quarter included our all-time highest single day volume of 66.3 million contracts on March 13,” said Duffy. “All of this and other things have led us to the highest adjusted diluted earnings per share in the history of CME Group.”

First-quarter options revenue grew 12% to a record $218m. Options ADV grew 26% year-over-year to a record 5.8 million contracts, including double-digit growth across interest rates, equities, and metals, and 30% growth in non-U.S. trading activity.

Duffy continued that CME’s past investments in building out the options franchise are paying off as they are an increasingly important risk management tool with such a turbulent macroeconomic backdrop.

“The first quarter was a great example of CME Group seamlessly doing what we are designed to do,” he added. “The significant volatility spikes and associated turmoil affecting the banking sector in March further highlighted the systemic importance of sound risk management practices by institutional participants.”

Lynne Fitzpatrick, chief financial officer, said on the call that CME had the best quarterly results in its history and generated over $1.4bn in revenue, up 7% compared with a strong first-quarter in 2022.

“Overall revenue growth outpaced volume growth of 4%,” she added. “Market data had a record revenue quarter, up 9% versus Q1 2022 to $166m.”