In August this year Miami International Holdings (MIH), which builds and operates regulated trading venues across asset classes, received a $100m investment from Warburg Pincus and launched its fourth national securities exchange for US multi-listed options.

MIAX Sapphire began operating on August 12 with the rollout of options on its first symbol, IBM, before adding more symbols each week.

Thomas Gallagher, chairman and chief executive of MIH, said in a statement: “MIAX’s expansion in the US options space has been accomplished entirely through organic growth and the successful launch of four options exchanges since 2012 is a significant achievement for our company.”

Andy Nybo, senior vice president, chief communications officer at MIAX Exchange Group, told Markets Media that the firm concentrates on building very strong and reliable technology and the new platform went through a long period of rigorous testing. The process to connect and technical protocols is very similar to the group’s other exchanges.

“We are pleased with MIAX Sapphire’s performance,” added Nybo. “More than 30 market participants are already connected to Sapphire.”

He argued that the reliability of MIAX’s technology is one differentiator, as the options exchanges have had 99.999% uptime since inception. Another differentiator, according to Nybo, is that MIAX Sapphire operates a taker-maker pricing model, which pays liquidity takers and charges liquidity suppliers.

“The reason there are so many different US options exchanges is because they compete on market and fee models to attract flow from various sectors of the market,” Nybo added.

Physical trading floor

The launch of the MIAX Sapphire electronic exchange will be followed by the opening of a physical trading floor in Miami, Florida, in 2025 when it will become the first national securities exchange to establish operations in the city.

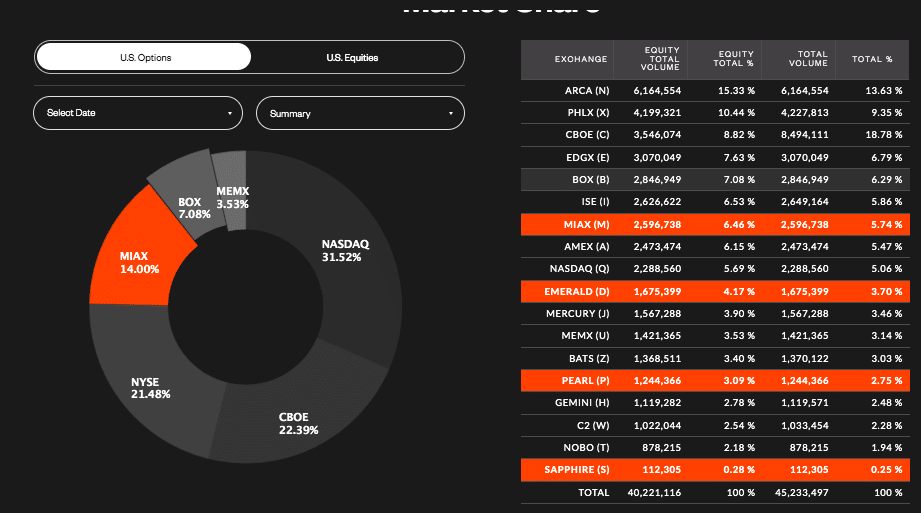

MIAX’s previous three options exchanges provided access to approximately 88% of the multi-listed options markets. The launch of the physical Sapphire trading floor will increase access to 100% of the market, according to Nybo. Warburg Pincus’ $100m investment will help fund the construction and fit-out of the new floor.

“Construction is well underway and work started on the physical trading floor earlier this year,” said Nybo. “We are on target to launch the trading floor in 2025 with state of the art technology and wide open views, which is very different from existing trading floors.”

Warburg Pincus’ funding will accelerate global expansion as the firm aims to build a diversified revenue stream across multiple asset classes and geographies.

Gaurav Seth, head of capital solutions, Americas at Warburg Pincus, said in a statement: “Our investment, along with ample dry powder to help support future growth, reflects our confidence in MIAX’s potential.”

Gallagher added in a statement that the funding will be used to expand strategic partnerships in financial futures and proprietary products, and also provide capital to pursue acquisitions in the US and internationally.

Miami is also continuing to emerge as an international financial market gateway to Latin America, according to Nybo. He added that the group owns and operates the Bermuda Stock Exchange, and so can provide products internationally.

“Part of the investment from Warburg will be used to roll out innovative products designed to meet emerging risk management needs around the world,” Nybo said.

The investment will also support expansion of MIH’s agricultural and financial futures businesses on its two US futures exchanges, Minneapolis Grain Exchange (MGEX) and MIAXdx, including the development of new matching engine and clearing technology using proprietary technology.

Exchange-traded derivative volumes

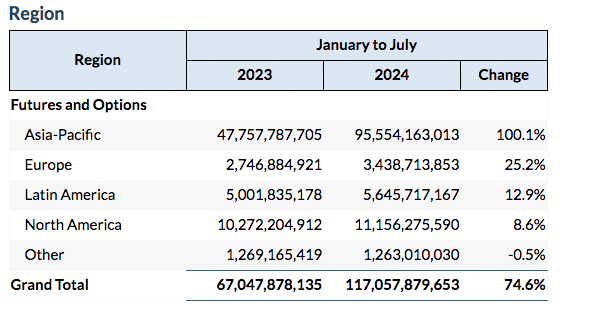

Exchange-traded derivative volume in the first seven months of this year was 117.06 billion contracts, up 74.6% from the same period last year, according to FIA. The trade body said the majority of that increase came from equity contracts.

Total options volume for the year to date was 100.16 billion contracts, up 98.4% from the previous year. Total futures volume was 16.9 billion contracts in 2024 so far, up 2% from 2023.

Worldwide volume of exchange-traded derivatives reached a record 18.99 billion contracts in July this year. This was 11.9% higher than June 2024 and 68.7% up from a year ago.

Global trading of options grew 85% year-over-year to 16.46 billion contracts in July, with most of that trading taking place in the Asia-Pacific region according to FIA. Global trading of futures reached 2.53 billion contracts in July, up 7% from the same month last year.