Cowen has launched a trading solution which allows institutional investors to achieve better execution by adjusting their algorithms for increased volumes of off-exchange trading in the US equity market following the rise in retail participation.

In the US retail trades are not executed on exchanges but most are sold to market makers under “payment for order flow” agreements. The market makers internalize the flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

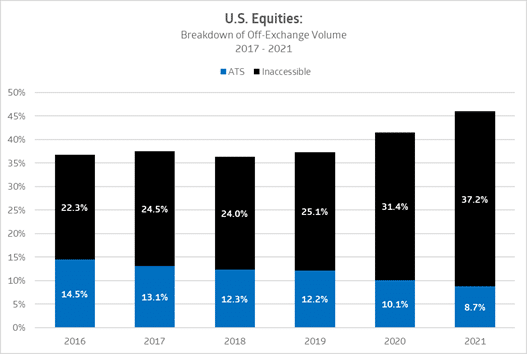

Cowen labelled this “inaccessible liquidity” because most institutional orders go to exchanges and dark pools. The firm estimated that “inaccessible liquidity” in the market has made up more than 37% of total volume so far this year.

Source: Cowen.

The broker has developed an “Inaccessible Liquidity Adjustment” which allows clients to automatically adjust algos for the share of inaccessible liquidity in individual stocks for the first time.

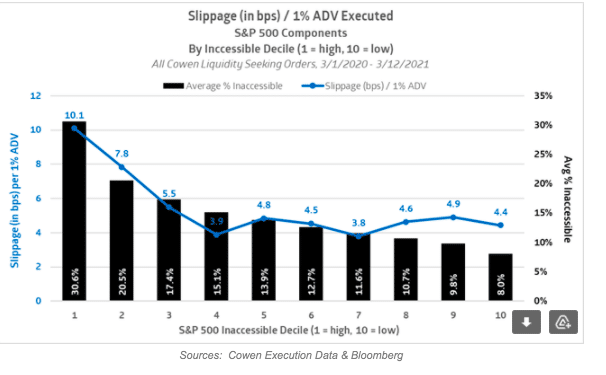

Cowen analysed all liquidity-seeking flow executed via the firm’s algos on a stock-by-stock basis over the past year to see if there was a correlation between inaccessible liquidity and algo performance.

Jennifer Hadiaris, Cowen

Jennifer Hadiaris, head of global market structure at Cowen, told Markets Media: “We looked at a lot of data and the results were stronger than I expected in the link between inaccessible liquidity and increased slippage.”

Cowen found that the S&P 500 stocks with most inaccessible liquidity, an average of 30.6%, had more than 10 basis points of slippage per 1% of average daily volume executed, which was significantly more than any other decile.

The firm said in a client note: “We were surprised to see the trend so clearly demonstrated in our execution data across such a wide range of orders and stocks. What this indicates is that the increasing rates of retail trading, and how those orders are executed away from public markets, can have measurable implications on institutional execution costs.”

Source: Cowen.

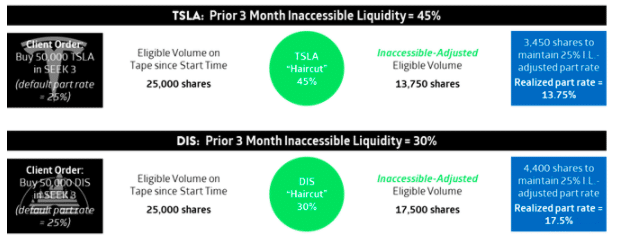

There is currently no way to identify “inaccessible” liquidity on the tape in real time. Cowen calculates the percentage of inaccessible liquidity in each U.S. security on a weekly basis using data from Finra, the US regulator, which is only available on a historical basis. Clients can choose whether to apply ‘haircut’ participation rates across the board through an algo wheel, or for individual orders or in a customized strategy.

Cowen gave an example of how algos can adjust their aggression for inaccessible liquidity on a name-by-name basis by subtracting the estimation of inaccessible volume from eligible volume for different stocks, for example, Disney and Tesla.

Source: Cowen.

“The key to our solution is that it is automated,” added Hadiaris. ”The client does not need to know the amount of inaccessible volume in each stock and does not need to manually adjust their algos in order to achieve lower market impact.”

Exchange innovation

At the beginning of this year Greenwich Associates predicted that off-exchange equity trading in the US would continue to rise after record volume last year,

The consultancy said in a report, Top 2021 Market Structure Trends, that the growth in TRF volume follows the large rise in retail trading (and resulting increased internalization of retail order flow) last year, but also highlights other trading systems and functionality offered by brokers and alternative trading systems.

Trade Reporting Facilities (TRFs) run by Nasdaq and NYSE capture trading off-exchange such as in alternative trading systems, internalizers, internal matching by central risk books and single-dealer platforms.

“The evolution of functionality away from strict price/time priority (and its attendant drive toward diminishing returns on latency gains) has allowed for these non-exchange systems to flourish,” added Greenwich. “Block trading systems, guaranteed market-on-close (GMOC) offerings, conditional orders, and alternative AI matching systems all continue to rise in importance, as the industry increasingly looks to find liquidity where it has the least market impact.”

Hadiaris continued that she would welcome innovation that provided more access to displayed liquidity for institutional investors, such as new order types from exchanges.

“For example, we have seen improved performance in our algos when using IEX’s D-Limit,” she added.

In part 3 of our bonus #BoxesAndLines episode, Ronan and JR discuss D-Limit performance to date. It's on fire: https://t.co/uqmG81ezMQ #StockUpResponsibly pic.twitter.com/vqRYjonmjM

— IEX (@IEX) February 16, 2021

IEX Exchange fully launched its D-Limit, discretionary limit order type, on October 1 last year after receiving approval from the US Securities and Exchange Commission. The D-Limit order protects liquidity providers from potential adverse selection resulting from latency arbitrage trading strategies in order to encourage members to submit more displayed limit orders to the exchange.

The exchange analysed the use of the D-limit order and said in a blog in February this year that it had better performance, even when rebates from the other venues were included.

Cboe Global Markets has also applied for regulatory approval to introduce periodic auctions in the US to attract more block trading.

The exchange has been using periodic auctions in Europe. They last for very short periods of time during the trading day and are triggered by market participants, rather than the venue, helping them find liquidity quickly with low market impact, while prioritizing size and price.