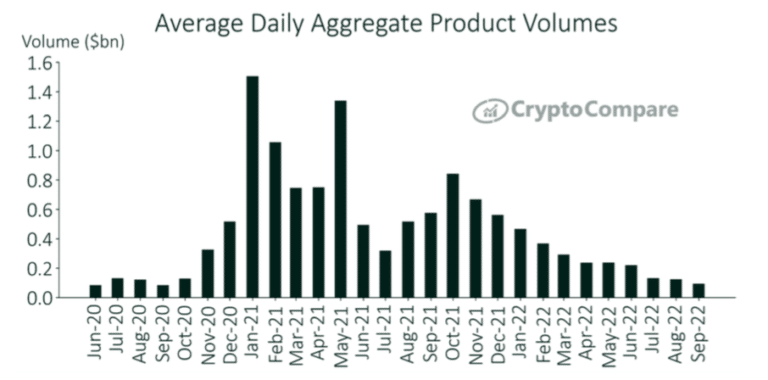

Average daily trading volumes of cryptocurrency exchange-traded products fell below $100m for the first time in two years in September according to CryptoCompare, an FCA-authorised benchmark administrator and digital asset data provider.

CryptoCompare said in its Digital Asset Management Review that average daily aggregate product volumes across all digital asset investment products fell 24.1% to $939m in September, continuing an almost continuous fall in volumes since November 2021. The report said: “It also recorded the first month since September 2020 where average daily volumes have fallen under $100m.”

Average daily volumes have fallen 79.9% from this year’s high in January according to CryptoCompare.

Trading volumes fell in line with the price of crypto assets in September as the US Federal Reserve raised rates by 75 basis points.

“This resulted in the price of Bitcoin and Ethereum falling 4.77% and 15.9% in September (as of the 28th),” said CryptoCompare. “Consequently, this had an adverse impact on the assets under management of digital asset products, with the merge catalyst proving to be of no support for the Ethereum-based ETPs.”

Our latest analysis shows that #ETH-based digital asset products witnessed one of their most challenging months, with all products dropping more than 10.0% in the last 30 days.

To access the complete Digital Asset Management Review report, click below!https://t.co/iIdNs3z5Bc

— CryptoCompare (@CryptoCompare) September 29, 2022

The merge involved the Ethereum blockchain moving from proof of work as a consensus mechanism, how all the computers maintaining a blockchain agree to add new transactions, to proof of stake.

“The merge drove the asset to a recent high against Bitcoin earlier this month amid speculation and ‘buy the rumour’ activity from traders,” said the report. “However, the optimism quickly subsided as the price of ETH fell significantly after the merge, reflecting the current economic downtrend.”

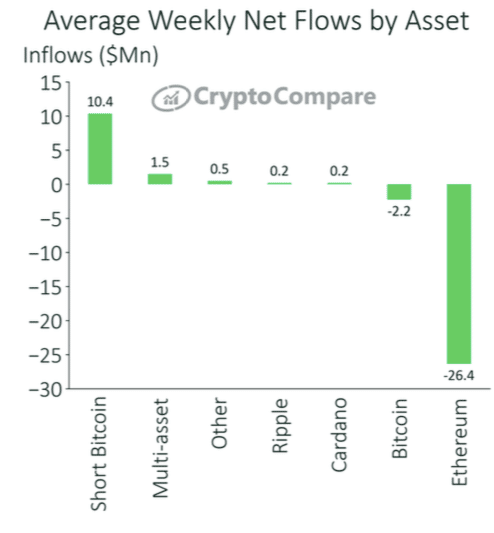

In September, as of 26th, all Ethereum-based digital asset products dropped more than 10%, according to CryptoCompare. After the merger Ethereum products recorded negative net flows of $26.4m in September, the largest out of any asset said CryptoCompare.

The data provider expects investors to move towards short bitcoin products to profit or to hedge their cryptocurrency holdings as macro-conditions worsen and the price of crypto assets continue to fall. As a result, short Bitcoin products increased assets under management in September.

Crypto ETFs and ETPs listed globally had net outflows of $83m during August according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem.

The outflows in August took year-to-date net inflows to $712m, much lower than the $4.2bn gathered at the same point last year.

Total assets invested in crypto ETFs and ETPs decreased by 10% from the end of July 2022 to $7.4bn at the end of August 2022. Assets have decreased 54% this year from $16.1bn at the end of 2021.

@ETFGI reports #Crypto #ETPs listed globally suffered net outflows of US$83 million during August 2022

Read More – https://t.co/Tg4pH1hPV9

— ETFGI (@etfgi) September 28, 2022

Staking yield indices

In September CryptoCompare and Blockdaemon, an institutional-grade blockchain infrastructure company for node management and staking, announced the launch of their industry-first family of staking yield indices.

The suite of indices is designed to measure the annualised daily staking yield generated by the digital asset, allowing institutional investors to create total return and yield swap products, benchmark portfolios, conduct research.

Participants of proof of stake blockchains delegate, or stake, their digital asset holdings to a validator node and receive staking rewards.

Charles Hayter, chief executive and co-founder of CryptoCompare, said in a statement that the new indices overcome the limitations faced by traditional indices, which ignore staking rewards generated by the underlying cryptocurrency. Hayter added: “These new innovative indices remove this hurdle, opening the door for new market participants while giving investors a vehicle by which they can easily gain exposure to the opportunities provided by staking.”

.@CryptoCompare and #Blockdaemon launch industry-first family of Staking Yield Indices which capture the annualized daily staking rewards of #PoS digital assets including:

•@Avalancheavax

•@Cardano

•@Cosmos

•@Polkadot

•@Solana— Blockdaemon ? (@BlockdaemonHQ) September 28, 2022

ETC Group, the institutionally focused digital asset manager in Europe, will be the first to license the Staking Yield Index Family for a series of products planned for the fourth quarter of this year.

Tim Bevan, co-chief executive of ETC Group , said in a statement: “We see this as a vital step to providing better access to institutional investors into the digital assets marketplace. Transparent, independent benchmark data provides the reference points required to navigate successfully and with confidence.”