The number of dedicated crypto hedge funds has risen sixfold since 2018 but less than one third are ready for institutional allocator capital according to a report from Coinbase.

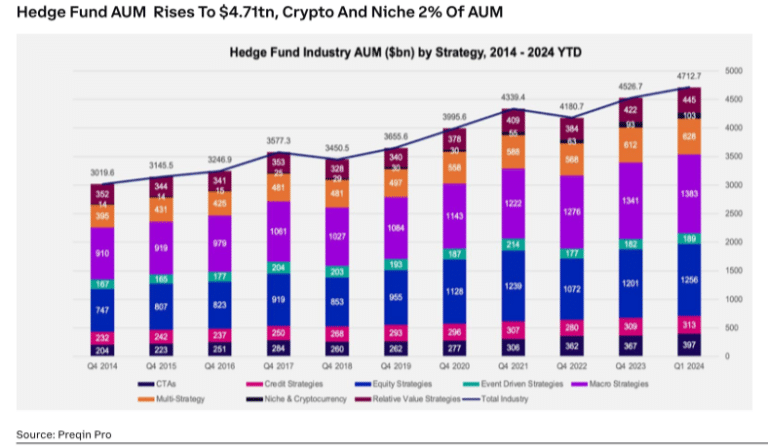

The second edition of the Coinbase Allocators Guide to Digital Asset Hedge Funds estimated that dedicated crypto hedge funds had aggregate assets under management of below $50bn, or less than 2% of traditional hedge fund assets.

“As of the first quarter of 2024, growth of dedicated crypto hedge funds has risen sixfold since 2018,” added Coinbase. “While multiple data sets track approximately 1,000 dedicated funds, we estimate that less than one third of crypto-dedicated funds are ready for institutional allocator capital.”

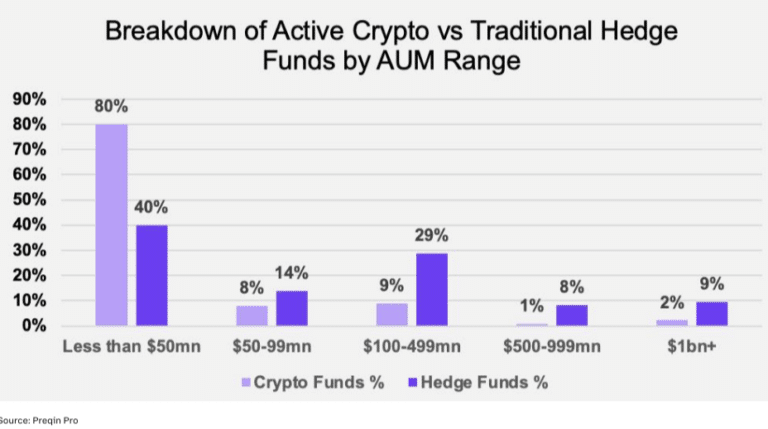

More than 80% of crypto funds have less than $50m in assets and only 5% have assets of more than $500.

Coinbase also noted that the space is institutionalizing quickly, with hedge funds such as Brevan Howard, Man Group and Millennium Management adding exposure and resources to launch new dedicated crypto strategies or expand existing ones. In addition, many hedge fund veterans are leaving traditional funds to start or join crypto-focused funds.

“They see this as an opportunity similar to the emergence of hedge funds in the 1990s at the cusp of electronic and high-frequency trading,” added Coinbase.

Many emerging managers have also now established three-year track records said Coinbase, and they have improved their risk- management process and built battle-tested teams with experience over multiple crypto market cycles.

The approval of bitcoin, and now ether, exchange-traded funds by the US Securities and Exchange Commission this year has also attracted traditional hedge funds into crypto, as they can trade volatility and seek high potential returns with a diversifying asset class.

“The 1Q24 US spot bitcoin ETF 13F filings listed marquee hedge fund platforms like Point72, Farallon Capital Management, Millennium Management, Boothbay, Renaissance Technologies, and DE Shaw as holders of bitcoin ETFs,” added Coinbase.

In addition, the filings showed that The State of Wisconsin Investment Board, one of the largest US pension funds, was a direct holder of bitcoin ETFs.

“Clearly, these institutional investors view crypto exposure as a tool for driving excess returns,” said Coinbase.

The report continued that, on average, hedge funds generally outperformed bitcoin in the 2017-2018 and 2021- 2022 bull markets according to data from Coinbase and Preqin, the private markets data provider. Over the five-year period ending in March 2024, a 2% allocation to bitcoin would have boosted annual returns by 2%, with only a 25 basis point rise in volatility, while increasing the Sharpe ratio from .41 to .58.

Active management, which includes token selection, portfolio optimization, and risk management to minimize drawdowns outperformed a spot-only bitcoin allocation. Three of the four primary dedicated crypto hedge fund strategies tracked by the Preqin Index since 2018, had a higher return than holding spot bitcoin or having long-only exposure.

“The best performing category is quant/active, followed by multi-strategy, market neutral, and long only,” said the report. “Long-only strategies generally underperformed spot bitcoin, likely due to a combination of limited drawdown risk-management, exposure to altcoins that underperformed bitcoin, and poor timing on the rebound.”