Deutsche Börse Group is reviewing an initial public offering of ISS STOXX, which includes the STOXX index businesses as well as ISS’ data businesses in governance, ESG, corporate solutions, and market intelligence, as part of a dual track process.

The group owns a majority 80% stake in ISS STOXX, which was formed in November 2023 by Institutional Shareholder Services (ISS) adding Qontigo’s index business, which included STOXX and DAX indices. Private equity firm General Atlantic and Deutsche Börse reached an understanding in principle on the combination aiming to form a leading combined ESG, data, index, and analytics provider, which they said would allow them to explore value creating capital markets options including a potential IPO in the medium term.

Stephan Leithner, chief executive of Deutsche Börse, said in the group’s annual press conference on 12 February 2025 that General Atlantic owns a 20% stake in ISS Stoxx, but has always been a temporary partner.

“Our cooperation has been very good and constructive, but nevertheless following the successful integration of ISS and STOXX we need to pave the way for a possible exit for General Atlantic,” said Leithner.

He stressed that Deutsche Börse may acquire General Atlantic’s shares or float ISS STOXX on the stock market, and is preparing for both options in the coming months. In the event of an IPO, Deutsche Börse will continue to hold a majority stake and fully consolidate ISS STOXX.

There has been a political backlash against ESG, especially in the US, but Leithner believes this will continue to be a long-term trend.

“When it comes to ESG data, we will support the expansion very actively“ he added. “ESG data is very necessary for investors, and will continue to be.”

Investment Management Solutions

Investment Management Solutions, led by Christian Kromann, comprises of ISS STOXX and software provider SimCorp, which focuses on institutional investors, and Leithner said the business advanced in 2024. SimCorp offers an accounting system for the investment activities of large institutional investors.

Leithner added: “SimCorp gives us strategic access to major institutional investors at top management level, and they are an important and growing customer group for Deutsche Börse. Its order books are full with further potential for growth.”

Major institutional investors are becoming increasingly important to Deutsche Börse as direct participants in capital markets, including pension funds, insurance companies and asset managers.

Gregor Pottmeyer, chief financial officer said at the conference that Simcorp won major new customers in North America in 2024 including new contracts with the TRS, Teacher Retirement System of Texas and PSP Investments, one of Canada’s largest pension investment managers. In January 2025 Simcorp also won a contract from the State of Wisconsin Investment Board.

The completed integration of SimCorp with Axioma, the US provider of risk models, had already proven successful in 2024, according to Leithner. The division contributed 22% to group revenues.

“Kromann will further strengthen IMS as a powerhouse at 22% of group revenue,” added Leithner. “IMS already makes a significant contribution to our recurring income.”

Trends

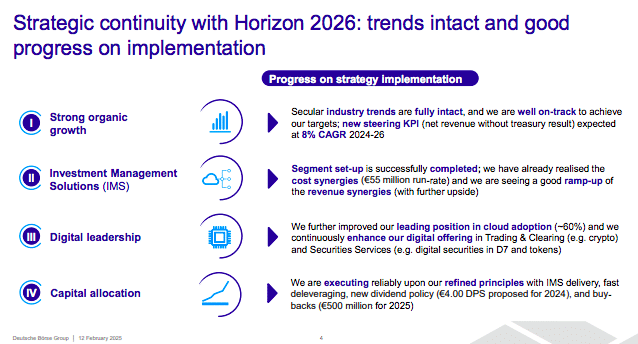

Leithner said that last year the group made significant progress in the implementation of its Horizon 2026 strategy which was announced about one and a half years ago.

A trend that the group expects this year is additional momentum in retail investments in ETFs, especially crypto products, and investment funds through savings plans, and wealth management products.

“This is a big wave, and it’s going to become even bigger,” added Leithner.

At the end of 2024, 60% of the group’s computing power had been migrated to the cloud, which Leithner said means better data security and increased ability to innovate in collaboration with Google, Microsoft and SAP. In 2024 D7, Deutsche Börse’s platform for digital issuance of securities, was used to issue more than €10bn.

“Together with Google Cloud, we are shaping the future with our digital asset platform,” said Letihner. “D7 enables Deutsche Börse to play a leading role also in shaping the next wave of innovation on the capital markets.”

He described 360T, Deutsche Börse’s trading platform for foreign exchange and digital assets as a “reliable growth machine.”