Deutsche Börse Group’s Crypto Finance has launched AnchorNote, which enables institutional clients to trade digital assets across multiple venues without moving assets out of custody, which improves capital efficiency and security. Crypto Finance Group, part of the German financial market infrastructure, provides regulated digital asset solutions to institutional and professional clients in Switzerland and Germany.

In crypto, clients usually have other pre-fund trades by moving collateral out of custody to a venue in order to trade. Crypto Finance acts as the collateral custodian and said in a statement that AnchorNote will be using BridgePort to connect to multiple venues at once, creating an end-to-end, off-exchange settlement infrastructure that meets institutional standards. The initial rollout focuses on Switzerland with plans to expand into Europe.

Philipp Dettwiler, head of custody and settlement at Crypto Finance, said in a statement that Crypto Finance AnchorNote closes a critical gap between custody and capital efficiency. He said: “Together with BridgePort, we are delivering an integrated solution that allows institutional clients to operate securely, flexibly, and in real time.”

Nirup Ramalingam, chief executive of BridgePort, told Markets Media that he had worked on FX and fixed income derivatives trading systems for nearly 15 years, including EBS and Brokertec, and the pain point of connecting an exchange to a custodian inspired the launch of his current firm.

In December last year BridgePort launched its middleware platform which it said in a statement was supported by institutions including Virtu, XBTO, Blockchain Founders Fund, Fun Fair Ventures, and Humla Ventures.

Philippe Bekhazi, chief executive of XBTO, said in a statement at the time: “As a pioneer in crypto trading, we understand the challenges of fragmentation and walled ecosystems. BridgePort addresses these barriers, paving the way for a scalable, interconnected trading ecosystem.”

Ramalingam explained that BridgePort connects exchanges and custodians so trading firms can hold assets at a custodian in a secure manner, but pledge them for trading. Bridgeport transmits a message to the exchange about the pledged assets, so the trader receives credit from the exchange for transactions.

“The problems we are addressing are credit risk from the exchange and, most importantly, capital inefficiencies for the trading firm, given that they have to pre-fund for a lot of these venues,” he added.

Role of custodians

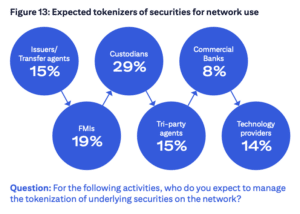

Citi’s latest Securities Services Evolution whitepaper found that half, 52%, of its survey respondents expect financial market infrastructures (FMIs) to be the core enablers of digital markets for equities and fixed income. Nearly one third, 29%, also expect custodians to be the network providers to these markets. The bank surveyed 537 market participants from buy- and sell-side firms.

Citi said the industry now recognizes the crucial role of existing FMIs and custodians as essential enablers and network providers for digital markets.

“A growing body of experience is showing that, while DLT offers efficiency, progress can only be scalable if it is backed by regulated, resilient, trusted infrastructures that have the operational expertise and member networks necessary for mainstream adoption,” added the report.

FMIs are also using DLT to offer functional improvements to their existing members, strengthening their role as central providers of regulated, scalable and resilient infrastructure rather than being disrupted or replaced, according to Citi.

“As we near industry-scale adoption for key activities such as margining and collateral, firms are reducing their execution and ongoing risks by leaning more heavily on their FMIs and their banks (in particular) to provide resilient and secure network connectivity, as they have to date,” said the report.

BridgePort

Ramalingam stressed that BridgePort is not a custodian, so does not hold any assets. Instead, BridgePort is a purely a middleware company that aims to build open custody by connecting reputable custodians and execution venues, giving trading firms the choice of using any custodian and using any venue without artificial limit constraints.

BridgePort performs two functions and the first is pre-order credit allocation. Once a trading firm wants to allocate a risk limit to an exchange, BridgePort confirms that it has sufficient assets at the custodian, which are then locked programmatically.

In the future BridgePort aims to add functions that are useful for trading firms, such as dynamic credit rebalancing. In this case, BridgePort would be able to pull unused allocations from one exchange and allocate it tp another exchange at the request of a trading firm.

The second function is to facilitate post-trade settlement time. Where possible, BridgePort nets the trades and sends settlement instructions so assets can be transferred onchain.

“The Holy Grail will be multilateral netting,” said Ramalingam.

He continued that compressing down line items is even more important in crypto because onchain transactions incur gas fees, which are ultimately paid by trading firms. If there are fewer onchain transactions, this improves the economics of trading and also mitigates settlement risk. The firm also uses AI to highlight any potential trade breaks.

BridgePort’s software serves as a coordination layer, so the firm is agnostic to the underlying collateral as long as it is accepted by the trading venue and custodian. Ramalingam said that when the founders were conceiving the company, they thought that bitcoin and stablecoin would be most common.

“I didn’t realize that tokenization was going to take hold in the way that it has,” he added.

As a result, BridgePort is working with a company that can tokenize treasuries that can be used as collateral, and is in dialogue with money market funds.

Off-Exchange Collateral: The Institutional Market Infrastructure Crypto Needs?

When I speak with institutional clients (both crypto natives and TradFi institutions) about crypto, the same concerns come up again and again: custody risk, counterparty exposure, and collateral…

— Jeremy Ng (@jeremyng777) September 12, 2025

Jeremy Ng, chief executive and founder of real-world asset tokenization platform OpenEden, said on X: “The traditional model of transferring assets onto a trading platform and trusting that they will remain safe is not acceptable to institutions with fiduciary responsibilities. To bring them in, crypto trading platforms need infrastructure that mirrors the safeguards and capital efficiencies of traditional finance trading.

When institutions transfer assets directly to trading platforms, they take on risks of security vulnerabilities or technical exploits, insolvency, or even fraud. Off-exchange collateral (OEC) removes this exposure by keeping assets with regulated custodians rather than the trading platform itself. The trading platform only receives verification that collateral exists and is sufficient to support trading.

This separation of roles mirrors long-standing practices in traditional finance, where collateral management is handled independently from trading venues. For institutions, it provides the custody safeguards required to trade with confidence.

Institutions are already familiar with structures such as tri-party repos and central clearing, where neutral parties manage collateral and ensure separation from the trading venue/exchange. OEC brings the same discipline to digital assets.

By aligning with these established models, OEC bridges the trust gap. Institutions can approach crypto with the same confidence they have in equities, fixed income, or FX markets. But removal of trading platform risks alone is not enough. To truly attract institutional capital, collateral must also be productive.”