Komainu, a regulated digital asset services provider and custodian, raised $75m this year to fund its growth plans as the FIA, the industry body for cleared derivatives, said tokenization has the potential to accelerate the movement of collateral.

In January this year Komainu said in a statement it had raised $75m in strategic investment from Blockstream Capital Partners. Komainu was launched in 2018 as a joint venture between Japanese bank Nomura, crypto security experts Ledger, and digital asset investment manager CoinShares.

Komainu said the funding enables the firm to accelerate its international growth plans, and to adopt and integrate Blockstream’s technologies in order to to maximise efficiencies in collateral management and tokenization. Paul Frost-Smith, co-chief executive at Komainu, told Markets Media that one of his first priorities in his role was to secure funding for the firm.

“We wanted a strategic partner in addition to the money, and we now have Blockstream,” he added. “It couldn’t be better.”

He was appointed as co-chief executive alongside Robert Johnson in May 2024. His career covers more than 30 years in financial markets including his previous role as co-founder and chief executive of Corinthian, a digital asset investment management and advisory firm. Johnson had joined Komainu as chief technology officer in October 2023.

Frost-Smith described the funding as a transformative event because Komainu is a traditional finance firm bringing those principles into the crypto world. In contrast, Blockstream is a crypto-native firm that has been in bitcoin from day one.

“We are implementing a lot of Blockstream technology in our systems, and they bring a lot of capital and experience to the table so it has been an amazing marriage,” he added.

For example, Blockstream Liquid Network will allow Komainu to cut the time for its off-exchange margining & settlement solution, Komainu Connect, from hours to minutes. Frost-Smith said Blockstream’s Liquid Network has block finality and a maximum time to chain of two minutes, rather than waiting for four hours or once a day settlement, which is much more the norm at the moment. This is really important for big hedge fund clients because they can get closer to real-time risk management.

In addition, Blockstream’s AMP technology will enable Komainu to automate its regulated asset support for tokenization and develop trustless trading solutions. Another technology that could be integrated is Blockstream’s enterprise HSM wallet, which would provide institutions with a broader range of bank-grade digital asset services.

PeterPaul Pardi, director at Blockstream said in a statement that the partnership is a “landmark” moment for the adoption of bitcoin-related technology by a bank-built, regulated financial services business. Pardi said: “It showcases the institutional use-cases for bitcoin as demand reaches new highs.”

Bitcoin treasury

Frost-Smith also highlighted the innovative nature of Komainu’s fundraising because it was the first ever in bitcoin. He said: “We like to be thought leaders and at the cutting edge of capital markets.”

Komainu is establishing its own bitcoin Treasury to manage the cryptocurrency provided by Blockstream with appropriate hedging and risk management.

“There are an increasing number of corporations that are starting to run bitcoin positions on their balance sheets, so we could provide a lot of education,” added Frost-Smith. “Blockstream is also in the process of looking at setting up an educational foundation.”

There are 129 public companies holding bitcoin as at 18 June 2025, according to data provider bitcointreasuries.

Growth strategy

There are a number of other digital asset custodians including crypto-native firms, as well as traditional banks looking to enter into the space.

Frost-Smith said that one of Komainu’s differentiators is that the firm has governmental contracts, and so has gone through some of the most rigorous background testing and screening, while beating off competitors from across the globe. He said: “It gives our clients a sense of security to know that we have been tested to those limits.”

He also argued that Komainu is now one of the best funded custodians in the market, which is very important for anyone wishing to place their assets in custody. Frost-Smith said: “Another differentiator is that we have an amazing partner standing alongside us and providing us with cutting edge technology.”

Komainu’s ambition is to become the leading full-scale financial services business in digital assets outside the Americas. The firm is qualified custodian in the U.S. through its Jersey license but Frost Smith said the country is not a priority simply because it is so well served by three established incumbents.

“We are looking at ways of growing inorganically through acquiring third parties and, in particular, we are looking at new geographies,” he added. “Over the next year we would like to be operating in some more jurisdictions in the same sensible and conservative way that we operate elsewhere.”

For example, Komainu can scale up in Singapore, Japan would be “very nice to have” and the firm would like to scale up its Italian registration into a full license.

In addition, the exchange settlement and collateral management solution moves Komainu towards a prime services offering because the firm is bringing balance sheet providers into the ecosystem to provide financing against collateral.

“In a year I would expect us to have made progress towards a prime services offering,” said Frost-Smith.

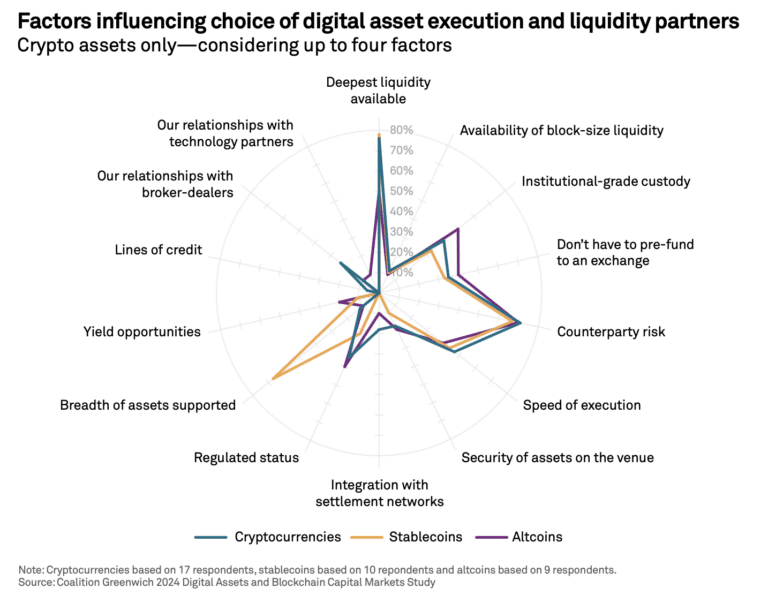

There is a growing demand for institutional-grade, institutionally-focused venues, markets and technology infrastructure for digital assets, according to a report from consultancy Crisil Coalition Greenwich. The report, Digital asset trading 2025: A market in transition, said the crypto market is undergoing a significant transition from its adolescent phase to a more regulated, mature and sophisticated stage.

Collateral

One of the common requests that Komainu receives is not to use crypto as collateral, but to also use securities and tokenized money market funds.

“We are the first custodian to be able to provide tokenized money market funds, such as BUIDL, as collateral which we see as a significant development,” said Frost-Smith.

BUIDL is BlackRock’s tokenized money market fund. Smith-Frost added that Komainu is the largest custodian for BUIDL and that the firm is working with a number of other tokenized money market fund issuers. He said: “We are bringing in balance sheet providers to enable people to trade in and out of their tokenized funds over the weekend.”

Komainu is looking closely at using its licenses to enable, for example, a large hedge fund to use a pot of collateral, whether it is crypto securities or traditional assets, and to be able to net and cross-margin across that portfolio.

“We have engineers working on that and it should launch this year,” said FrostSmith.

David Easthope, who advises on market structure and technology at Crisil Coalition Greenwich, said in the report that the emergence of full-stack prime brokerage operations will provide institutional traders with a more comprehensive and coordinated approach to trading, custody, settlement, and staking.

“As the crypto market continues to evolve, it is likely to become an increasingly attractive and viable option for institutional traders, offering a more sophisticated and robust landscape for investment and growth,” added Easthope.

FIA white paper

Walt Lukken, president and chief of FIA, said at the International Derivatives Expo (IDX) in London on 17 July 2025 that tokenisation has the potential to make huge improvements in collateral management and settlement.

“It will make it possible to move collateral and meet margin requirements on holidays and weekends when banking systems are closed,” Lukken said. “It also could play an important role in the transition to 24/7 trading.”

Lukken gave the example of CME Group, DTCC, Eurex and ICE actively exploring the use of tokens for margin and settlement, which banks and asset management firms are also investing in their own capacities to manage tokenized assets on blockchain networks.

The FIA said in a white paper that the cleared derivatives industry is at an “inflection point” in the adoption of tokenization due to its four main benefits – increasing the speed of asset transfers from days to minutes; allowing for extended trading hours, including the potential for 24/7 trading; reducing errors and using smart contracts to automate certain processes.

Will Acworth, global head of market intelligence at FIA, said in a statement: “Although there are many issues that will need addressing before it can be deployed at scale, we think the time has come for both the industry and its regulators to recognize the benefits of technology and work together on adoption.”

However Frost-Smith warned: “There could still be a significant period before you see returns from tokenisation so, for me, it is a longer lead business line. I will be surprised if many people make much money inside three years.”