John Avery, head of product for digital assets at technology provider FIS, said digital assets reached a tipping point last year but 2022 is when the industry will become confident that the infrastructure is ready to support the demand for institutional exposure.

Avery told Markets Media: “There are clients that already have access through FIS to digital assets, some will be getting access in 2022 and a whole bunch more are working to be ready for 2023.”

There has been a huge downturn in both traditional and digital asset prices but Avery said conversations with clients indicate they are taking a long view and acknowledging the increased volatility while believing that digital assets are here to stay. In addition, there are definitely some traders who are taking advantage of the fall in prices.

He continued that in 2021 FIS had recognised that the switch had flipped in crypto and institutions would begin seeking a path to getting exposure and integrating the new asset class. The firm formed a dedicated crypto and digital asset product team responsible for the capital markets business which supports more than 6,400 clients. They range from hedge fund managers and family offices who are looking for more advanced forms of digital asset exposure to more conservative clients who are unsure how to manage through the current regulatory ambiguity.

“It is really important that every one of our 6,400 clients has a clear path to start their digital asset journey,” Avery added. “We play an important role as a bridge for hundreds of billions of dollars of institutional capital to flow into this asset class and creating a more robust infrastructure for traditional finance to access new exciting forms of exposure.”

In addition to making it easy for clients to trade digital assets, the firm aims to ensure that all the downstream operational processes and risk assessments already supported by FIS platforms are updated.

Custody

In April FIS announced it had partnered with Fireblocks to provide enterprise-grade digital asset investing and wallet technology, lending and decentralized finance (DeFi) to capital market clients.

Fireblocks said in a statement that the collaboration will allow FIS customers to instantly gain secure access to a deep crypto liquidity network; support for more than 1,100 tokens and more than 35 blockchain protocols including fiat on & off ramps and access enterprise-grade DeFi and staking.

"With Fireblocks direct custody, clients have direct access to the blockchain, which gives them greater choice in what they can do natively— support multiple protocols, #Defi, trading, and so on." Fireblocks Co-Founder & CEO Michael Shaulov at #FTCrypto. @FTLive @TheBanker pic.twitter.com/gQpnEdqDsf

— Fireblocks (@FireblocksHQ) April 29, 2022

Michael Shaulov, chief executive at Fireblocks, said in a statement: “The strategic partnership with FIS will bring the Fireblocks technology to nearly every type of buy-side, sell-side and corporate institution in traditional assets. Together, we will enable a quick way for existing and prospective FIS clients to onboard their digital asset operations and begin tapping into these fast-growing markets.”

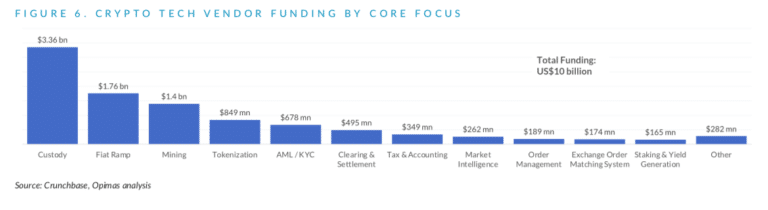

Any financial services firm wishing to offer support for crypto assets must employ a high-caliber custody solution at the core of its systems as cryptocurrency transactions that take place on the blockchain are final and irreversible according to Opimas, the capital markets consultancy.

Suzannah Balluffi and Anne-Laure Foubert, analysts at Opimas, said in a report: “Legacy banks, such as BNY Mellon and State Street, have also entered the scene, and have turned to crypto tech vendors to help them add support for cryptocurrencies. However, vendors that do not tick the box when it comes to cybersecurity controls will have a hard time bringing in big banks as clients.”

Crypto tech vendors will generate revenues of close to $2.1bn in 2022, more than double the $800m they generated last year according to research from Opimas. The consultancy expects more crypto tech vendors to expand their market reach by joining forces with incumbent vendors according to a report.

For example, BNY Mellon has backed several firms, including Fireblocks. Opimas said: “BNY Mellon has good reason to invest in the crypto ecosystem: the reserves backing USDC stablecoins issued by Circle are held in BNY Mellon’s custody.”

Avery continued that the Fireblocks announcement led to a lot of inbound interest in understanding how their technology can be integrated into existing infrastructure.

“We think there is a role for third-party technology amongst our traditional institutional capital markets client base,” Avery said. “Part of the value that FIS adds in this process is frontloading some of the onboarding work, so clients get access very quickly and we also reduce the time to market it takes for a crypto technology provider to get into TradFi clients.”

He expects that as institutions get comfortable with crypto and DeFi investing, the next wave will be tokenized asset exposure.

“That is really exciting because that unlocks a tremendous amount of liquidity in illiquid assets that many of our clients have on their books,” Avery added. “By the end of this year I would love to be able to announce some of those clients who have entrusted FIS to support their digital asset journey and announce more partners as part of our ecosystem.”