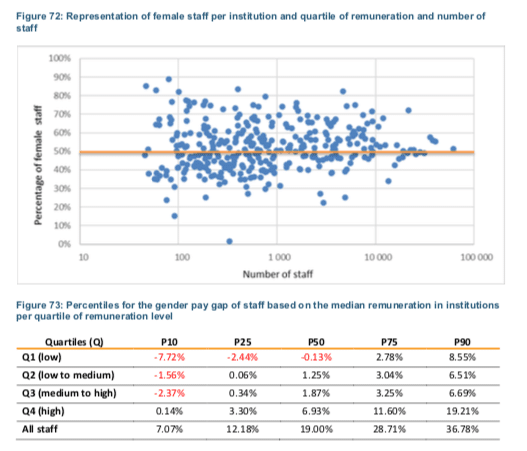

The European Banking Authority found that women earned materially less than men in financial institutions and investment firms, with a bigger gap in investment firms.

The EBA’s Report on Remuneration and Gender Pay Gap Benchmarking found that, on average, female staff in institutions earned 24.5% less in 2023 than their male counterparts. For risk takers the difference was at 21.6%. In investment firms, the pay gap larger with female staff earning 32% less than their male colleagues.

Data on the gender pay gap was collected from 351 institutions and 102 investment firms. The report contains data for 2023 for all staff of institutions and investment firms and separate information on the gender pay gap of identified staff who have a material impact on the entities risk profile.

The pay gap was mainly caused by the underrepresentation of women in higher paid positions, according the EBA.

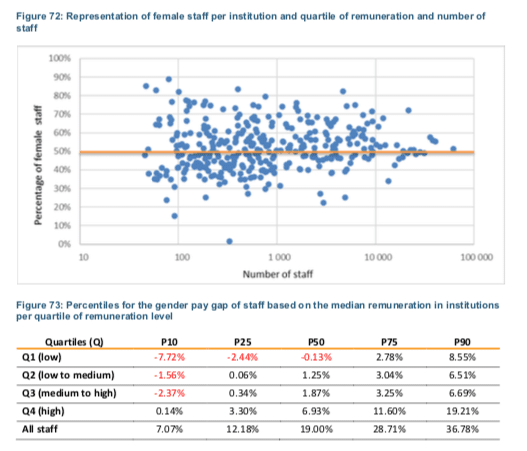

Women held one third, 33.45%, of the highest paid positions in institutions and just 12.99% in investment firms, although women and men were equally represented in institutions overall, but underrepresented in investment firms.

The EBA said the materiality of the identified gender pay gap raises concerns about the application of the obligation to ensure equal opportunities for staff.

“The data underscores the need for entities and competent authorities to analyse closer the reasons for the observed gender pay gap and to address gender representation and pay disparities and implement measures to promote equal opportunities and pay equity,” added the report.