Wealth managers in Europe, Middle East and Africa are expecting to increase allocations to private equity and private credit over the next three to five years, although they cited liquidity as the most common obstacle.

State Street Investment Management’s 2025 EMEA Wealth Manager Survey found that 53% of respondents expect to increase allocations to private equity and 42% to private credit over the next three to five years. However, 68% said liquidity was the most common obstacle followed by fees, costs, and minimum order sizes.

The integration of private assets into portfolios for wealth managers is a matter “of when, not if” according to the report. The survey was conducted between May and July this year with responses from 82 wealth managers across nine countries, who have a total of over $5 trillion in assets under management.

“The push toward alternatives grows stronger, and new products are emerging, expanding access to private credit, infrastructure, and other real asset exposures that were once reserved for a select few,” added the survey.

Ann Prendergast, head of EMEA at State Street Investment Management, highlighted at a media briefing on 30 September 2025 that ETFs are a really useful way to democratize access to asset classes, particularly for retail intermediary clients. She said: “They are thinking about how to access private markets in an efficient way.”

In the U.S., State Street Investment Management and alternatives manager Apollo Global Management launched an ETF in February this year, PRIV, which includes exposure to investment-grade private credit, including asset-based finance, alongside investment-grade public credit.

Anna Paglia, chief business officer at State Street Investment Management, said in a statement at the time: “We have worked with Apollo to provide a liquidity solution within PRIV and PRIV continues the mission of democratizing access to private markets.”

Frank Koudelka, global ETF product specialist at State Street Bank, highlighted at the media briefing that the firm is seeing a lot of interest from clients to provide access to private markets though the ETF market.

“However, these products need intra-day liquidity and cannot have lock up periods so I think it is going to be an evolution,”he added. “The Apollo product is in the market but other clients are taking a wait and see approach.”

J.P. Morgan Asset Management has also recently filed with the U.S. Securities and Exchange Commission for its Total Credit ETF that allocates up to 15% of assets to private credit.

Fixed income ETFs

State Street Investment Management’s 2025 EMEA Wealth Manager Survey said nearly all, 88%, of wealth managers expect to use ETFs more frequently in client portfolios, with cost efficiency as the top driver of adoption.

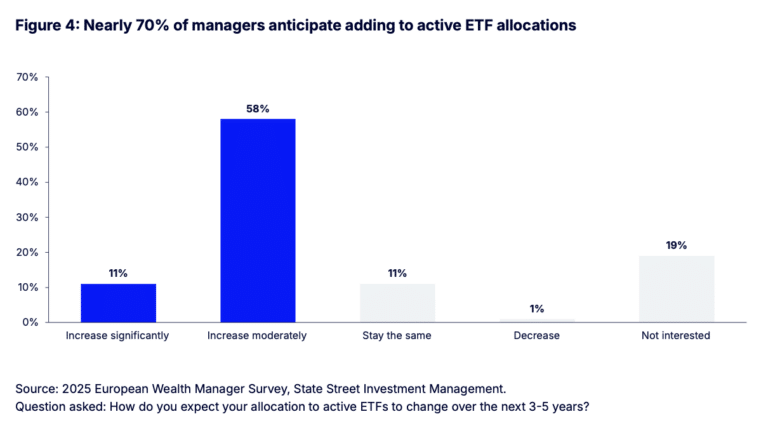

Approximately half, 47%, of wealth managers also expect to maintain their current allocation between active and index investments. About four in five wealth managers are already invested in active ETFs and among this crowd, 85%, plan to increase their allocation according to the survey.

Matteo Andreetto, State Street Investment Management’s head of intermediary clients coverage for Europe, said at the briefing: “ETFs continue to dominate, but active strategies are on the rise. I think an additional acceleration could potentially come from active fixed income products.”

Active fixed income ETFs have attracted record global inflows of $123bn this year, according to State Street. The report highlighted that active ETFs give managers the ability to adjust in real time to rate movements, widening spreads, emerging credit risks or other market events.

“The result is broader optionality in portfolios, including core and core-plus strategies, targeted satellites like high yield or EM debt, and even newer vehicles such as private credit ETFs,” said the report.

In September 2025 State Street Investment Management and Blackstone Credit & Insurance said in a statement they were launching an actively managed European Collateralised Loan Obligation ETF. This is the first credit collaboration between the two firms in Europe, building on their US credit partnership which includes two US ETFs sponsored by State Street IM and sub-advised by Blackstone that focus on the loan and high yield segments.

The new ETF provides access to floating rate AAA-rated tranches of Euro-denominated debt issued by CLOs. Blackstone actively manages the securities, while State Street IM is responsible for the governance of the ETF and will also oversee distribution to institutional investors, including asset managers, asset owners, private banks and wealth managers.

The European CLO market, valued at €250bn, has grown at an average of 8% in the past five years and is forecast to result in €50bn of issuance by the end of this year, according to Blackstone, the largest global CLO manager.

Mark Alberici, global head of product innovation and strategic partnership at State Street Investment Management, said in a statement:“With this launch, we are expanding our liquid credit partnership with Blackstone beyond the US and are excited to bring Blackstone’s historical expertise in CLOs to the European market via the UCITS ETF structure, as we continue to democratize investing by helping reduce barriers to entry into this historically hard-to-access area of the market.”

Rise in active ETFs

Koudelka highlighted that ETFs were not originally designed just for passive vehicles, but were meant to be a wrapper to deliver any investment strategy “to the masses.”

“In the last 10 years we have seen the beginnings of what we call ‘ETF 3.0’, which is the emergence of active managers,” Koudelka added.

He expects more U.S. asset managers to launch active ETFs following a regulatory change. In September this year the U.S. Securities and Exchange Commission allowed Dimensional Fund Advisors to launch an ETF share class of an existing mutual fund, and the regulator is expected to quickly allow other fund managers to do the same.

The ETF share class allows a share class of an existing mutual fund to trade as an ETF. This is already authorised in Europe, Canada and Australia but had not been approved by the SEC.

“We know from the filings and the conversations that we are having with clients, that we are going to see significant launches in this regard,” he added.

There are about 78 SEC filings to launch an ETF share class for an existing fund, of which half are State Street clients, according to Koudelka, and the firm has been working with clients on an operating model.

In Europe, State Street is also talking to about a dozen of its existing ETF clients about launching new ETF share classes, according to Koudelka. As existing funds have a brand, scale and a track record, Koudelka argued that adding an ETF share class allows managers that are new to the ETF market to enter with significant scale and accelerate adoption.

“We think this is going to be another significant leg of growth,” said Koudelka. “State Street has about 110 ETF clients and this could easily double in the next five years, because so many active managers have been waiting on the sidelines.”

He continued that 37 of the top 50 active managers offer ETFs in the U.S. market and these strategies are quickly evolving into the European market and other overseas markets.

“The U.S. looked exactly like Europe six or seven years ago and we are now at over $1 trillion in assets in active ETFs, and accelerating to the point where it’s close to 40% of flows,” said Koudelka. “In the next five years, you’re going to see the same growth rate in Europe that we’re seeing in the US.”