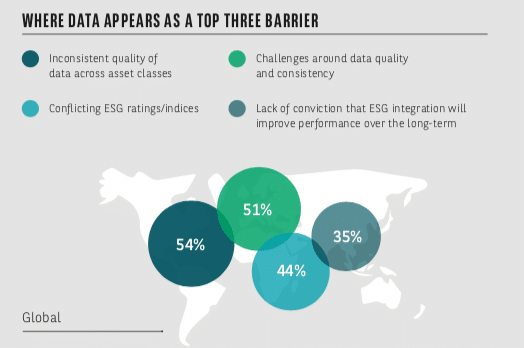

Data remains the primary barrier for asset managers to integrate environmental, social and governance strategies.

The majority, 59%, of respondents in BNP Paribas’ ESG Global Survey 2021 said data issues are a top two impediment to ESG integration, only slightly lower than the 66% in the previous survey in 2019. The 2021 survey of 356 institutional investors, with an estimated $11.3 trillion in assets under management, was carried out between April and May this year.

#ESGSurvey2021 | ? Pleased to announce the launch of ESG Global Survey 2021.

The research shows the incorporation of #ESG among institutional investors has matured and is accelerating, but key challenges remain.

Download the report now ➡️ https://t.co/lJlzndN94K pic.twitter.com/UNuR8udkbz

— BNP Paribas Securities Services (@BNPP2S) September 13, 2021

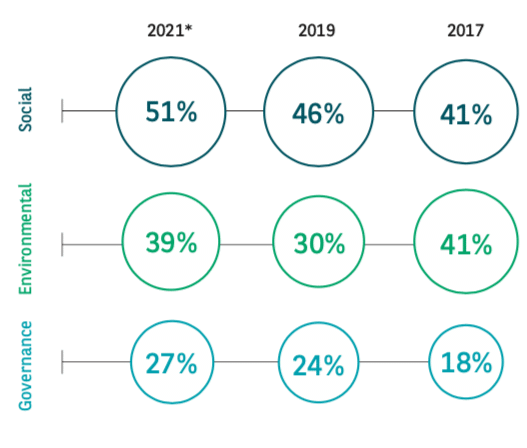

Half the respondents, 51%, said the social element of ESG remains the most challenging due to a lack of the right data.

“Social data is more difficult to come by and there is an acute lack of standardisation around social metrics,” said the report. “This comes at a time when the social component is of growing importance to end investors.”

Jane Ambachtsheer, global head of sustainability at BNP Paribas Asset Management, said in the report that most ESG metrics are not subject to mandatory reporting.

“As we are relying on corporates’ voluntary reporting, the resulting data may be inconsistent in terms of quality and what’s reported,” she said. “We can certainly observe many regional disparities which can lead to the use of a lot of estimations.”

Source: BNP Paribas’ ESG Global Survey 2021.

In order to overcome the data barrier nearly three quarters, 74%, of asset managers use multiple sources as their primary approach. A significant number, 41%, conduct their own research methodologies rather than just relying on third-party data and 43% ensure the transparency of the source of raw data.

Alexandre Gautier at Banque de France, said in the report: “In view of what happened in the global financial crisis with credit rating agencies, it is clear that there is a risk of greenwashing of data. This will be a major challenge for regulators, investors and customers.”

Florence Fontan, head of company engagement and general secretary at BNP Paribas Securities Services, said in a media briefing that data has been a challenge since the first survey.

“Three years ago we didn’t have accurate data in some areas, even on the environment,” she added. “Now the question is less a question of whether we have the data, it is rather the consistency and level of granularity.”

Florence Fontan, BNP Paribas Securities Services

Fontan said the European Union’s Sustainable Finance Disclosure Regulation, which is expected in November, should help disclosure as defining standards should reduce the risk of misrepresentation.

“SFDR today is missing important details in the implementation guidelines as we need much more granular detail,” she added.

Trevor Allen, sustainability research analyst at BNP Paribas, agreed in the media briefing that SFDR will provide more detail around reporting standards for companies. He continued that governments and regulators also need to consider dual materiality – how companies report on the physical and transition risks of climate change and also how they impact the environment.

“Once we start to get granularity and transparency, we’re going to see a significant change in terms of how we can actually integrate this into our investments but we need consistency,” he added. “Understanding, year in and year out, how a company can be affected by climate change and impact climate change is going to be a game changer.”

Technology can also help order to improve the use of ESG data and two thirds, 67%, of the survey cited the main priority for investment as ESG reporting/disclosure at all levels (company, portfolio and fund).

Michael Woolley at Eastspring Investments said in the report: “Technology has the ability to combine structured and unstructured data which then allows you to look more widely, past the formal company disclosures that might be captured through traditional ESG sources of information.”

Source: BNP Paribas’ ESG Global Survey 2021.

ESG integration

Fontan continued that that ESG integration has shown a big acceleration since the last survey.

“Niche or specialist ESG teams no longer sit somewhere in the organisation but ESG but are spread across the organisation in investor strategies and core processes,” she added.

Not one respondent in 2019 said their organisation incorporated ESG into all their investments. Now over a fifth, 22%, of investors, say all or most of their portfolio incorporates ESG.

However, more progress needs to be made as two thirds of investors still include ESG in less than half of their portfolio.

Trevor Allen, BNP Paribas

Allen added that the trajectory of ESG integration is expected to continue. He described a barbell effect with one fifth of investors saying ESG is critical to everything but 44% of investors integrating ESG into 25% or less of their overall investment portfolios.

“When we look forward, 55% of respondents are telling us that in two years they expect that ESG will be integrated into at least 50% of their portfolios,” Allen said.

He continued that negative screening is “maxed out” as investors that wanted to get out of the controversial businesses have probably done that by now. Instead, active engagement has become the focus for transitioning businesses.

“One of the key elements that we see changing is how we engage with companies to ensure they have the capital to change their business activities,” he added.

Alternatives

Delphine Queniart, global head of sustainable finance and solutions at BNP Paribas said in the briefing there is a growing ESG sensibility in alternatives, particularly non-listed assets.

In the survey 41% of investors incorporate ESG considerations within infrastructure, followed by private equity/debt (38%) and real estate (37%).

Delphine Queniart, BNP Paribas

“An important point which came up in the survey is that non-listed assets face greater challenges with regard to standardized measurements,” added Queniart. “Nevertheless, they have considerable potential for impact.”

She explained that the majority private equity shareholder has the ability to influence change within a company and improve reporting.

Infrastructure strategies can influence positive environmental outcomes, for example through energy transition projects, and their longer investment horizons also align strongly with those of asset owners (54% have an average horizon of seven or more years, compared to 31% of asset managers according to the survey).