Europe has established a long lead in environmental, social and governance investing but recent gains in the United States have been remarkable according to Broadridge Data and Analytics.

Broadridge said in a report, ESG: Transforming asset management and fund distribution, that Europe will likely maintain a higher volume of ESG business for the foreseeable future but recent gains in the US have been “remarkable.”

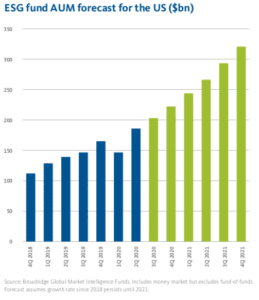

“If current growth rates persist, assets in the US will exceed $300bn (€256bn) by the end of next year,” added Broadridge. “As a result, asset management companies from around the world – and particularly from Europe – will find more attractive opportunities in the Americas.”

Global net flows into ESG mutual funds and exchange-traded funds more than doubled to $173bn last year according to Broadridge.

The expansion continued this year with average monthly flows in the first half running 35% higher than in 2019. As a result, global assets in dedicated ESG mutual funds and were more than $1.3 trillion in June 2020, more than twice the amount five years ago.

“Although volumes remain greatest in Europe and international cross-border markets, activity is growing much faster in North America,” added the report. “The US market has grown the fastest with assets rising to $185bn.”

Best-in-class, sustainable/thematic, and impact investments made up more than three quarters, 77%, of total ESG fund flows in the first half

of this year. Systematic ESG integration strategies also increased their share, but funds that solely employ exclusionary screens captured only 7% of flows.

“As investors favor outcome-oriented strategies such as sustainable and impact funds, asset managers will need to demonstrate how real-world ESG outcomes are being delivered and benchmarked,” said Broadridge.

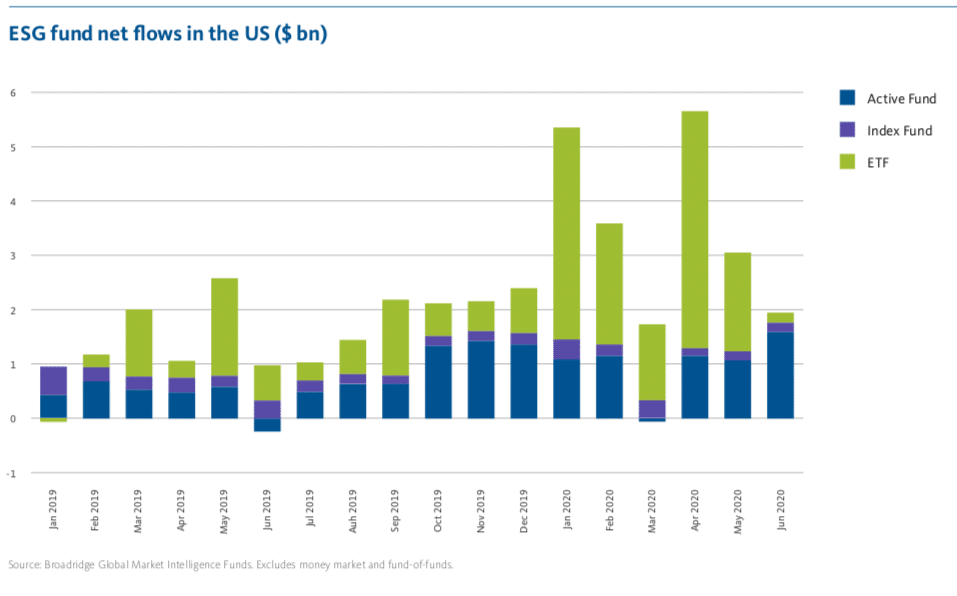

Recent gains have been driven mainly by a surge in ETF purchases, although active funds set a record for net flows in June.

The study said: “Together, active and passive ESG strategies set a record in the first quarter that was matched in the second, despite the financial and economic shocks of the Covid-19 pandemic.”

Active strategies represent 81% of ESG fund assets in Europe and 68% in the US.

“These numbers will decline over time as passive strategies gain,” added Broadridge “Last year in the US, active funds attracted 52% of ESG net flows, but their share dropped to 35% during the first half of 2020.”

Broadridge continued that its global market intelligence datasets suggest that retail made up approximately one-third of mutual fund and ETF assets flows, and their share has been growing.

Schroders’ survey

Schroders Global Investor Study 2020 also found that the majority, 55%, of American investors are more likely to invest in sustainable funds.

The UK asset manager surveyed more than 23,000 people who invest from 32 locations globally, including 2,000 in the US. The study found that higher returns, rather than just positive societal and environmental impacts, are driving Americans’ adoption of sustainable funds

Sarah Bratton Hughes, head of sustainability – North America at Schroders, told Markets Media that this year’s survey showed an increase in interest from boomers due to the strong performance of ESG funds, especially during the pandemic, and their long-term value creation

“2020 has proven to be a turning point as the evidence is increasingly clear that investing sustainably could lead to better long-term outcomes,” she added.

She continued that the conversation is also switching from risk mitigation to value creation.

“Decarbonization and energy transition to renewables are the next investment trend,” Bratton Hughes said. “There are opportunities for returns as trillions of dollars will be invested across the supply chain.”