Use-of-proceeds bonds have been the most popular form of labelled environmental, social and governance US municipal bond issuance and this market segment has significant potential according to the United Nations-supported Principles for Responsible Investment.

The PRI said in a report, The Thematic ESG Approach in US Municipal Bonds, that the US municipal bond market is one of the largest and most liquid sub-sovereign bond markets and measured $4 trillion last year.

US municipal bonds fund key infrastructure & public services with clear environmental & social implications so are well-positioned for investors pursuing a thematic ESG approach.

Read our report on key issues for the thematic approach in this market: https://t.co/RxaWSAfsy7

— The PRI (@PRI_News) January 18, 2023

Households and non-profits hold about 40% of munis due to their tax-exempt status, which also results in institutional investors treating US muni bonds as a separate asset class to corporate and sovereign bonds, and often managing them separately.

“Interestingly, the proportion of foreign investors in the muni market, albeit still small (at 2.9% of the total outstanding volume) has grown in recent years,” added the report. “One potential factor may be that insurers in the EU and the UK receive favourable capital treatment under Solvency II rules for investments in revenue muni bonds that fund infrastructure.”

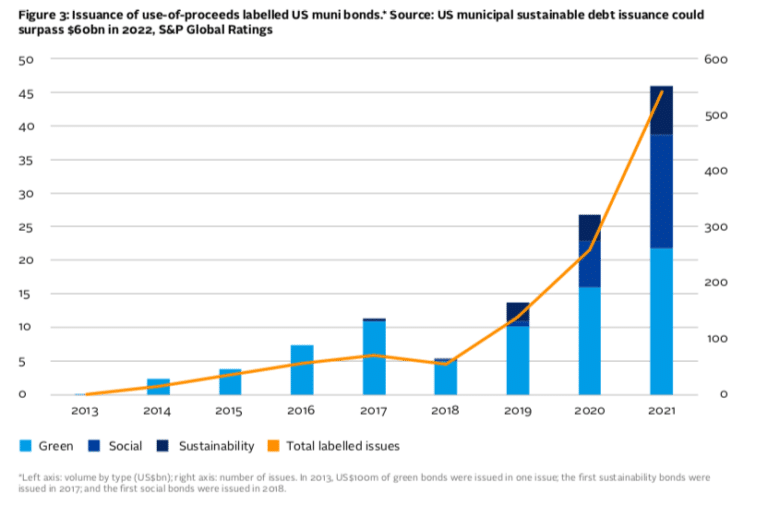

The Commonwealth of Massachusetts issued the first green US muni bond in 2013 and the PRI said that a new labelled bond market has developed which enables issuers to earmark funding for projects that deliver specific sustainability outcomes.

“However, the extent to which such instruments are genuinely supporting sustainable finance rests on how robust and rigorous the standards used to issue the labelled bonds are, as well as on the underlying data and methodologies used to structure the bond,” added the report.

Two-thirds, 64%, of muni green bonds had an external review in 2021, less than the 73% in 2020. A lower proportion of social bonds, 52%, and sustainability bonds, 30%, received external reviews. Issuers may decide not to solicit an external review if they have difficulty devoting staff, time and funds towards these processes according to the report.

The main advantage of choosing to issue a labelled ESG muni bond rather than an unlabelled one is that it signals to stakeholders, including citizens and local governing bodies, the issuer’s commitment to sustainability, especially if the bond forms part of a wider sustainability strategy, added the PRI.

Another benefit may be the “greenium”, where the yield on labelled bonds is lower than for non-labelled equivalents because the former attract investors with a specific ESG mandate. There is anecdotal evidence of a greenium of several basis points for taxable muni bonds but limited evidence of one for tax-exempt debt according to the report.

Use-of-proceeds bonds have been the most popular form of labelled bonds to date.

“Although still in its infancy, this market segment has significant potential,” said the report.

In 2021, muni bond issuers raised $45.9bn through use-of-proceeds labelled debt, in the third consecutive year of above 70% year- on-year growth. As a proportion of total muni bond new issuance, it also increased to 9.7%, from 5.5% in 2020 and 3.2% in 2019.

Issuance is skewed to the US northeast and the west coast and the largest 10 issuers of use- of-proceeds labelled muni bonds represent one third, 35%, of the total issuance.

The average par amount for labelled use-of-proceeds debt in 2021 was $86m in 2021, and around $100m in each of 2018, 2019 and 2020, compared with a general muni bond average of less than $40m annually over the same period.

“Many US muni bonds are self-labelled, and it is crucial that issuers provide sufficient information on the use of proceeds, pre- and post-issuance, as well as any available performance metrics, to allow investors to scrutinise how funds are spent,” added the report. “Whether the bonds are self-labelled or carry an external review, investors should encourage greater reporting on the use of proceeds or regular progress towards adequately ambitious sustainability targets.”

In addition, the PRI also highlighted that controversy in some US states, where politicians have pushed back against aspects of ESG incorporation in finance, may hamper issuance.