Eurex has become the only derivatives exchange outside Korea to offer access to a Korean equity index after working on the project for more than a decade.

Deutsche Börse Group’s derivatives exchange launched futures on the MSCI Korea Index on 14 July 2025. Ralf Huesmann, heading product design for MSCI Derivatives at Eurex, told Markets Media that there were trades during the first week, with the biggest one of 600 lots.

“I expect this to be a block trading product for institutions, and that it will start to get active during the roll periods in September or December,” he added.

Huesmann said MSCI Korea is not a retail product as the initial push came from banks who wanted to move out of total return swaps. The new futures cater specifically to the needs of international institutional investors, including asset managers, asset owners, as and banks, who want US-dollar denominated exposure to the Korean market within the MSCI framework, enhancing trading and margin efficiencies.

The Korean contract helps fulfil Eurex’s ambition to offer contracts on all the separate countries which are classified as either developed or as an emerging market by index provider MSCI. Eurex offers 42 out of 47 countries, and Korea was the last major market missing as the country is more than 10% of MSCI’s emerging market index. The remaining missing markets are not so relevant or the index may be too small, according to Huesmann.

Korea accounted for 10.73% of the MSCI Emerging Markets Index as of 30 June 2025, ranking as the fourth-largest country allocation in the index, which captures large- and mid-cap representation across 24 emerging market countries, according to Eurex.

Eurex started working with MSCI in 2013 based on customer requests following the uncleared margin rules which Huesmann said were a key regulatory driver for the whole listed derivatives segment.

After beginning with the main benchmarks, Eurex has listed contracts on regional indices. Huesmann gave the example of MSCI World, where investors can trade USA, Canada, Europe, Japan, and Australia and in emerging markets, Eurex offers contracts for Latin America, EMEA and Asia.

“This has turned out to be a very successful strategy as investors trade the emerging market benchmark but then hedge locally,” Huesmann added.

He continued that Eurex has been working with MSCI on the license for the Korea Index for more than a decade.

“It finally came about due to Korea Exchange, KRX, deciding to extend their own trading hours and allowing direct access to their products across time zones,” he added.

The addition of the Korean contract means MSCI has almost completed the full puzzle of breaking down the benchmark indices into the regional or country levels. Huesmann said there could be further additions, such as when Eurex listed factor futures to allow a sector or factor rotation in 2022.

Eurex’s strategy to grow the MSCi suite of contracts is now about education and broadening the client group who uses MSCI futures by making them aware that futures are available on all these different markets. Huesmann said Eurex needs to explain that futures are there, but also that there is sufficient liquidity and the potential advantages.

“It’s now about getting additional end-clients active,” he added. “In the past, we have worked more with asset managers but we also need asset owners like sovereign wealth funds and insurance companies to become more familiar with MSCI futures.”

One growth driver is Asian flow as approximately 75% of the MSCI emerging market index is related to Asia. China is the biggest market followed by India, Taiwan, and then Korea as number four.

Eurex currently offers 146 MSCI futures, with approximately half of the trading volume focusing on the Asia-Pacific region. Nearly half, 45%, of the total open interest worth €135 bn is linked to Asian underlyings.

Performance

Xav Feng, Asia Pacific head of research at LSEG Lipper, said in a report that the South Korean stock market fell by 9.6% in 2024, ranking last among the Asia-Pacific markets.

“However, this year, the South Korean stock market has shown signs of a turnaround,” he added. “As of June 12 this year, the Korea Composite Stock Price Index (KOSPI) has surged by 21.7%, leading all Asia-Pacific stock markets.”

Feng said that since Lee Jae-myung, the candidate from the Democratic Party, won the presidential election he has actively promoted tax law reforms, corporate governance, supplementary budgets, and introduced a series of new economic policies.

“His call for a “KOSPI 5,000-point” era successfully boosted market confidence, leading the South Korean Composite Stock Price Index (KOSPI) to break through the 2,900-point barrier, reaching a nearly three-year high,” he added.

As a result, asset managers including Aberdeen Investment, Baird Wealth Management and Franklin Templeton have gradually increased their holdings in South Korean stocks or upgraded their outlook, according to the report.

Bloomberg reported that Goldman Sachs, JPMorgan Chase, Citigroup and Morgan Stanley are amongst the banks who have upgraded South Korea since the start of June this year.

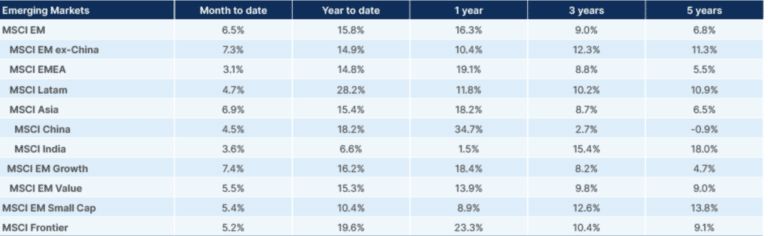

Ashmore Group, the emerging markets investment manager, said in a report at the end of June that emerging markets ex-China equities continued to outperform both US and non-US developed markets.

“The strong rebound of the S&P 500 from its post-Liberation Day lows means the gap between the EM and US equity performance is much narrower, but it is hard to dispute that non-US equity markets have had significantly better risk-adjusted returns,” said Ashmore.