Robbert Booij has been chief executive of Eurex since July 2024 and from April this year Deutsche Börse Group’s derivatives trading and clearing arm implemented organizational changes which he believes will unlock new capacity for growth.

Booij told Markets Media that Eurex used to be organised around asset classes. Equities came under the exchange, while fixed income was covered by the clearing business as the latter fitted Eurex’s strategy of being the home of the euro yield curve, which was linked to central clearing.

“We wanted to make our strategy consistent across these two pillars,” he added. “There was duplicative client coverage and multiple interaction points for clients which was not very efficient.”

In addition to duplication, the asset class siloes also led to opportunities being missed, such as an equity product which is not traded on the exchange and only cleared. As a result, Eurex decided to make changes and form global client-facing sales teams who cover all asset classes, trading and clearing, and are organised by region with teams in Asia, Europe and the U.S.

“This makes us more efficient, and we can allocate more resources towards onboarding more new customers, especially buy-side firms,” Booij added. “It is my belief that we can further grow our markets and increase the diversification of liquidity by adding more clients.”

In March this year Eurex said in a statement that global products and sales teams would be combined across equity/index, fixed income, currency, repo sales and business development into two new departments. Jens Quiram was given responsibility for the global sales & marketing department. Matthias Graulich became head of the global products & markets team, consolidating all product and market development activities across trading and clearing.

Booij said: “Matthias’s role is to find which opportunities we have not yet stepped into.”

As part of this organizational change and based upon the departure of Erik Müller, chief executive of Eurex Clearing AG, Booij also assumed overall responsibility for financial derivatives trading and clearing. As head of financial derivatives, Booij reports to Thomas Book, Deutsche Börse executive board member for trading & clearing.

Book said in a statement: “I am confident the streamlined structure in combination with the expanded role of Robbert are the basis for growth and will take Eurex to the next level.”

Sponsored access

Eurex will use this “newly unlocked capacity” for growth according to Booij. One of the bottlenecks to growth was barriers to access.

On 10 November 2025 Eurex’s new sponsored access model went live. This lowers market access barriers for market participants, especially buy-side firms, who do not want to establish a MiFID- regulated entity in Europe.

The model allows an existing Eurex trading member to act as a sponsor and provide direct electronic access (DEA) under the MiFID II framework. The sponsor provides its clients with direct access to Eurex’s high-speed T7 platform and full connectivity suite, enabling them to deploy latency-sensitive electronic trading strategies without the need for a full exchange membership.

“A key priority is to make our markets more accessible to a wider range of trading firms,” added Booij. “It’s a significant step in enhancing our service portfolio and growing our distribution network.“

He continued that next year Eurex will be implementing cloud access to its T7 trading system for clients who do not want to have a physical presence in a data centre.

Geographical expansion

The organizational split surprised Booij when he joined Eurex from ABN Amro Clearing Bank where he had been CEO Europe, but so did the breadth of its client base outside Europe.

For example, Eurex has clients in Asia whose business is to trade Euro Stoxx products. Booij has met senior representatives of central banks in Singapore and Hong Kong, who said they value Eurex products in helping them manage interest rate risks.

“When I joined I thought the business was more European and less global, he added. “I think the US makes up around 30% of our total business and Asia approximately 15%, which are very significant numbers.”

In July this year Eurex launched futures on the MSCI Korea Index and became the only derivatives exchange outside the country to offer access to a Korean equity index. With the addition of Korea, Eurex offers country futures on any market with a weighting of above 1% in either the MSCI World Index or the MSCI EM Index. Global investors can now trade all these markets with the same index methodology, similar contract specifications and use one clearing house to be highly margin efficient.

Booij said: “The MSCI Korea Index futures have over $2bn in notional outstanding after only two or three months, which I think is really good.”

In addition, some Asian retail brokers have told Booij they have end clients who are mainly trading U.S. products, but they also want to trade European products, especially related to the defence sector. In November this year Eurex launched options on the WisdomTree Europe Defence UCITS ETF.

“These types of clients may additionally want exposure to defense firms or the Stoxx Europe 600 index,” he added. “We are speaking to these brokers and seeing if we can onboard them.”

New products

Booij said one of the biggest trends is that clients are asking for more bespoke products. For example, Eurex intends to launch a new segment for trading Quantitative Investment Strategies (QIS) index futures in partnership with Premialab, the provider of data and analytics specializing in systematic QIS indices.

This represents Eurex’s ongoing “futurization” efforts by offering products that were previously only available over-the-counter (OTC) in a listed, centrally cleared format, which expands reach and efficiency.

In the same vein, Eurex launched total return futures (TRFs) back in 2106 which Booij said provide the return of an index without the need to hold the whole of the index.

“TRF volumes have significantly increased year over year,” he added. “We are looking at how can combine TRFs with the gold ETF.”

Volumes

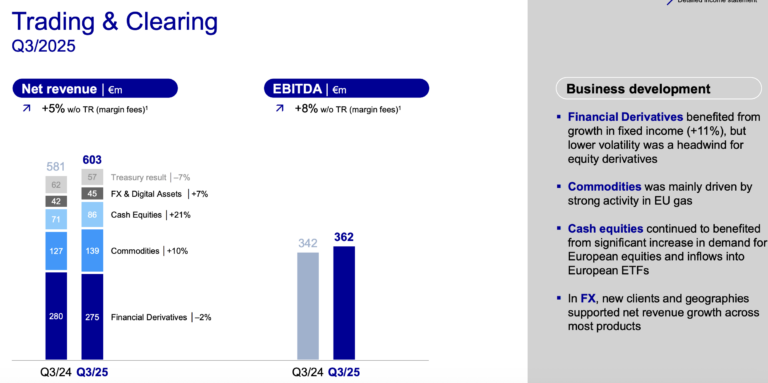

In its third quarter results Deutsche Börse reported that financial derivatives had made further progress in fixed-income, but there were cyclical headwinds for equity derivatives.

In October this year Eurex reported that trading volume was down 6% during the month reflecting calmer market conditions.

During the month, the exchange processed 157.7 million contracts, down from the 168.5 million contracts recorded in the same month last year. Interest rate derivatives declined by 7% year-on-year to 80.4 million contracts and equity derivatives fell 16% to 23.5 million contracts. Index derivatives fell 1% to 53 million contracts.

In contrast, notional outstanding volumes at OTC Clearing grew 41% year-on-year to €49,407. Eurex said the surge was primarily driven by overnight index swaps, which jumped 65% to €6,583bn.

Graulich said in a media briefing that Eurex had onboarded more than 2,300 clients in advance of the regulatory requirement for clients to maintain an active account for systemically relevant products with an EU CCP, which has been delayed and is due to become effective at the end of this year.

“It was remarkable that we dealt with a flood of additional clients so smoothly after implementing an electronic workflow,” Graulich added.

Although these new clients have been onboarded, only about 20% of them are currently active. Graulich expects a “significant” increase in volumes once they start to become active in the first quarter of 2026.

Eurex Repo’s average term-adjusted volumes rose 42% to €467bn in October.

Eurex has announced that the European Central Bank will join Eurex’s centrally cleared repo market in the first quarter. 2026. The ECB is the sixth central bank to join Eurex’s repo ecosystem of over 160 participants. Total outstanding volumes in Eurex’s repo market, which include Special, GC Repo and GC Pooling, have grown approximately 50% since the end of 2024, according to the statement.

Eurex plans to continue expanding its network by connecting more central banks and public sector institutions across Europe.

In July this year Euronext launched the Repo Foundation, the first phase of a multi-year strategy to expand access, improve margin efficiency, and the pan-European capital market infrastructure has also introduced a suite of fixed income derivatives on main European government bonds.

Booij said: “This does not change our strategy as home of the euro yield curve. Clients can trade and clear all the euro different maturities on Eurex from short to long-tear futures, OTC, interest rate swaps and repo in a one margin pool approach.”