The majority, 65%, of the finance community in the European Union are actively engaged in preparing for the transition to a shorter securities settlement in October 2027. The survey, published by the ValueExchange in November this year, covers more than 350 industry professionals and is the first of a series of EU T+1 reviews that will be carried out during the transition

The U.S. and Canada migrated from a securities settlement cycle of two days after a trade, T+2, to T+1 in May last year. The European Union, UK and Switzerland are aiming to make the same move on 11 October 2027.

To support this transition Euroclear, the post-trade services provider, is offering a single, consolidated view of all settlement instructions across its central securities depositaries (CSDs), which represent over 60%, of EU settlement. Late matching fails represent around 25% of fails according to Euroclear’s settlement efficiency analysis, and this might increase in a shorter T+1 cycle.

Euroclear said in a statement in June this year that it had partnered with software providers Meritsoft, a Cognizant company, and Taskize to enhance its EasyFocus service.

“While we have worked closely with participants who were facing matching issues, we have noticed considerable improvements,” added Euroclear. “By the end of 2025, we aim to have 95% of instructions matched by the end of T+1, adding to the existing benchmarks.”

EasyFocus+ uses artificial intelligence to provide predictive analytics to flag likely mismatches and identify root causes so that exceptions can be resolved quickly. The new version runs on Microsoft cloud to provide real-time data, insights and resolution capabilities so clients can reduce fails, streamline operations and benchmark their performance internally and across the industry to identify and address recurring issues.

Isabelle Delorme, head of product strategy and innovation at Euroclear, said in a statement that EasyFocus+ is a harmonised solution for every Euroclear client to help them overcome the operational challenges of a shortened settlement cycle and boost settlement efficiency. She added: “Euroclear’s open access model gives clients a choice of interconnected international and national CSDs, supporting competition, avoiding costly silos – ultimately delivering a single, seamless interface.”

The platform integrates Meritsoft’s instruction tracking and exception management solution and Taskize’s communication and collaboration platform to ensure that these issues are resolved as efficiently as possible.

Helen Adair, chief product officer at Taskize, told Markets Media that EasyFocus+ turns Euroclear’s trade data into actionable insights that address the pain points in the settlement process.

She added: “Tasksize has a communication layer that is embedded in EasyFocus+ to provide visibility, ownership, prioritisation, automated routing and proven faster resolution of exceptions.”

Daniel Carpenter, chief executive of Meritsoft, told Markets Media the firm has been having “hugely positive” meetings with market participants who see the value in consolidating trade data, communication and analytics in one platform. He added: “Since launching firms have been able to to solve three or four times as many issues.”

He highlighted that having al the data in one place and using predictive analytics makes it much easier to permanently solve the root cause of errors, such as being able to identify that trades always fail with one counterparty because the settlement reference data is incorrect.

The survey also found that more than half of firms expect to increase automation including standard settlement instructions, corporate action processing, and partial settlement/partial release implementation. Carpenter said: “Early adopters will benefit.”

“The good news is that investments into automation are growing, with over a third of respondents’ T+1 project activity now focused on platforms investments across the entire trade cycle,” added Euroclear.

Adair stressed that participants cannot just automate, but need to ensure they are solving the right pain points, especially if they want to use the technology to eventually move to same day settlement, or T0.

Costs and benefits

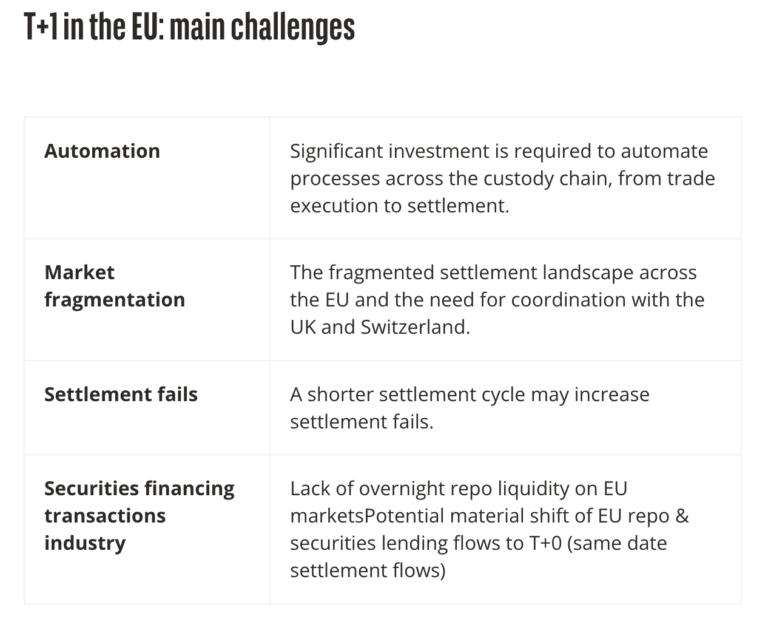

Euroclear said in a blog that while long-term benefits are expected from T+1, the main concerns are around higher operational costs during the first year and increased risks and costs from potential trade fails.

“Many of these short-term costs – such as upfront investments in automation – will deliver lasting benefits by improving efficiency,” added Euroclear. “Likewise, short-term risks will diminish as T+1 quickly becomes business as usual.”

BNP Paribas said in a blog that the reduction of the settlement cycle is expected to result in a significant reduction of margin requirements being held at central counterparties, and associated an increase of capital liquidity in the impacted markets. In addition BNP Paribas expects a reduction of counterparty risk exposure, and an increase of automation and standardisation across the post-trade landscape.

“The alignment of the EU, UK and Swiss markets with industry standards is set to enhance global investors’ perception of the competitiveness of European markets,” added BNP Paribas. “The move to T+1 may also prove to be a catalyst for private initiatives and is meant to promote market integration and ultimately, the Savings and Investments Union (SIU) objectives.”

The French bank highlighted that funding on the settlement date becomes more acute with a tighter settlement window.

“The need for counterparties may experience a higher demand for cash or repo financing to cover their positions,” added BNP Paribas. “It is therefore prudent to examine existing liquidity buffers, explore repo and securities financing facilities, and, where appropriate, consolidate cash pools across legal entities.”

Foreign exchange clients should also be aware of the pressure on sourcing FX to support settlement and consider internal processes or existing market solutions to meet their needs, according to BNP Paribas.

DTCC, the U.S. post-trade infrastructure, said in a blog in November that alignment across Europe is critical to novice the shift to T+1. Industry participants recently took part in a discussion of the challenges and opportunities of moving to a T+1 settlement cycle across Europe.

Andrew Douglas, co-chair of the UK T+1 Taskforce, said at the event: “You should be getting budgetary approval to do the work that needs to be done in 2026, to be ready to start testing in 2027.”

There is a proposal to make testing available from January 2027, and the UK and the EU are working closely together to provide a common test plan, as much as possible according to the DTCC.

UK T+1

Douglas highlighted that if firms settle late in the UK after T+1, they will be fined and that other people will stop wanting to work with firms who settle late.

Nearly all, 95%, of firms are preparing for the UK’s shift to T+1 settlement, with 60% of firms set to hit key 2026 confirmation deadlines, according to a UK T+1 Pulse Survey from The ValueExchange, led by the UK Accelerated Settlement Taskforce.

The UK’s Accelerated Settlement Taskforce has set transition milestones, including mandatory T+0 allocations and confirmations by December 2026 and full compliance with T+1 settlement by 11 October 2027.

However, the survey also found that less than one-third of firms believe their service providers will be ready to support key requirements for T+1, with investors being the least confident. Dependencies on clients, custodians, and CSDs are cited as barriers to readiness.

“62% of firms expect to implement T+1 for under $500k, while 4% will spend more than $5 million, but cost underestimation remains a risk for complex operations,” said the survey.