Euronext, the European capital market infrastructure, is entering the fixed income derivatives market via the retail segment, and has launched a retail educational program in five countries, as it aims to become the region’s retail exchange for derivatives.

Charlotte Alliot, head of financial derivatives at Euronext, told Markets Media that the firm is entering fixed income through the retail door.

“The mini fixed income futures will allow us to build liquidity and we have attracted about seven retail brokers, including one in Italy, and private banks,” she added.

Euronext plans to launch the first mini futures cash-settled on European government bonds in September 2025. Euronext said in a statement that these contracts are designed to meet the needs of retail investors, but will also provide asset managers and private investors with the granularity required for hedging or taking exposure to government bonds.

“We aim to become the European retail exchange for derivatives,” said Alliot. “We have launched a retail educational program with brokers in five countries and host a podcast and webinars.”

In the first phase, fixed income futures contracts will be introduced on the Euronext Derivatives Milan market. The futures will focus on key European government bonds, including Italy’s 10-year and 30-year BTPs, France’s OAT, Germany’s Bund, and Spain’s Bono.

Eurex, the European derivatives exchange owned by Deutsche Börse Group, is also expanding in fixed income futures. In April this year Eurex said in a statement that it will start trading futures based on bonds issued by the European Union, Euro-EU Bond Futures, on 10 September 2025. The new contracts will have the same 6% coupon as Eurex’s fixed income futures in the same tenor (10-year Bund, OAT, BTP and Bono futures) as part of the firm’s ambition to become home of the Euro yield curve.

Alliot argued that Euronext owning MTS, its platform for institutional bond trading, and the retail-focused MOT bond market, makes the group a credible entrant into fixed income derivatives. By building on MTS, Euronext will take advantage of its active retail and algorithmic trading communities, to ensure a broad appeal and the utility of this offering.

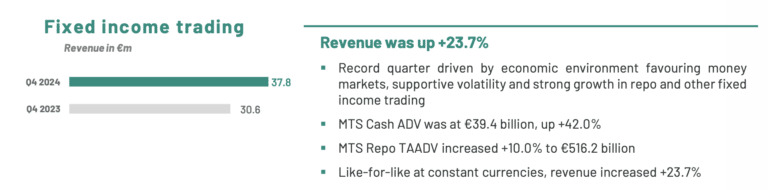

For full year 2024, Euronext’s fixed income trading revenue grew by 23.7% and reached a record €37.8, which the group said reflects record quarter volumes in MTS cash and repo, driven by an economic environment favouring money markets and supportive volatility.

The new fixed income derivatives will be traded on Optiq, Euronext’s proprietary trading platform, to provide easy access for all members.

Attia said: “This is our first step in fixed income and we have hopes that it will transform Euronext. After the launch of the first phase of futures, we will explore other ideas and look to expand the number of contracts.”

Euronext Clearing

Liquidity for the new contracts will be guaranteed through dedicated market makers, and trades will be cleared by Euronext Clearing.

In September 2024 Euronext completed the final phase of the expansion of Euronext Clearing to create its multi-asset class clearing house with the addition of the clearing of all Euronext financial derivatives markets. This marked the conclusion of the migration from London Stock Exchange Group’s LCH SA to Euronext Clearing and the end of the contractual relationship with LCH SA.

Anthony Attia, global head of derivatives & post-trade at Euronext, said on the fourth quarter 2024 results call that demand has been increasing for fixed income products due to the expansion of Euronext Clearing into all Euronext markets and into listed derivatives outside Italy, and its strong fixed income footprint in Europe.

“I’m talking about MTS, I’m talking about MOT, I’m talking about the assets under custody within Euronext securities,” he added. Attia argued that combined with Euronext’s strong retail and institutional network, this makes Euronext the natural partner for clients who want to diversify into the asset class.

The migration of clearing also marked the completion of the integration of the Borsa Italiana Group three years after it was acquired by Euronext. Since the acquisition Euronext has moved its core data centre from the UK to Italy, migrated Borsa Italiana cash and derivatives markets to Optiq and expanded the clearing activities of Euronext Clearing cash markets in November 2023 and commodity derivatives in July 2024.

“The completion of the migration to Euronext Clearing was an important step to allow clients to receive the benefits of offsets and opens up many doors to new products,” said Alliot. “We aim to extract as much value as possible from the integration.”

The value includes enhanced risk management through a value at risk (VaR)-based margin methodology, improved efficiency and reliability in risk capture and allocation, and the introduction of a unified equity and derivatives default fund to facilitate cross-margining. Clients can streamline their collateral management and access consolidated information on collateral, risk and clearing activities through a single platform, according to Euronext.

Another benefit is that Euronext can develop its own derivatives contracts and bring them to market more quickly as it has control of its own clearing house. Euronext now releases new derivatives every quarter, according to Alliot. For example, Euronext has introduced single stock options from Germany, Ireland and Portugal, and on 12 May 2025 it launched mini single stock options on French and Dutch underlyings

“Equity options volumes are 25% up since the start of the year but there is still a lot we can do to expand the suite,” Alliot added.