Euronext will launch dark, mid-point and sweep functionalities in the first quarter of this year after the pan-European exchange group operator opened the test environment for its new dark pool at the end of January 2024.

Stéphane Boujnah, chief executive and chairman of the managing board of Euronext, confirmed the launch in the full-year 2023 results call on 16 February. The new functionalities will allow participants to source liquidity in both dark and lit pools in Euronext’s central order book with no latency.

Nicolas Rivard, global head of cash equity and data services at Euronext, said on the results call that there is a significant increase of trading in dark pools at the expense of systematic internalisation in Europe, due to the regulatory uncertainty around the review of MiFID II.

Rivard said: “Our dark pool will be included in our data centre in Bergamo in Italy and provide customers with very simple and direct access to that functionality with absolutely no latency.”

The sweep functionality will move orders from the dark pool to the lit order book when required, and Rivard said this is appealing for clients to ensure they benefit from the best liquidity.

Clearing

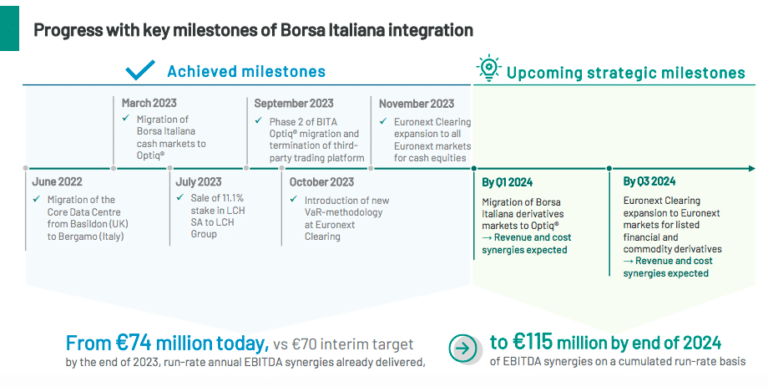

Boujnah said that last year Euronext Clearing was expanded to become a pan-European clearing house for clearing cash products.

Euronext Clearing expanded to Euronext Brussels cash markets on 6 November last year and to France, Ireland, Netherlands, and Portugal on 27 November 2023. As a result, the group now clears equities, ETFs, structured products, warrants, and bonds across six Euronext markets. For the first time, Euronext generated revenues for clearing cash instruments in the fourth quarter of last year.

“This new harmonised post-trade set-up allows clients to execute their entire trading lifecycle through Euronext,” he added.

In addition, Borsa Italiana’s derivatives are due to migrate to Optiq, Euronext’s proprietary technology platform, in the first quarter of this year. Boujnah said this paves the way for the expansion of Euronext Clearing activities to listed and commodity derivatives in the third quarter of this year.

“This will complete our presence on the entire trading value chain and will position Euronext ideally to capture future growth opportunities,” said Boujnah.

In 2023 Euronext also completed the second phase of the migration of the Italian cash market to Optiq, meaning all of the group’s seven exchanges are integrated on the same trading platform.

Fixed income

Fixed income trading reported record revenue at €107.4m last year, up 15.6% from 2022.

Giorgio Modica, chief financial officer at Euronext, said on the results call that average daily volume on MTS, the European bond trading platform, reached €27.7bn in the fourth quarter of 2023, an increase of nearly 80% year-on-year.

“The increase reflected continued market volatility as well as the contribution of MTS EU, the new market launched last November which contributed around €1bn of ADV,” Modica added.

Last year MTS EU was recognized as an interdealer platform for the implementation of electronic market making on European Union issued debt instruments. The European Commission’s NextGenerationEU program aims to issue about €750bn of new sovereign debt.

Boujnah added: “What is impressive is that we are making progress in the Europeanisation of MTS, which for years was trying to penetrate further into debt management beyond Italy and Spain. The platform is getting traction with one of the largest issuers on the continent, the European Commission.”

Analysts questioned whether the progress of MTS and Euronext Clearing would lead to Euronext developing derivatives that reference European bonds and Boujnah said this is part of the roadmap.

Financials

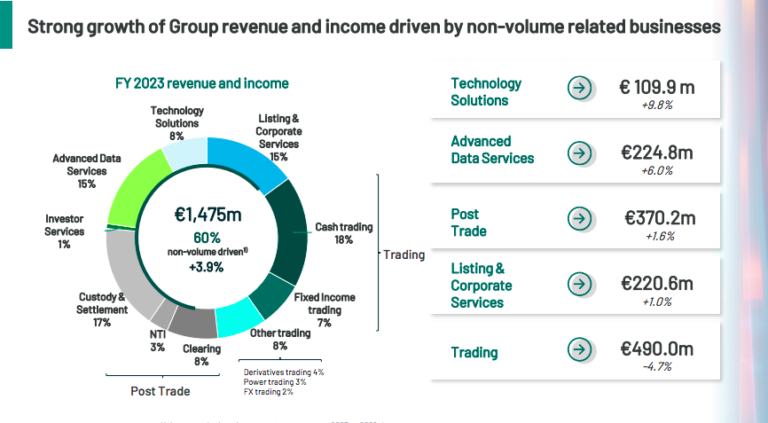

Boujnah said Euronext reached record revenue and income close to €1.5bn in 2023. Non-volume related revenue represented 60% of total revenue and income.

“Robust organic growth in our non-volume related businesses and double-digit growth in fixed income and power trading drove group revenue’s growth to 3.9%, despite negative FX impacts and the softer cash trading environment,” he added.

Boujnah highlighted that the trading franchise remained resilient despite the lower volatility environment for equities.

“While cash trading and derivatives trading volumes were down by over 10%, total trading revenues only decreased by 4.7%,” he added. “This is a demonstration of our more diversified business model.”

Euronext also made an €11.4m capital gain from selling a minority stake in Tokeny Solutions, which provides private markets securities issuers solutions to issue, manage and transfer tokenized securities on a public blockchain. In 2019 Euronext bought a 23.5% stake in the fintech.

Boujnah said: “We decided to sell because the allocation of capital to achieve the objective of being a positive influence in tokenisation was not optimised as a minority shareholder in this company.”

He continued that Euronext is also carrying out a full review on AI, across every cost centre and innovation centre to identify potential use cases that can accelerate the origination of new products, the penetration of new clients or significantly impact the cost base.

“2023 was a pivotal year for Euronext as our diversification journey is paying off and we are posting growth driven by non-volume and diversified activities,” added Boujnah.