In his first interview as manager of Liverpool football club, Jürgen Klopp said his aim was to change doubters into believers. Stéphane Boujnah has been on a similar journey since becoming chief executive officer and chairman of the managing board of Euronext, the European financial market infrastructure, in November 2015.

Boujnah told Markets Media: “The recipe for success is cost management, operational discipline, the willingness to have unpleasant conversations and to accept being lonely as a CEO. To be successful, you can’t afford to be the one that pleases everyone.”

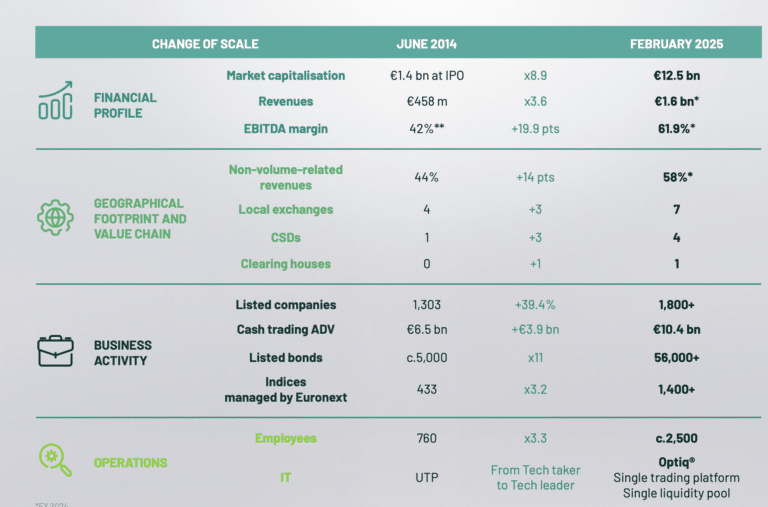

Over those ten years Euronext has diversified its top line away from equities, expanded into post-trade in order to service the full capital markets value chain, added new asset classes and entered new geographies through a series of strategic acquisitions.

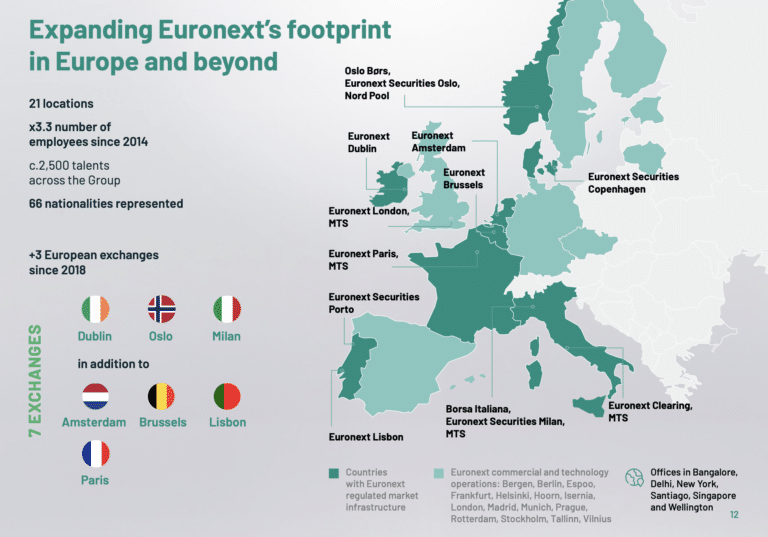

The group has grown from a cash equities-focused operator of four national exchanges to covering seven local markets, one clearing house, four central securities depositories, a fixed income trading platform and a power trading venue. The transformation was highlighted by Euronext joining the CAC 40, France’s blue-chip index, in September 2025.

Early years

Before joining Euronext Boujnah was head of continental Europe of Santander Global Banking and Markets. He describes his first years as CEO as very different from now as he mainly had to deal with” issues, problems and crises.”

“The previous CEO resigned six months after the initial public offering and my chief financial officer resigned six weeks before the first capital markets day,” he added.

Euronext had returned to being an independent company in June 2014 when it went public in a spin-off from Intercontinental Exchange. In 2007 the New York Stock Exchange had acquired Euronext to create the first transatlantic stock and derivatives exchange. However, when ICE subsequently acquired NYSE Euronext in 2013, the European equities business was seen as surplus to requirements.

“When ICE carved out the European equities business, European stock exchanges were seen as museums,” added Boujnah. “The first focus was on survival as the capital market infrastructure landscape in Europe was being derailed by the potential deal between London Stock Exchange and Deutsche Borse.”

Diversifying revenue

In 2014 nearly half, 48%, of Euronext’s total annual revenue of €458m was related to trading according to the firm. Boujnah said it was critical for Euronext to become more profitable as 65% of volume was related to equities trading. He added: “This required rebuilding and one of the most important factors was for the management team and the people to have pride in the project.”

In contrast, Euronext reported total revenue for the third quarter of this year which was nearly as high as for the whole of 2014 at €438.1m, but the majority, 60%, was non-volume related. On the results call Boujnah emphasised that this was Euronext’s sixth consecutive quarter of double-digit topline growth.

Euronext also reached a new record of €7.5 trillion in assets under custody in the third quarter of this year, driven by growth in equities and bonds. Boujnah said this reflected the strength and the growth of the post-trade business.

Volume-related business was fuelled by double-digit growth in fixed income and commodities trading and clearing according to Euronext. Boujnah added: “Euronext continues to record robust volumes and revenue capture in cash equity trading and clearing, driving revenue up 11.5% year-on-year.”

Acquisitions

This diversification has been accelerated through a series of strategic acquisitions. In 2014 the majority of Euronext’s revenue, 58%, came from France. In contrast this year, France is second behind Italy, one of the geographies added to the group since 2014 alongside Denmark, Ireland and Norway.

“Euronext’s federal model had originally been envisaged as open-ended,” said Boujnah. “This model for European integration was critical for our survival and allowed us to become a serial acquirer.”

Boujnah highlighted the acquisition of Oslo Bors in 2019.

“A defining moment was when we punched above our weight to buy Oslo Bors against Nasdaq as nobody thought we would make it,” he added. “We had instilled a culture of survivors and fighters.”

The acquisition of Borsa Italiana Group from London Stock Exchange Group in 2021 was transformative as it allowed Euronext to accelerate geographic diversification, accelerate horizontal diversification with new asset classes such as fixed income through bond trading platform MTS, and accelerate vertical diversification by adding clearing.

Euronext offered the same price as Germany’s Deutsche Börse for Borsa Italiana according to Boujnah. On the first call about the deal, Boujnah said he told David Schwimmer, chief executive of LSEG, that Euronext could offer superior certainty of execution and partnership with Italian stakeholders through its federal model.

“We had prepared for years to buy Borsa Italiana which we regarded as a ‘must have’,” he added. “We had to fix clearing as we were the only important European exchange without our own CCP.”

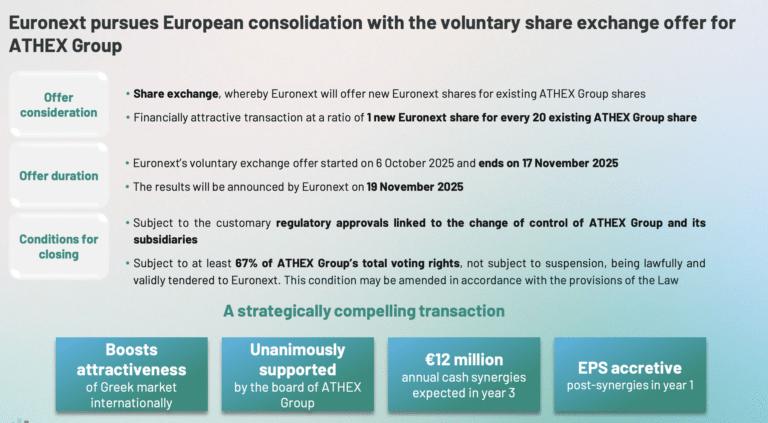

ATHEX acquisition

Euronext is in the process of adding another local market to its federal model. On November 13 2025 Greek regulators approved Euronext’s offer to buy ATHEX Group, the operator of the Greek capital market.

“Our offer for ATHEX Group is a step towards consolidation of European market infrastructure to support European listings and economic growth and create an even deeper liquidity pool in Europe,” added Boujnah. “This transaction is clearly a sign of confidence in the recovery of the Greek economy.”

Euronext expects to deliver €12m of annual cash synergies by the end of 2028 from the integration of ATHEX into its European market infrastructure, single liquidity pool, single order book and single technology platform.

The offer is open until 17 November 2025 and Boujnah said Euronext does not intend to change the price of the offer. Euronext will communicate the results of its tender offer on 19 November 2025.

European consolidation

In October this year German Chancellor Friedrich Merz called for the establishment of a single European stock exchange so that companies can access financing in the region, without having to list in the U.S.

Boujnah welcomed Merz’s comments, which echoed the aspirations of Christine Lagarde, president of the European Central Bank. He added: “We share that vision and we are available to contribute to the next phase of potential consolidation within Europe.”

He argued that Euronext provides a solution to fragmentation in Europe with a single liquidity pool, a single technology platform and in post-trade, through the convergence of its central securities depositories (CSDs), which is slated for September 2026. Euronext has announced the consolidation of the settlement of equity trades and ETFs in its Amsterdam, Brussels, and Paris markets under Euronext Securities. These markets will join those already supported by Euronext Securities in Lisbon, Milan and Oslo.

“The total market capitalization of companies on our integrated European exchange is €6.5 trillion, which is twice the one of companies listed on LSE and more than three times the one of companies listed on Deutsche Börse,” he said.

Euronext could offer both LSEG and Deutsche Borse a structure to let their listing and equity businesses join the Euronext model, and have a stake in Euronext as a counterpart, to ensure federal governance according to Boujnah.

He added: “Airbus became a global competitor to Boeing and shows we can succeed by pulling together.”

Airbus was formed as a consortium of European aerospace companies from France, West Germany, Great Britain and Spain in 1970 to compete with American-built airliners.

Future growth

On the third quarter results call Boujnah described Euronext as being at a “cornerstone moment” for the group in terms of industrial developments as all its teams are fully engaged to deliver the “ambitious” targets of the Innovate for Growth 2027 strategic plan.

The group recently launched the first fully integrated European marketplace for ETFs which it said will provide substantial efficiency gains for the entire value chain. In order to boost retail participation, Euronext has introduced the first mini cash-settled futures on main European government bonds, which Boujnah said have been trading from day one.

“In order to maintain our growth dynamic, we need to avoid the Kodak moment and stay relevant, while not burning cash on too many buzz-word driven innovations,” said Boujnah.

He argued that new technology has to be transformative and “allow you to eat your competitors’ lunch.” For him, this could be quantum computing.

Boujnah expects to leave Euronext in May 2027 at the end of his contract. He said: “I think I would like to do another job that makes me continue to feel alive, transform things and have a tangible impact.”