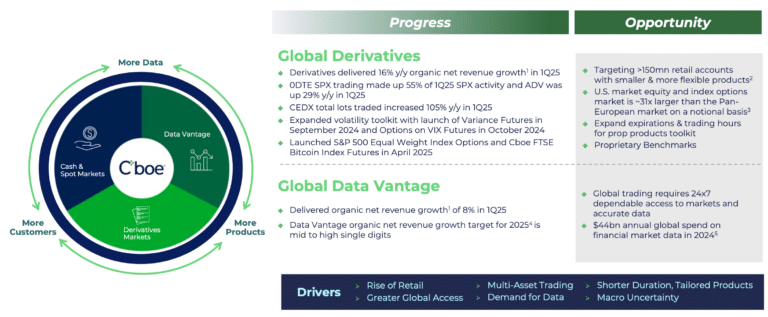

Cboe Global Markets believes that options markets in Europe are on the cusp of change as CEDX, its pan-European derivatives market, aims to make the region’s options mainstream on the global stage.

Iouri Saroukhanov, head of European derivatives at Cboe Global Markets oversees Cboe Europe Derivatives, and told Markets Media that the geopolitical scene is changing. There is more interest globally towards the European capital markets and the European Commission is helping to fuel that excitement though the Savings and Investments Union (SIU) initiative.

Saroukhanov said: “At CEDX, we want to make European options mainstream on the global stage, in the same way that Cboe made SPX options mainstream. The story for CEDX is about the growth of European derivatives markets overall, rather than taking market share, as a rising tide lifts all boats.”

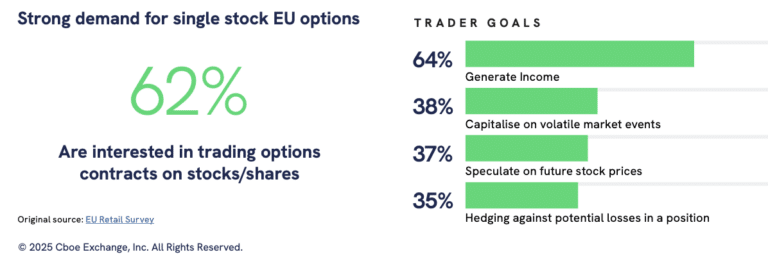

Cboe is looking at this as a long-term initiative, and five-year time periods as it builds out its strategies. One of these strategies is to increase retail participation to propel European options, as has happened in the U.S.

In a white paper published in June 2025, Cboe described European options market as “notably stunted.” Retail investors in the region have traditionally used contracts for difference, warrants/turbos, and structured products/certificates) which Cboe described as having potentially higher costs and risk profiles.

“Beyond the direct utility of equity options to investors, well-functioning exchange-traded derivatives (ETDs) markets facilitate efficient price discovery and liquidity provision in underlying markets, and the central clearing of ETDs reduces counterparty credit risk and, in turn, systemic risk,” added the white paper. “Robust derivatives markets are also necessary to support the green transition and key to developing an investing culture.”

Saroukhanov continued that Cboe’s message is that options should very much be part of the EU’s Savings and Investment Union initiative, and that if the bloc wants to attract money towards the capital market it needs to give investors the tools to make that money efficient.

“Regulators can help by looking at the various product wrappers and looking at the economic exposure of contracts, such as warrants and options,” he added. “If that exposure is similar, then access should be similar.”

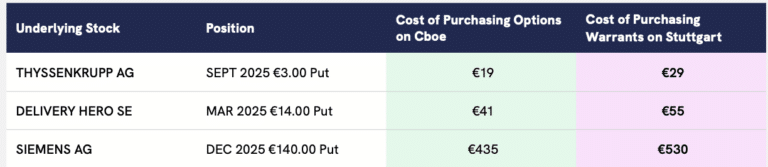

In addition, the pricing of warrants compared to equivalent exchange-traded derivatives shows that the end-client is worse off, according to Saroukhanov.

Market structure

The white paper highlighted that CFDs, warrants, and structured products are significantly more diffuse and fragmented than ETDs and are not in a position to serve pan-European integration. Therefore, Cboe is encouraging policymakers to consider whether market structure reforms may be beneficial for single stock options.

For example, unlike equities, single stock options in Europe are not fungible across exchanges or clearing houses – a single stock option position cannot be opened on one exchange and closed on a different exchange even when the underlying stock is the same, which impacts the ability to create pan-European pool of liquidity.

“Fungibility could be achieved if policymakers reevaluated open access requirements for the clearing of single stock options and harmonised the contracts and legal framework applicable to single stock option contracts traded on different exchanges,” added Cboe.

Cboe also encourages policymakers to consider encouraging cross-margin agreements between EU CCPs clearing derivatives, which helps reduce margin for certain market participants, and to continue to evaluate capital requirements for market-makers and banks.

“The ability of market-makers to provide liquidity to European markets and the ability of banks to provide client-clearing services is greatly impacted by regulatory capital requirements applicable to those entities, and European markets cannot flourish without these services,” added the white paper. “Moreover, the systemic benefits of a diverse ecosystem of market participants cannot be overstated.”

Saroukhanov also highlighted that one of the pain points in Europe for single stock options is that over 70% of liquidity can be off screen, dissuading potential new entrants.

“Market structure changes are needed to get more liquidity on screen,” he added. “Interoperability in the derivatives market, open access and fungibility of equity options would go a long way to help.”

In addition, he said Esma needs to raise the minimum thresholds for block sizes to attract more flow towards the screen. This builds more confidence amongst participants on executing orders and they will start to tighten prices.

“If spreads start tightening, this becomes a global shop window to get participants more excited about the European derivatives model,” said Saroukhanov.

Education

In addition to market structure changes, education is also needed to encourage retail investors into European options.

“Europe does not have the culture of buying insurance on investment portfolios – which is an important use case of options,” added Saroukhanov.

Cboe is attempting to change this culture by expanding the reach of The Options Institute, the group’s education arm, into Europe and by working with retail brokers to provide education in different European languages. For example, Cboe is currently partnering with Interactive Brokers on a multi-language education programme in Europe and working closely with the broker on finding ways to make options more accessible through their multiple models and partnerships.

Saroukhanov said: “We are seeing the green shoots of European derivatives becoming more mainstream on the global stage with, for example, U.S broker Robinhood expanding into the UK to provide access to U.S. options.”

A Cboe survey found that over 70% of retail investors had exposure to stocks from the country of their origin, so Saroukhanov believes brokers expanding into Europe will ultimately need to offer access to the wider region as well.

“CEDX offers a single access point for pan-European exposure, so we can give brokers an opportunity to expand in a cost effective manner across the region,” he said. “We believe retail clients should have access to free data, so we provide that as well.”