The European Union should develop a savings and investments union to unlock €33 trillion in private savings which is predominantly held in currency and deposits, according to Enrico Letta, president of the Jacques Delors Institute and former Italian prime minister.

Letta compiled a report, Much More Than a Market, at the request of European leaders. The study was published in April 2024 and Letta took part in a round table with the Investment Company Institute on 23 April hosted by Eric Pan, president and chief executive of the ICI in Washington DC.

He highlighted that the report was the result of more than 400 meetings held in 65 European cities and proposes strategies to modernise the European Single Market, which launched in 1985 when both the EU and the world were smaller, simpler, and less integrated. Three areas – financial services, energy, and electronic communications – were left out of the original single market and Letta said they need to be addressed in the next European five-year legislature, following elections in June this year.

The EU launched the Capital Market Union in 2015 to integrate financial markets but Letta said it was not successful in achieving concrete and tangible results, mainly due to the lack of a strong political voice to mobilise action.

“The three leftovers are the main problem in terms of competitiveness, and among these the most important one, in my view, is capital markets,” Letta added.

Letta recommended developing a savings and investments union in the framework of the single market as the EU’s share in global capital market activities, including equity issuance, total market capitalisation, and corporate bond issuance, does not align proportionately with its gross domestic product.

“The European Union is home to a staggering €33 trillion in private savings, predominantly held in current accounts (34.1%),” said the report. “This wealth, however, is not being fully leveraged to meet the EU’s strategic needs; a concerning trend is the annual diversion of European resources towards the American economy and US asset managers.”

The report also said the EU should facilitate the creation of an EU Deep Tech Stock Exchange with specific rules and supervision for pension funds and large asset management firms, who can take high risk and wait for long term return.

Letta was asked if there was a “home bias” in the European Union, in the sense that assets invested by Europeans ought to be invested into European markets, while ICI members focus on maximising returns for underlying shareholders.

He answered: “My point is that we need to create a bridge between the European savings and some missions, which needs fiscal incentives. Now is the time for the US and Europe to start to try to create a transatlantic single market with what is happening today with Russia, with China and the aggressive attitude towards the common US/EU vision of the world.”

One attendee suggested that one of the implications of a transatlantic single market is that European companies will choose to list in the US and large US financial institutions will become the largest service providers to European investors and savers.

“In reality, that is what is happening today due to the weakness of the European financial markets,” said Letta. “The only way to make European financial markets attractive is to make them integrated and that is not the case today.”

He argued that European companies prefer to list in the US, on NYSE or Nasdaq, while there are 27 exchanges in the European Union which fragment liquidity. For example, Nasdaq alone is as big as all the European stock exchanges put together. However, it is a political challenge for national governments to allow the consolidation of their national exchanges.

“I am strongly in favour of mergers to try to help this consolidation process,” said Letta.

In order to allow consolidation, Letta said competition authorities may need to consider applying competition rules to larger relevant markets, but admitted this was a controversial and complicated issue.

Letta’s report highlighted the scope to integrate clearing and settlement. There are 18 clearing and 21 settlement markets in the EU, mainly owned by national stock exchanges, against one company for each of the two markets in the US, mutually-owned by the Depository Trust and Clearing Corporation (DTCC). Post-trade barriers between countries in Europe were identified in the two Giovannini reports in 2001 and 2003 but still continue to pose significant obstacles to cross-border investing and capital raising.

“It is crucial to better harmonise differences in rules and practices pertaining to withholding and transaction taxes, the cross-border exercise of shareholder rights such as participation in general meetings, effective shareholder identification by issuers, and market insolvency procedures,” said the report.

Investors

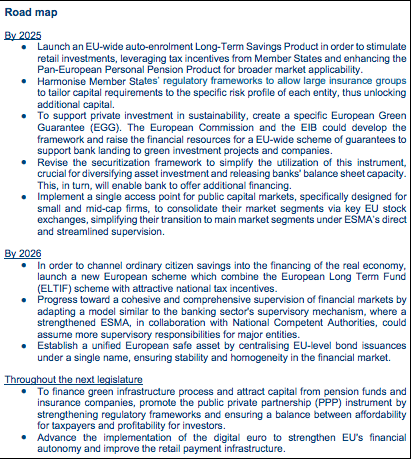

Letta’s report also highlighted that European institutional investors, and particularly pension funds, are much smaller and play a lesser role than in other advanced economies due to national fragmentation of welfare systems and pension schemes. He proposed creating an auto-enrolment EU long-term savings product.

In addition, insurance companies in the euro area hold substantially more assets than pension funds, so Letta said policies to help allocate savings towards their most productive use must therefore take a broader approach. For example, increasing the coherence between EU member states’ frameworks for approving internal models to calculate capital requirements for large insurance groups could help unlock more capital.