Phil Gillespie, co-chief executive of B2C2, said the crypto liquidity provider’s execution of a bitcoin non-deliverable forward is a “monumental step” in allowing investment banks to increase their presence in crypto.

B2C2 executed a crypto NDF with QCP Capital, a Singapore-based digital asset trading firm.

Gillespie told Markets Media: “I want to emphasise the significance of what has happened. This is a huge step in getting the banks comfortable with the crypto ecosystem which is one of the things that has been missing for the last few years.”

NDFs are derivatives that are used to hedge or speculate against currencies where exchange controls make it difficult for overseas investors to make a physical cash settlement, for example, the Chinese renminbi. Traditional banks do not use spot crypto due to challenges such as compliance and risk, so NDFs give them exposure to the spot market without having to take physical custody of the cryptocurrency.

B2C2’s executed NDF had a bitcoin underlying and was denominated in US dollars. The reference rate used for the crypto derivative was the CME CF Bitcoin Reference Rate (BRR), with a maturity date of November 19 2021.

Darius Sit, co-founder of QCP Capital, said in a statement: “QCP views NDFs as a gateway to crypto markets for traditional financial institutions, such as investment banks, that are currently unable to handle the underlying assets. We are delighted to participate in this innovative product alongside B2C2, opening up a new crypto derivatives market.”

A recent survey from Coalition Greenwich agreed that NDFs could be an effective way for institutional investors to use crypto products within their existing regulatory and compliance frameworks. The consultancy said in a report that NDFs are relatively easy to manage because of their over-the-counter nature, flexible 24 hours a day access and the ability for contracts to expire on bespoke days.

*New* Cryptocurrencies: The Road Ahead May Not Be Cryptic Anymore https://t.co/UiUNLQdIoC via @CoalitionGrnwch by #SubodhKarnik, @davidstryker

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) November 2, 2021

Gillespie continued that banks could not previously find authorised counterparties to provide crypto liquidity and facilitate their trades. He has experience of investment banks as he joined B2C2 in 2018 from Goldman Sachs where he had been a systematic market making trader.

B2C2 was founded in 2015 and and provides 24/7 electronic execution in the major cryptocurrencies and fiat currency pairs, and the firm said it has traded hundreds of billions in notional since launching. The B2C2 OTC Ltd. platform was authorised by the UK’s Financial Conduct Authority in 2019 to arrange and deal in contracts for difference (CFDs) with eligible counterparties and professional clients. Last year B2C2 was acquired by Japan’s SBI Financial Services, which Gillespie said is an important differentiator.

“One thing that really separates us is that we’re owned by a listed financial institution,” said Gillespie. “We will be visiting banks in London with an SBI director to explain they can trade bitcoin NDFs through a counterparty they have known for years and that they already have a relationship with.”

Adam Farthing, chief risk officer at B2C2 Japan, told Markets Media that NDFs allow banks to perfectly offset cash flows on bespoke dates, which is really useful for hedging and arbitraging against futures and options that settle or expire on specific dates. In October this year B2C2 launched bitcoin and ether OTC vanilla options with bespoke expiry dates and strikes to institutional counterparts.

We are happy to announce that we traded our first #crypto #NDF yesterday.

NDFs enable banks to get price exposure to crypto without touching the underlying product.

It also allows native crypto traders to perfectly match expiry dates of other futures & options positions.

— Phillip Gillespie (@PhillipGilles13) November 11, 2021

Chris Dick, senior trader at B2C2 said the firm is going to offer ethereum NDFs immediately, and is willing to launch the product in other cryptocurrencies once there is sufficient demand.

Cryptocurrencies are highly volatile but Gillespie said the firm manages its risk in a similar fashion to investment banks.

“We are market risk neutral so we don’t take directional risks,” said Gillespie. “We excel in the volatility and we’ve done very well without any major issues for the last four or five years.”

Crypto ecosystem

Gillespie believes that the crypto market will develop in a similar fashion to foreign exchange, which is largely bilateral.

“The FX market is OTC-driven and we are in a strong position because we specialize in OTC trading,” he added. “We’re one of the largest, if not the largest, OTC liquidity provider in crypto.”

As a result, he expects crypto exchanges to become less dominant.

“I think the transition from tech-oriented to more financial-oriented firms is already happening,” he added. “It’s going to accelerate from crypto exchanges to OTC which will be the big momentum for the next five to 10 years.”

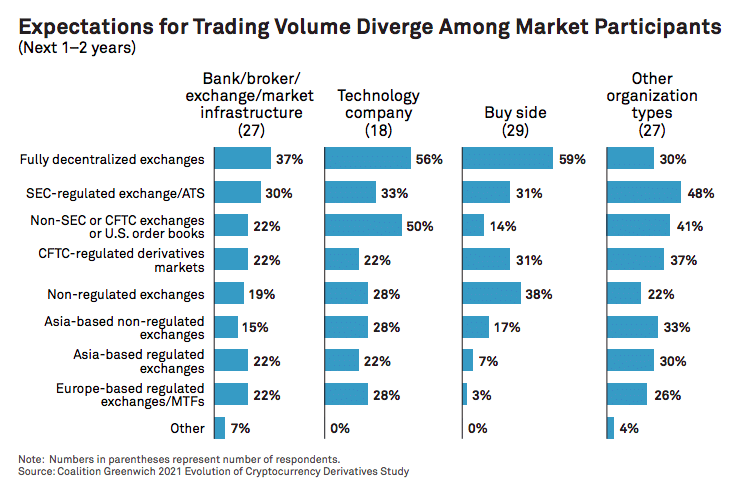

However, the Coalition Greenwich survey found that one of the challenges to wider NDF adoption is participants’ preference for transacting crypto on central limit order books and exchanges.

Banks and brokers in the survey expect a third of crypto volume in the coming years to be executed on fully decentralized exchanges, while the buy side thinks under 15% will be handled by non-SEC/CFTC venues. In contrast, fintechs expect about half the volume to go through that channel.

Coalition Greenwich expects a move to multilateral venues or an aggregated central limit order book before bilateral trading takes off. The consultancy believes that first movers in providing platforms will gain significant advantage.

Another reason for the growth in OC trading in crypto is the increase in institutional participation.

Dick said: “The recent rally in bitcoin has not been as retail-driven as the 2017 rally, which shows that institutional players that are impacting the market and we can see that in our flows.”