At Deutsche Börse’s capital markets day in London on 10 October 2025, senior managers spoke about the group’s new strategy, “Leading the Transformation.” Chief executive Stephan Leithner said he wanted to explain how to take Deutsche Börse forward beyond its current Horizon 2026 strategy, which was launched in 2023.

Leithner took on his current role on 1 October 2024 and initially led Deutsche Börse as co-CEO with his predecessor Theodor Weimer until the end of last year when Weimer’s contract expired. Previously, Leithner had been a member of the executive board of Deutsche Börse since 2018, responsible for pre- & post-trading and including the Investment Management Solutions division and Clearstream, the post-trade infrastructure.

“It’s been a tremendous first 12 months of transition,” Leithner said. “A new picture has emerged that is much clearer.”

The group sees opportunities as the pension and retail wave has fundamentally changed in Europe, especially as young people have changed their investment patterns. In addition, there are structural inflows into the region, increased debt issuance, a desire for autonomy in sectors such as defence, as well as the European Union’s Savings and Investment Union which aims to increase participation in capital markets.

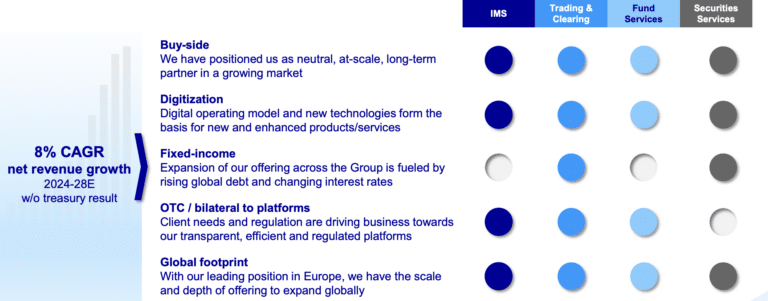

Deutsche Börse’s business is divided into four divisions – investment management solutions; trading & clearing; fund services and securities services. Leithner argued that the portfolio mix offers commonality in what Deutsche Börse can offer to clients, as well as synergies across the breadth of its businesses. He added: “Fund services is a true pearl in our portfolio.”

Leithner expects the portfolio to drive an 8% net revenue growth for the group until 2028 as Deutsche Börse leads on transformational changes in the industry, including growth in Europe and the development of new asset classes.

“If you look across that portfolio, it is much more balanced than in the past,” he added. “Investment management solutions (IMS) has opened a totally new environment in the client footprint and formed a unique anchor for the buyside.”

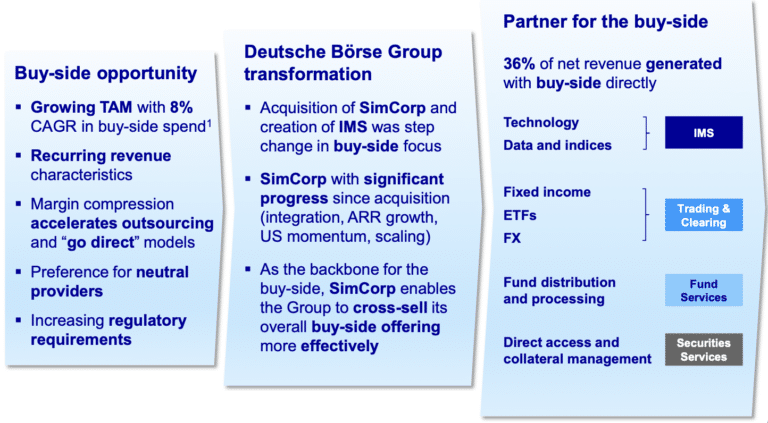

Buy side

Investment Management Solutions consists of SimCorp, which provides technology for the buy side and ISS STOXX, the index and shareholder advisory business. The unit provides end-to-end investment solutions and high-quality data, which intends to address the evolving needs of the buy-side.

Leithner continued that the importance of the buy side has increased for market infrastructure as the sector is growing faster than the sell side, but asset managers are looking for solutions to margin compression. To combat margin pressures, fund managers are accelerating outsourcing by connecting directly to market infrastructures and are also looking for a neutral provider, according to Leithner.

“We are the solution as a partner for for buy side,” he said. “The creation of IMS has given us proximity and strategic dialogues with the buy side, which Deutsche Börse has not historically had and we have started to monetize that.”

Approximately one third, 36%, of net group revenue is generated directly with the buy side, and that is expected to grow.

Christian Kromann, previously chief executive of SimCorp, was appointed to lead IMS from the beginning of this year. Kromann said there are approximately €45 trillion of assets running on the Simcorp platform from about 800 clients but there is still room for growth, especially in the U.S.

“The key performance indicator for Simcorp has always been moving all our clients to a software-as-a- service delivery model,” Kromann added. “We are now reaching the 50% point, which was always an important trigger for our economic model.”

In addition, between €100bn and €80bn of ETF assets under management track Stoxx indices and ISS Stoxx has more than 5,000 clients.

“We underpin every single investment strategy, whether it’s active or passive, “ Kromann said.

In alternatives, Kromann said 70% of clients already host their alternatives and private assets on Simcorp. In September this year SimCorp launched SimCorp Alternatives to serve the needs of all alternative investment firms and acquired the cloud native, alternative investment software provider Domos FS. The acquisition increased alternative investment assets managed on SimCorp’s platform to over €6 trillion

Leithner added: “The integration of alternative assets that is happening around Simcorp is very important. On the fund side, it’s going to be one of the main drivers of positive high margin opportunities.”

In order to add further capabilities for the buy side, Deutsche Börse confirmed in November this year that it is in exclusive discussions for a possible acquisition of Allfunds, which provides fund services. Leithner said: “Allfunds is a very exciting company that has a strategic commercial and financial fit that is just very compelling, and is complementary from a pan -European and global footprint perspective.”

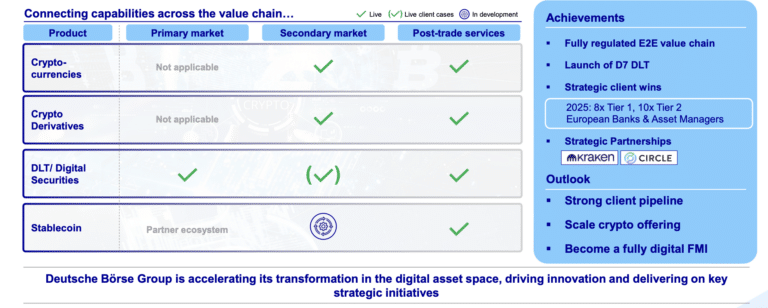

New asset classes

In addition to providing more services to the buy side, another fundamental acceleration for the strategy is new asset classes including crypto and digital assets.

Leithner said Deutsche Börse has made “enormous progress” in digital assets and has a hybrid offering.

Stephanie Eckermann, member of the executive board at Deutsche Börse, said at the capital markets day that Deutsche Börse has a two-fold strategy for digital assets. Clearstream will play a role in settlement, while the group has digital securities platforms as part of its roadmap to digitize the full life cycle of securities and funds.

“Our ambition is to digitize our central securities depository and put the €2 trillion of securities we hold onchain,” she added. “We see ourselves as a bridge between the old traditional world and the new world where we see a huge demand for the tokenization of real world assets.”

Deutsche Börse is “very, very” focused on technology with approximately three quarters, 74%, of the group’s commuting capacity in the cloud according to Leithner. As a result, the group sees AI as an opportunity, rather than a threat.

“A key change in our approach has been that we have achieved platforms with the move into the cloud,” he said: “The cloud allows us to be more aggressive, more extensive, more complete, and provide for quality and speed.”

Financials

Jens Schulte, chief financial officer, confirmed at the capital markets day that the group is committed to meeting its 2026 targets, including €6.4bn in net revenues next year.

The group expects a compound annual growth rate in net revenue without treasury result of 8% to €6.5bn by 2028, with only a 3% compound annual growth rate in costs.

“We therefore expect an average annual increase in our EBITDA without treasury result of 12% by 2028,” added Schulte.

The dividend payout ratio is targeted at between 30% and 40% with a continuously increasing dividend per share. Deutsche Börse intends to complement its dividend with regular annual share buybacks, with volumes subject to the expected excess liquidity. The executive board has resolved to implement a share buyback program of €500m in 2026.

Organic growth driven by secular trends will be the highest capital allocation priority, while the group expects mergers to continue if strategically and financially attractive to complement organic growth.

Leithner said he expects consolidation in Europe as the continent is too fragmented when it comes to capital market infrastructure.