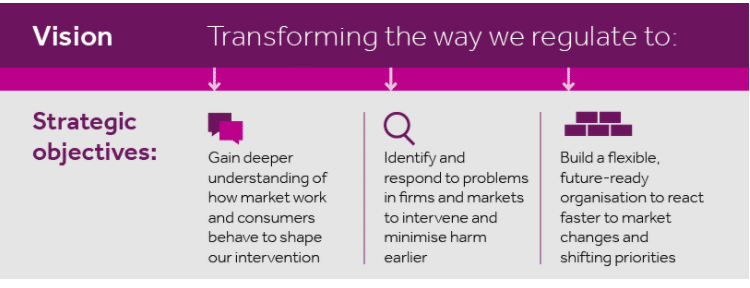

The Financial Conduct Authority, the UK regulator, is halfway through its strategy of using new technology, data and analysis to improve its efficiency and effectiveness.

Steven Green, head of central data services, innovation, strategy and competition division at the FCA, gave a presentation at the TSAMDigital conference yesterday.

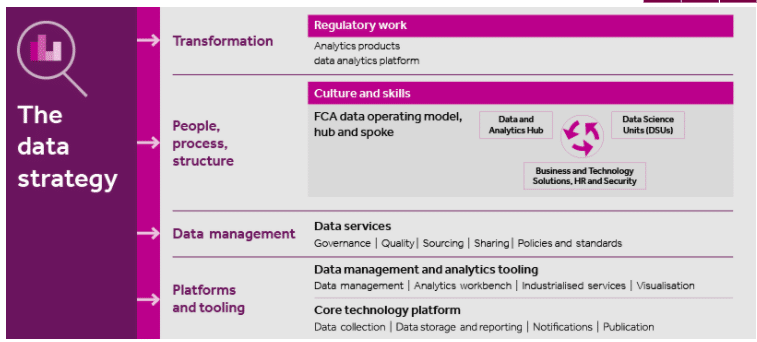

The FCA first published a data strategy in 2013 which was focused on the collection and management of data. However, the regulator realised it needed to use data more effectively to identify outliers amongst the firms it oversees and target interventions more effectively.

“The techniques from five years ago are not sufficient,” said Green. “We now regulate 62,000 firms and it has become harder to identify more complex patterns, especially amongst such large amounts of data.”

The FCA formed an advanced analytics team three years ago and has run a series of pilots and workshops.

“We need to change the way we work and we are in the middle of that strategy,” Green said. “We are looking at expanding the use of data across the depth and breadth of our activities so we can manage our mission more efficiently, react more quickly and adapt to future so we can pivot at speed.”

To become more flexible, the FCA expects to move to the cloud next year and increase its data sources.

“We have announced a plan to move to a new platform for our data collection systems, which will replace Gabriel,” added Green. “We have also created a new data lake and we are looking to publish more data and insights that we can share with the market.”

The FCA is using tools such as web scraping, network analytics and natural language processing to identify outliers and improving intelligence gathering by gathering data from more sources including social media.

“We are looking at how we innovate externally,”added Green. “We tested digital regulatory reporting with six firms and we will open testing to the new data collection platform to external firms.”