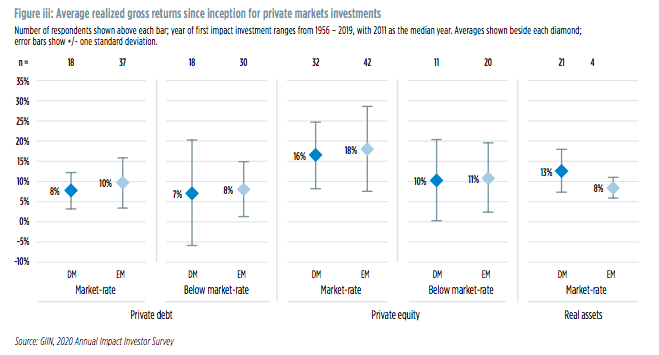

Almost all impact investors said they have met or exceeded their financial expectation and two-thirds seek risk-adjusted, market-rate returns for their assets.

The Global Impact Investing Network this month released the tenth edition of its flagship report, The 2020 Annual Impact Investor Survey. The report said 69% of respondents expect impact investing to grow steadily with 21% describing the market as ‘about to take off.’ No respondents said the the impact investing market was ‘declining.’

Last week, the GIIN launched the 10th edition of the Annual #ImpInv Survey! Learn more in the press release on @NextBillion here: https://t.co/S6BplggP3c Download the report here: https://t.co/ot6p6opDJu

— GIIN (@theGIIN) June 15, 2020

The report added: “70% of investors find the financial attractiveness of impact investing relative to other investment strategies at least somewhat important.”

There were 294 respondents managing a total of $404bn (€360m) of impact investing assets, more than half of the global market of $715bn. The growth of impact investing in the past decade is shown by the increase in the number of respondents from just 24 in 2010.

“Together with the fact that 88% of respondents report meeting or exceeding their financial expectations and over two–thirds of respondents (67%) seek risk-adjusted, market-rate returns for their assets, this finding may imply a shift from the increasingly outdated perception of an inherent tradeoff between impact and financial performance,” added the survey.

In contrast, a decade ago investors expected a tradeoff. Allocations have grown most quickly to the water, sanitation, and hygiene sectors.

One change in the past decade is that nearly all, 89%, of investors now use external systems, tools and frameworks for impact measurement and management. In contrast, ten years ago 85% of respondents used their own proprietary systems.

However, two-thirds of respondents expressed concerns about impact washing and one third about the market’s inability to demonstrate impact results. The study said half of the respondents indicated that impact measurement and management would be a significant challenge for impacting investing over the next five years.

“As the market matures, opportunity still exists for greater depth and refinement, especially for impact performance comparison and verification of results,” added the study.

Amit Bouri, co-founder and chief executive of the GIIN, said in a statement: “Over the past decade, we have seen incredible growth and increased sophistication in impact investing. Investment capital has an important role to play in driving positive impact for our communities and planet, and I believe we’ll see even greater possibilities for what impact investing can achieve, in this moment, as well as in the years ahead.”

Impact of Covid-19

Following the annual report, GIIN carried out a subsequent survey in April this year to gauge changes in response to the COVID-19 pandemic which received 122 responses.

The Response, Recovery, & Resilience Investment Coalition (#R3Coalition) – which is managed by the GIIN, working with a group of partner networks – has just launched its first issue brief on The #ImpInv Market in the #COVID19 Context! Learn more: https://t.co/AKX4enKC8N pic.twitter.com/9DHxYrSjwY

— GIIN (@theGIIN) June 18, 2020

A report this week said the majority, 57%, expect to maintain their 2020 investment plans and one fifth expected to change their target impact themes.

“Some investors expecting changes shared additional color on how their impact themes may evolve, highlighting emerging interest in Social Development Goal-aligned themes such as good health and wellbeing (SDG 3), quality education (SDG 4), and decent work and economic growth (SDG 8),” said the report.

The United Nations’ 17 Sustainable Development Goals address global challenges including poverty, inequality, climate change and environmental degradation and have set targets to be achieved by 2030.

COVID-19 has led to significant need for financing in financial services, food and agriculture, and healthcare and the report said impact investors most commonly seek to invest in these same sectors as part of their COVID-19 response.

“Deploying capital effectively in the current climate requires innovation and efficiency,” said the report. “Impact investors describe challenges constraining capital deployment, particularly related to due diligence (52%), limited resources – including capital availability (41%) and staff time (27%), and deal sourcing (29%).”