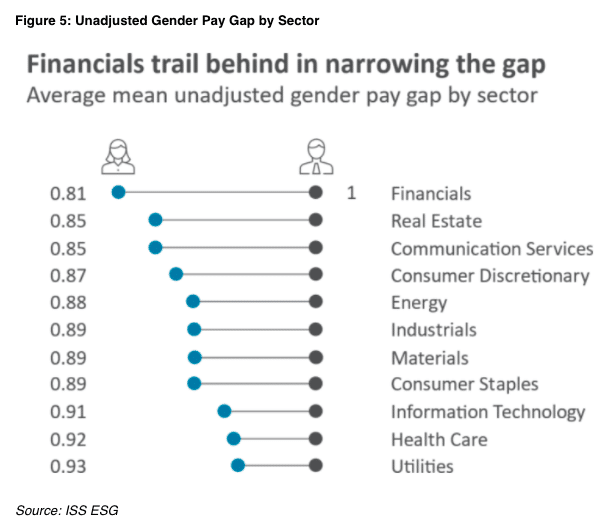

The finance sector is the worst performing sector in closing the pay gap between men and women although it calls for companies to improve female economic empowerment under their environmental, social and governance stewardship.

The topic of gender diversity has been talked about by the responsible investment sector for many years but outcomes in the real world are mixed at best according to a paper by Duncan Paterson, head of the ESG thought leadership program at ISS ESG, and Katharina Gallowski, associate vice president for research at ISS ESG.

Posted: Gender Pay Gap, https://t.co/gcHWkieWtG @issgovernance #corpgov #Diversity #Compensation

— Harvard Law School Program on Corporate Governance (@HarvardCorpGov) March 7, 2022

Paterson and Gallowski said research by the ISS ESG country rating team suggested that countries with a higher proportion of women in senior political roles tend to perform more strongly on ESG metrics. In addition, boards with at least two women outperform the average Russell 3000 returns over three, four, and five-years while male-dominated boards underperform the index over the same periods.

However, the majority of female employees are still earning less than men with half of the companies disclosing that women are earning between 2.6% and 21.1% less than men according to ISS ESG.

“There is perhaps some irony in the fact that while it will be the financials sector calling companies to account under the EU’s Sustainable Finance Disclosure Regulation (SFDR) and Principle Adverse Impacts (PAI) regulations for their performance in relation to women’s economic empowerment, the finance sector is itself the worst performer on this measure,” added Paterson and Gallowski .

Paterson and Gallowski said: “In 2022 responsible investors should prepare for a more outcomes-focused approach from regulators and stakeholders anxious to ensure that the real-world situation is improved for female employees.”

Female leadership

Sudhir Roc-Sennett, head of ESG at Vontobel Quality Growth, agreed that the male/female earnings gap is still sizable. He said women in the EU earn an average of $86 for each $100 by men, and $83 in the US.

“A large contributor to this gap is the ‘motherhood penalty,’ lost income mothers face due to seniority advances withheld, or to leaving altogether due to difficulties balancing their work environment with the needs of being a parent,” he added.

Roc-Sennett highlighted that last year the Fortune 500 had its highest number of women chief executives at 41. However he noted that executive leadership still fails to reflect the available female talent pool, let alone the workforce composition at large.

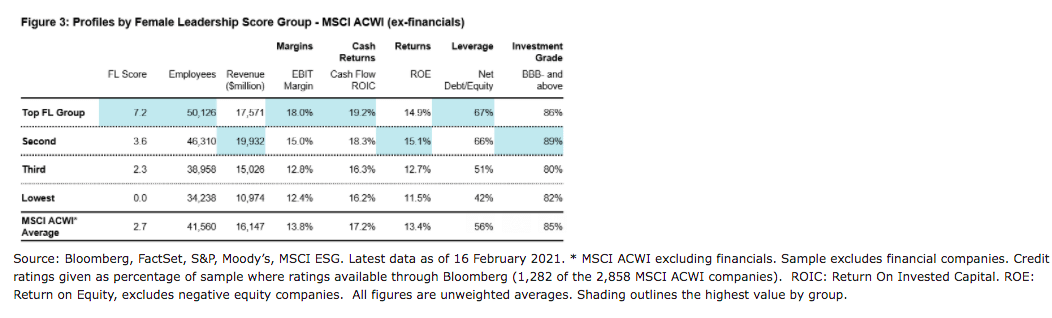

“For investors, there are significant risks when diversity is ignored both in terms of upside in missed potential and downside from the inefficient allocation of scarce resources,” he said. “The profile of companies under female leadership tend to have notably larger employee bases, manage higher margins and generate more cash flow from their investments than the market average.”

Last year the Fortune 500 had a record 41 women CEOs. Yet US women earned just $83 for each $100 by men on average, reflecting the corporate ladder’s ‘broken rungs.’

This blog explore the ways to improve the flow of meritocracy. https://t.co/cF9XdYN1i7— Seraina Benz (@Vontobel_AM_PR) March 8, 2022

His research found a stronger correlation between the female leadership in corporations rising with higher GDP-per-capita than to equality of wealth as measured by the Gini Coefficient. “It makes sense – there’s value in meritocracy,” he added.

Roc-Sennett built a profile of the businesses led by women by grouping the MSCI ACWI companies into four buckets ranked by ‘Female Leadership’ score. The average of the top tier companies has a large employee base, higher operating margins and cash flow generated from invested capital than the other groups.

To remove emerging markets bias, he ran the same figures for the S&P 1500 and found that the operational profile is similar.

Roc-Sennett said: “The profile of women-run companies is that they are large, profitable, steady growers that run with a little more leverage.”

Women entrepreneurs

Closing the gender gap in business growth globally could add up to $2.3 trillion to GDP and up to 433 million jobs according to a report from Citi GPS.

According to our latest #Citi GPS report, closing the gender gap in business growth could add up to $2.3 trillion to the global GDP, creating up to 433 million jobs. Learn more about why investing in women entrepreneurs makes both social & economic sense: https://t.co/NIEq0sraaz pic.twitter.com/CX2DVBbr3x

— Citi (@Citi) March 7, 2022

The report cited data from Global Entrepreneurship Monitor (GEM) which found that women participate in entrepreneurship at 80% the rate of men. This has improved since 2001 when female participation was just 50% but women entrepreneurs still face many barriers including lack of access to finance.

“Financial institutions, including microfinance initiatives, banks, venture capital and private equity firms, and institutional investors, will be key to unlocking the opportunities around women entrepreneurs,” said the report. “We are here encouraged by two growing trends: the rapid transfer in wealth to women and the rise of ESG and gender lens investing.”