UK start-up Finteum has built an execution venue for treasury funding using distributed ledger technology as intraday transactions are on the rise and banks will have to fund shorter settlement cycles for securities.

Brian Nolan, co-founder and chief executive of Finteum, told Markets Media: “Intraday transactions are getting more and more traction and nearly all the large banks are planning to do intraday transactions relatively soon.”

He has a background in banking and liquidity management and started Finteum in 2018 with co-founder Zbi Czapran, a software engineer. The Finteum platform allows for intraday treasury funding, rather than using financial products which are currently only used overnight or longer and have led to funding inefficiencies and higher capital requirements.

“FX swaps and repo are the two primary interbank funding markets,” said Nolan. “Most incumbent platforms cover one or the other but we cover both which is more efficient than using separate venues for separate products.”

He continued that market participants have talked about intraday markets for a long time but the required technology to make transactions work effectively did not exist, as they are very different from overnight transactions. Finteum reviewed the technology that could be applied to the problem and chose Corda, R3’s private and permission DLT protocol.

For example, the technology helps to optimize efficiency in the compressed time frame for intraday transactions as it removes the need to exchange confirmations through Swift, the financial markets infrastructure.

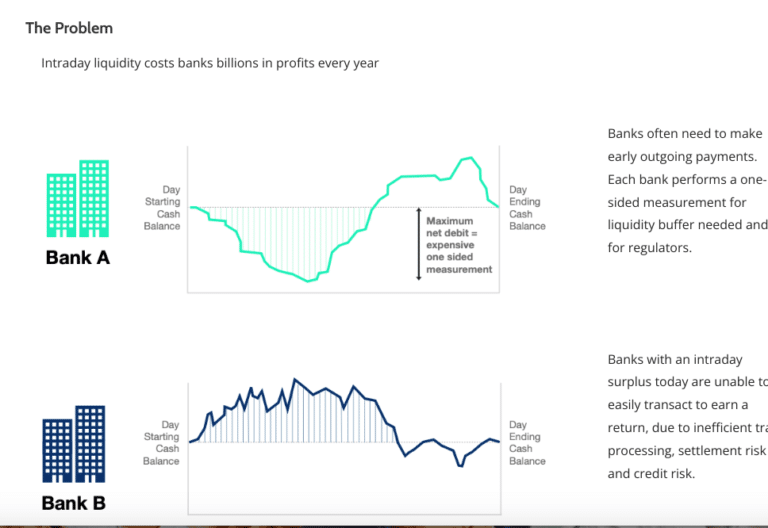

However, Nolan highlighted that the biggest benefit of the venue is that banks can reduce the high quality liquid assets (HQLA) they need to hold and meet their regulatory expectations. Bank treasury teams maintain large buffers of high quality liquid assets for intraday transactions, which has become increasingly expensive in a rising interest rate environment. Finteum estimated that a large bank could save up to $75m per year by gaining faster and better access to a currency, and only keeping it for as long as it is needed.

In addition, funding will need to be more efficient when the US reduces its settlement cycle next year. The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The US Securities and Exchange Commission said the aim is to reduce latency, lower risk and promote efficiency and greater liquidity.

“We are glad to be one of the tools that is stepping up to help banks to help meet faster settlement times,” Nolan added.

Testing

In August 2023 Finteum said 19 banking groups with a combined balance sheet of $23.5 trillion attended a joint trial of the software in the second quarter of this year, together with observers from national prudential authorities.

“We had a trial two years ago with 11 banks and one last year with 14 banks, so they get bigger every year,” added Nolan. “The trials have been very useful for us and for market participants as they enter into the mindset of using this new venue to generate P&L and fit it into their daily workflows.”

Trades during the interbank trial were agreed in a simulated settlement environment with real money trades scheduled for later in 2023.

The banks integrating with Finteum are going live using existing real time gross settlement (RTGS) systems for intraday FX swaps.

Nolan said the platform covers pre-trade and post-trade but not settlement. Finteum has scoped integrations with traditional market infrastructures so users can choose where they want to settle including BNY Mellon’s triparty repo platform, Euroclear Bank’s triparty repo platform and T2S, the European securities settlement engine in central bank money.

In addition, Finteum can integrate with DLT-native technology such as the Fnality Payment System, HQLAX and Baton Systems’ Core-FX.

The platform is expected to complete its first live trades by the end of this year. The banks progressing with the integration work and planning to go live soon include UBS and NatWest.

“We had to get a group of banks to agree to go live all at the same time,” said Nolan. “We and the banks are both completing technical work to integrate the venue into their front office booking system.”

The firm is also having discussions already with banks who want to join in 2024 and has incentives in place for them to join the second wave. Some banks have told Finteum they want to see the venue go live before they join to make sure they can really generate savings and that regulators are happy.

“In one year we would like to have at least $1bn of daily volume on the venue as banks have integrated the venue into their systems and to have more than 10 market participants,” said Nolan.