FIX Trading Community, the non-profit standards body, aims to make it easier for the financial industry to use environmental, social and governance data as asset managers could spend roughly $554m ($515m) for ESG data next year.

Rebecca Healey, global head of market structure & strategy at Liquidnet and co-chair of the FIX Trading Community’s EMEA regulatory subcommittee, told Markets Media that the group can provide a backbone of how new data fields are defined, the assumptions that are made and the reports that end-investors find useful so each market participant does not have to reinvent the wheel.

“The organisation provided the same service for MiFID II and saved the industry hundreds of millions of dollars,” she added. “FIX helped solve the pain points between data providers and the buy side.”

She continued that ESG as an investment strategy is a rapid success story and so is moving from niche to mainstream, requiring the use of more ESG data.

“It is becoming a consideration in every investment decision and as a result the industry’s data consumption will be on steroids,” said Healey. “Data consumption on the investment process will change as managers turn to alternative data sources and techniques such as artificial intelligence and natural language processing.”

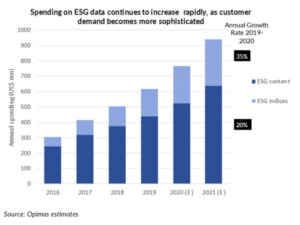

The demand for ESG data is expected to grow 20% annually, and the demand for ESG indices data to grow at 35% each year, according to a report from consultancy Opimas this month. The study, ESG Data Market: No Stopping Its Rise Now, said the ESG data market hit $617m last year and estimated that the the market could approach $1bn next year.

Co-authors Axel Pierron, managing director, and Anne-Laure Foubert, analyst, said in the report: “Of that, the ESG content segment currently represents a market of $525m and could exceed $630m in 2021.”

Opimas continued that asset managers are the heaviest spenders, at 59%, as they already buy ESG data in varying forms ranging from raw data to ratings, from different providers.

“With the integration of ESG consideration into their fiduciary duty required by the European Union by 2021, asset managers will likely continue to be the main consumers of ESG data,” said the study.

The consultancy estimated that asset managers could spend roughly $554m for ESG data by 2021.

Greed is no longer good

Healey said: “Global asset managers also need to take ESG data into consideration when monitoring investments, benchmarking and reporting and that is where FIX can potentially play a role.”

A recent survey form Liquidnet, the institutional liquidity pool, found that 62% of fund managers said ESG was increasingly important in giving greater insight into the underlying investment. In addition, Healey explained that the new EU Sustainability Action Plan requires every firm to incorporate and disclose their ESG considerations. Fund managers will also have to give ESG information before recommending an investment under suitability criteria.

“ESG is not just led by regulators but also by consumers so it is the direction of long-term travel,” she added. “My conversations with asset managers have found there is just as much demand in the US as in Europe.”

Healey continued that finance industry leaders are discussing ESG issues and unpicking some of the challenges. However, she warned that it is a very labour intensive process to move from ESG being a niche strategy to becoming embedded across all their investments.

“Fund managers are just at the start of having to rethink what they do, how they do it and waking up to the enormity of what this could potentially mean for the industry,” she added. “Ethical investments outperform in the longer term so it is the end of the greed is good era.”